Answered step by step

Verified Expert Solution

Question

1 Approved Answer

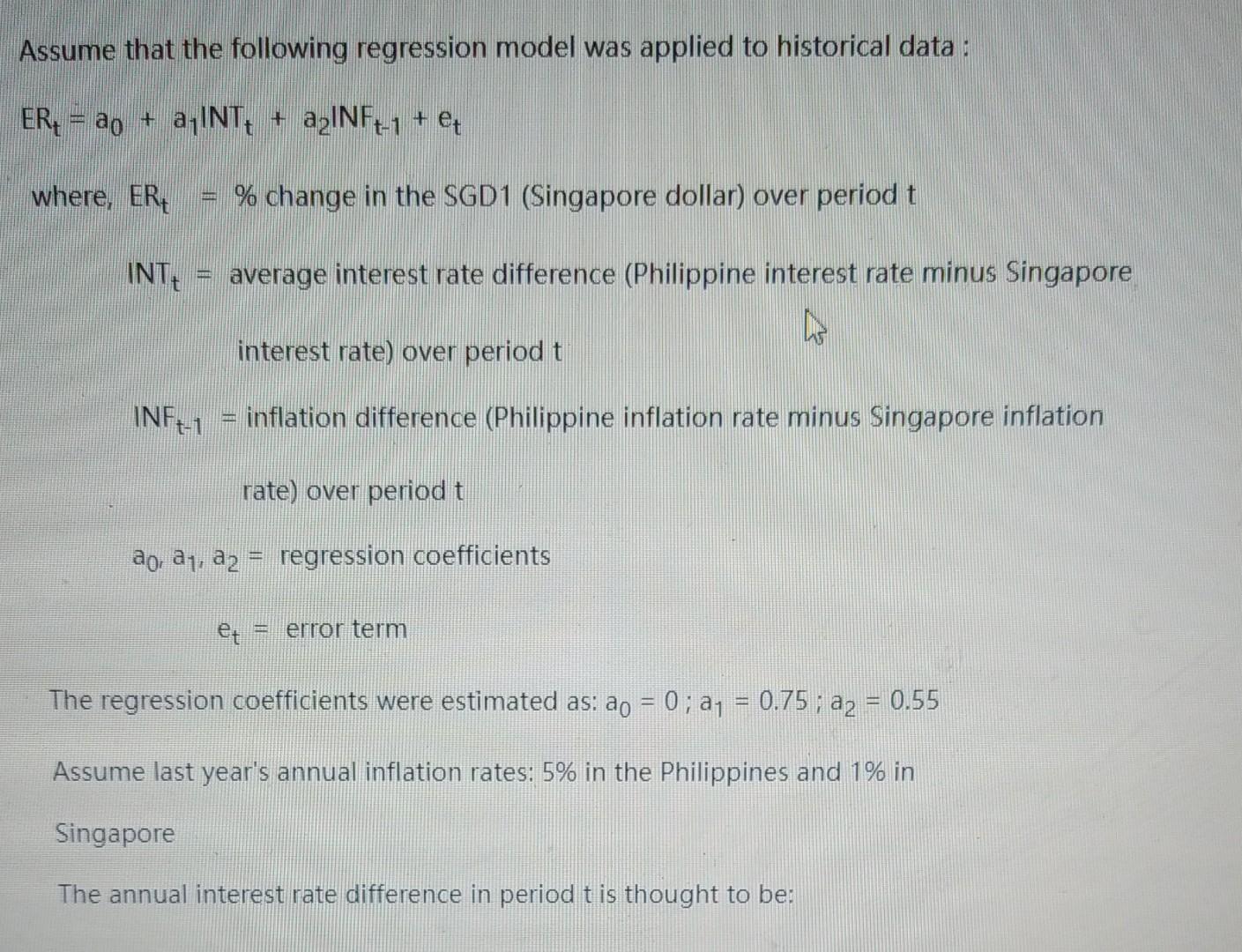

Assume that the following regression model was applied to historical data : ER; = 20 + a,INT: + a2INF-1 + et where, ER % change

