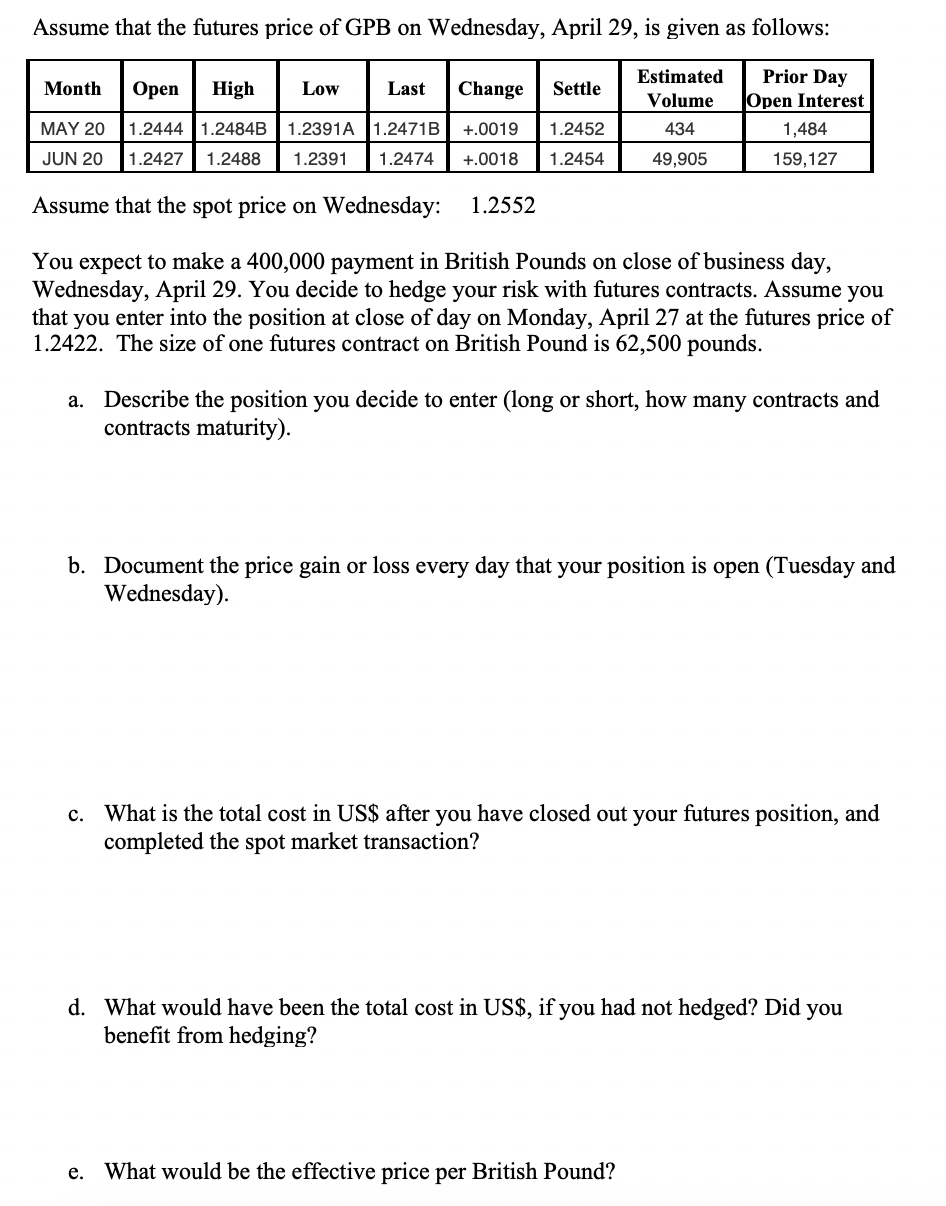

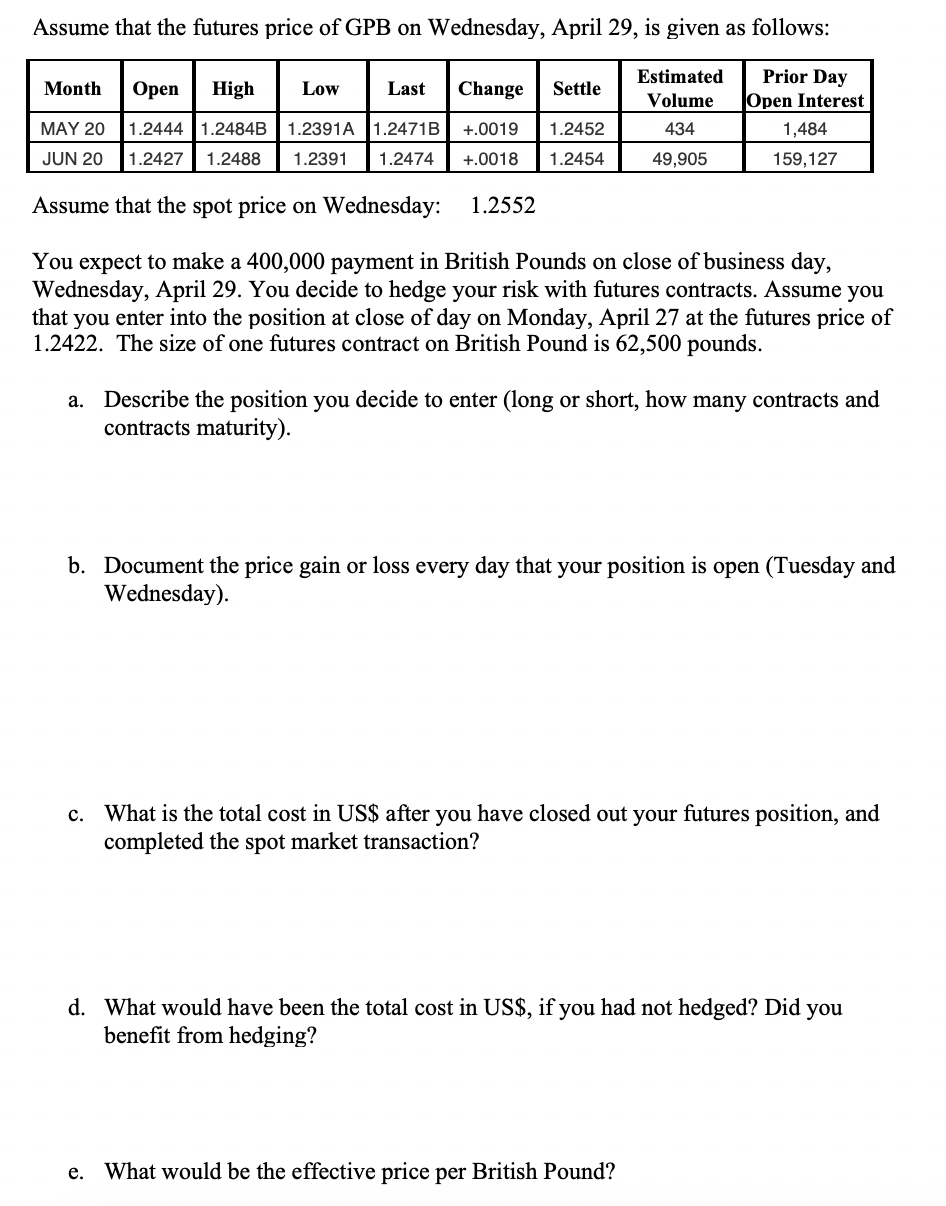

Assume that the futures price of GPB on Wednesday, April 29, is given as follows: Month Low Last Change Settle MAY 20 JUN 20 Open High 1.2444 1.2484B 1.2427 1.2488 1.2391A 1.2471B 1.2391 1.2474 +.0019 +.0018 1.2452 1.2454 Estimated Volume 434 49,905 Prior Day Open Interest 1,484 159,127 Assume that the spot price on Wednesday: 1.2552 You expect to make a 400,000 payment in British Pounds on close of business day, Wednesday, April 29. You decide to hedge your risk with futures contracts. Assume you that you enter into the position at close of day on Monday, April 27 at the futures price of 1.2422. The size of one futures contract on British Pound is 62,500 pounds. a. Describe the position you decide to enter (long or short, how many contracts and contracts maturity). b. Document the price gain or loss every day that your position is open (Tuesday and Wednesday). c. What is the total cost in US$ after you have closed out your futures position, and completed the spot market transaction? d. What would have been the total cost in US$, if you had not hedged? Did you benefit from hedging? e. What would be the effective price per British Pound? Assume that the futures price of GPB on Wednesday, April 29, is given as follows: Month Low Last Change Settle MAY 20 JUN 20 Open High 1.2444 1.2484B 1.2427 1.2488 1.2391A 1.2471B 1.2391 1.2474 +.0019 +.0018 1.2452 1.2454 Estimated Volume 434 49,905 Prior Day Open Interest 1,484 159,127 Assume that the spot price on Wednesday: 1.2552 You expect to make a 400,000 payment in British Pounds on close of business day, Wednesday, April 29. You decide to hedge your risk with futures contracts. Assume you that you enter into the position at close of day on Monday, April 27 at the futures price of 1.2422. The size of one futures contract on British Pound is 62,500 pounds. a. Describe the position you decide to enter (long or short, how many contracts and contracts maturity). b. Document the price gain or loss every day that your position is open (Tuesday and Wednesday). c. What is the total cost in US$ after you have closed out your futures position, and completed the spot market transaction? d. What would have been the total cost in US$, if you had not hedged? Did you benefit from hedging? e. What would be the effective price per British Pound