Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the lease has been classified as an operating lease. 1. Determine the value of the right to use asset and lease liability at

Assume that the lease has been classified as an operating lease.

1. Determine the value of the right to use asset and lease liability at the commencement of the lease

2. For the lease expense recognized each year, determine the amount of interest and amortization that are included in each years expense.

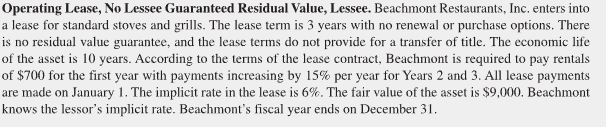

Operating Lease, No Lessee Guaranteed Residual Value, Lessee. Beachmont Restaurants, Inc. enters into a lease for standard stoves and grills. The lease term is 3 years with no renewal or purchase options. There is no residual value guarantee, and the lease terms do not provide for a transfer of title. The economic life of the asset is 10 years. According to the terms of the lease contract, Beachmont is required to pay rentals of $700 for the first year with payments increasing by 15% per year for Years 2 and 3, All lease payments are made on January 1 . The implicit rate in the lease is 6%. The fair value of the asset is $9,000. Beachmont knows the lessor's implicit rate. Beachmont's fiscal year ends on December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started