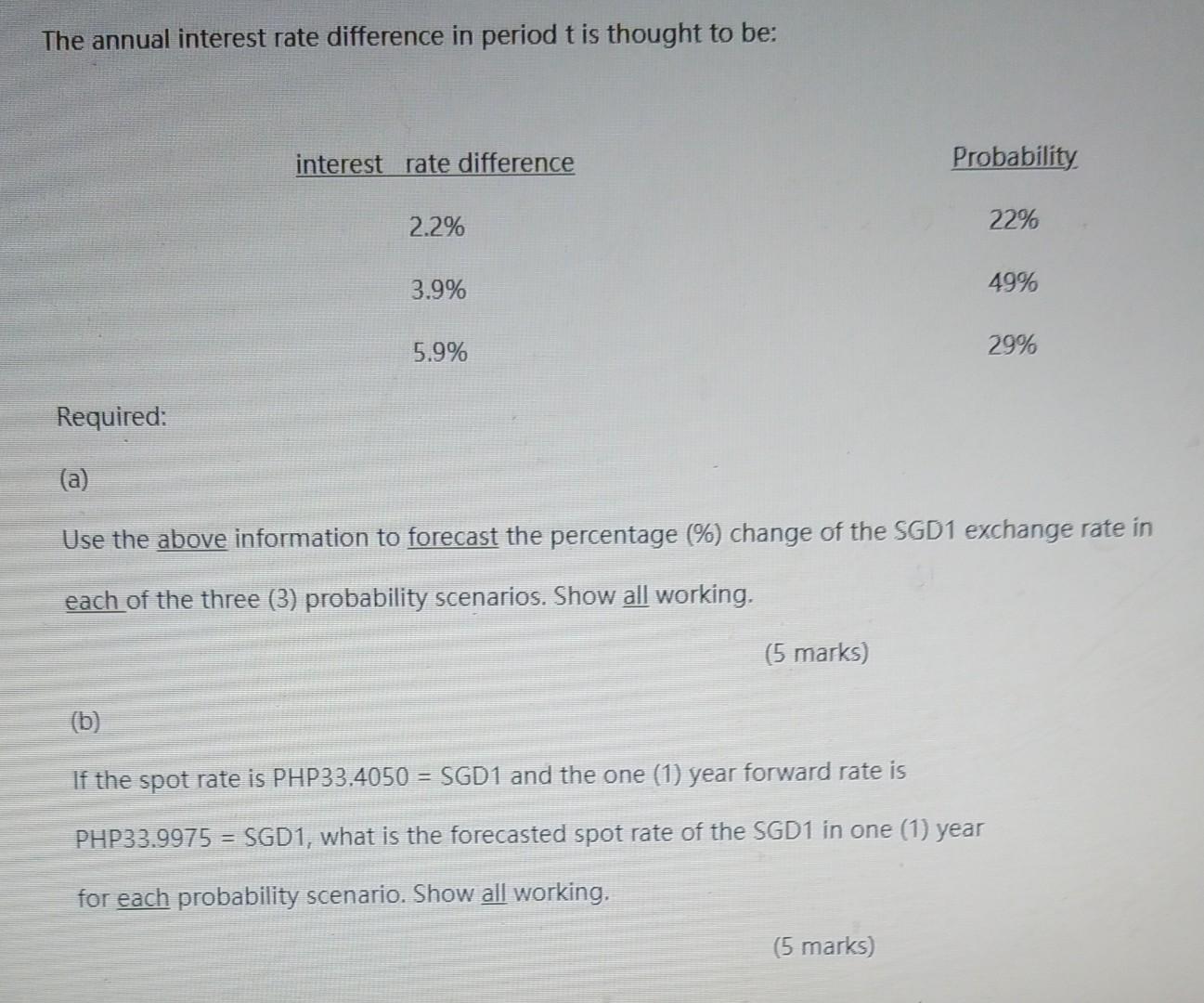

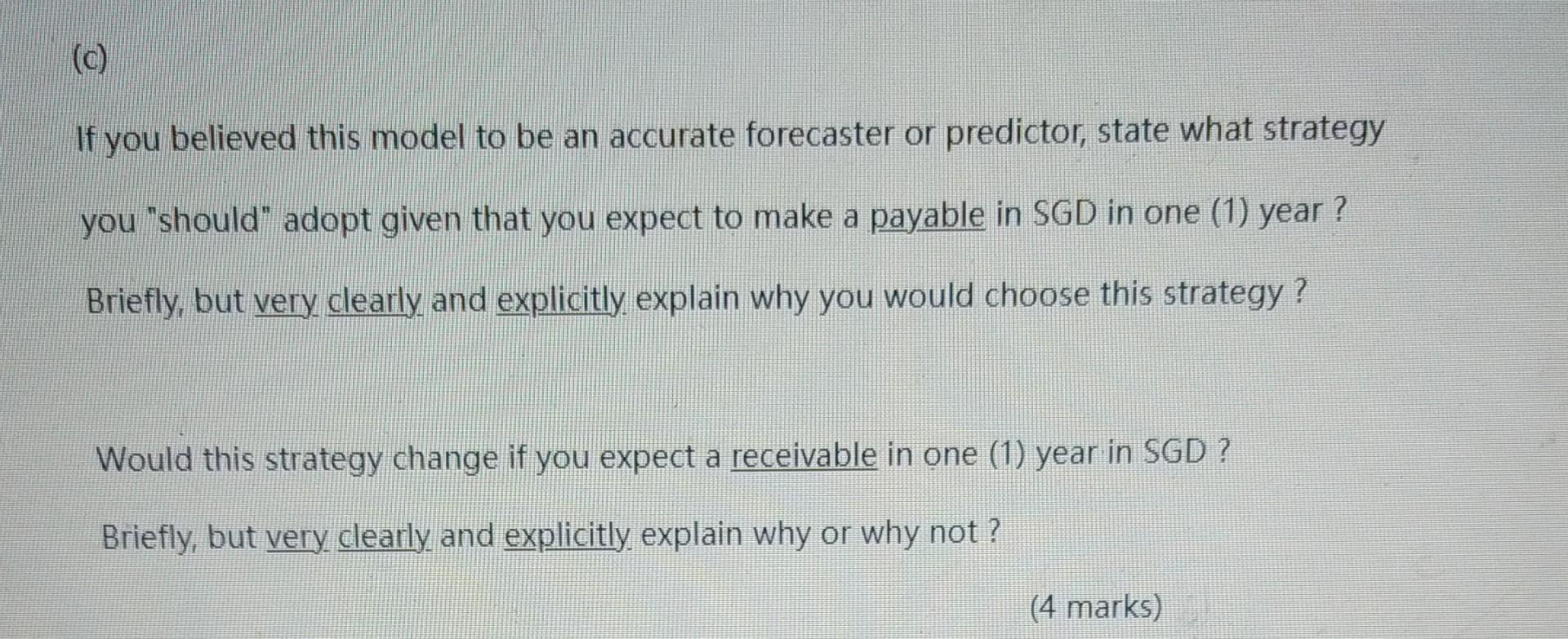

Assume that the following regression model was applied to historical data : ER; = 20 + a,INT: + a2INF-1 + et where, ER % change in the SGD1 (Singapore dollar) over period t INTE average interest rate difference (Philippine interest rate minus Singapore interest rate) over period t INFZ-1 = inflation difference (Philippine inflation rate minus Singapore inflation rate) over period t ao, 81, az = regression coefficients et error term The regression coefficients were estimated as: ao = 0; ay = 0.75 ; a2 = 0.55 Assume last year's annual inflation rates: 5% in the Philippines and 1% in Singapore The annual interest rate difference in period t is thought to be: The annual interest rate difference in period t is thought to be: interest rate difference Probability 2.2% 22% 3.9% 49% 5.9% 29% Required: (a) Use the above information to forecast the percentage (%) change of the SGD1 exchange rate in each of the three (3) probability scenarios. Show all working. (5 marks) (b) If the spot rate is PHP33.4050 = SGD1 and the one (1) year forward rate is PHP33.9975 = SGD1, what is the forecasted spot rate of the SGD1 in one (1) year for each probability scenario. Show all working, (5 marks) (c) If you believed this model to be an accurate forecaster or predictor, state what strategy you "should" adopt given that you expect to make a payable in SGD in one (1) year? Briefly, but very clearly and explicitly explain why you would choose this strategy? Would this strategy change if you expect a receivable in one (1) year in SGD ? Briefly, but very clearly and explicitly explain why or why not? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started