Answered step by step

Verified Expert Solution

Question

1 Approved Answer

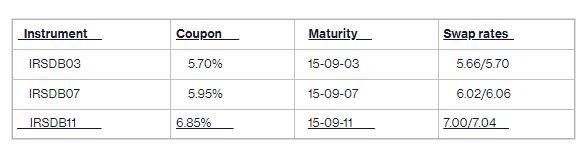

Assume that the following swap instruments are available. The applicable interest rate for the floating side of the swap is 5.02%. Today is March 15,

Assume that the following swap instruments are available. The applicable interest rate for the floating side of the swap is 5.02%. Today is March 15, 2002 and there are exactly 90 days between now and the end of the quarterin June.

Required:

Calculate the market value of an IRSDB11 swap that has a $1,000,000 face value. If you are paying floating and receiving fixed, does the swap have a positive or negative value to you?

Will the swap involve a net cash inflow or outflow for you today?

Detail the variouscashflows (and their timing) associated with using an interest rate swap in the trading game. In what situation would you want to enter the swap as a fixed rate payer?

Instrument IRSDB03 IRSDB07 IRSDB11 Coupon 5.70% 5.95% 6.85% Maturity 15-09-03 15-09-07 15-09-11 Swap rates 5.66/5.70 6.02/6.06 7.00/7.04

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the market value of an IRSDB11 swap with a 1000000 face value we need to calculate the present value of the cash flows associated with th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started