Answered step by step

Verified Expert Solution

Question

1 Approved Answer

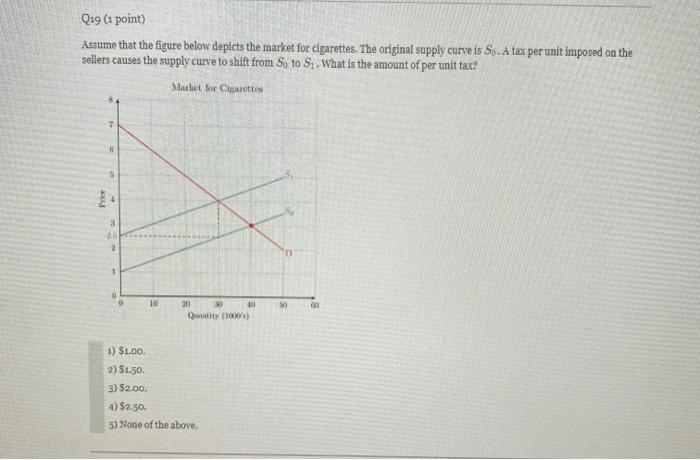

Q19 (1 point) Assume that the figure below depicts the market for cigarettes. The original supply curve is So.A tax per unit imposed on

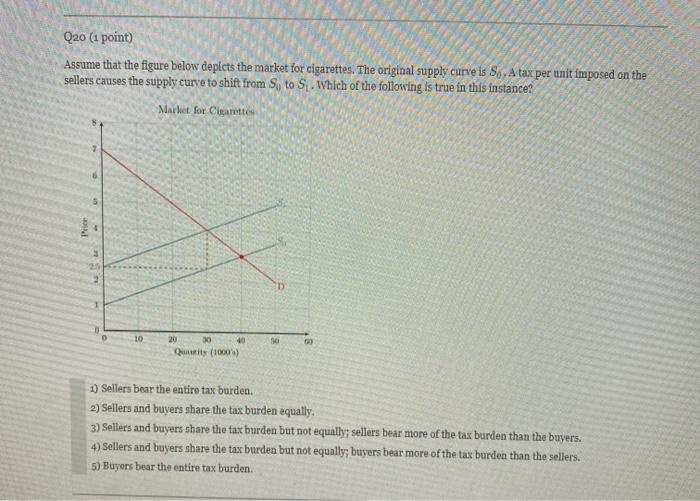

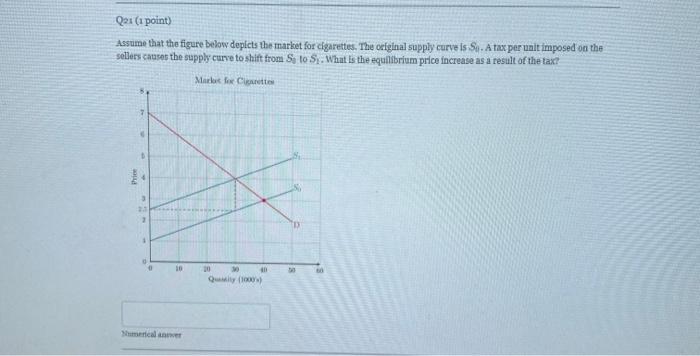

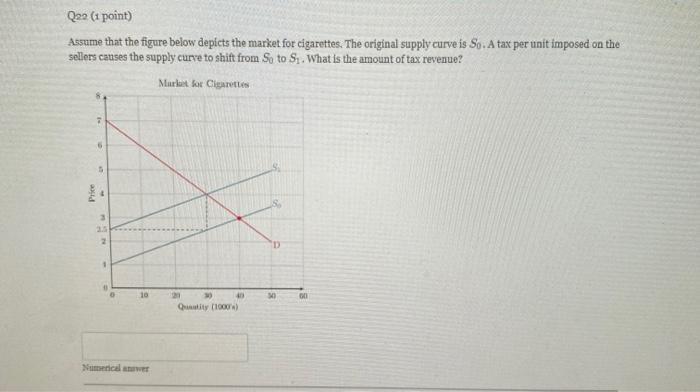

Q19 (1 point) Assume that the figure below depicts the market for cigarettes. The original supply curve is So.A tax per unit imposed on the sellers causes the supply curve to shift from So to S. What is the amount of per unit tax? Market for Cigarettes Price 7 6 Na 1) $1.00. 2) $1.50. 3) $2.00. 10 20 40 Quantity (1000) 4) $2.50. 5) None of the above. 30 8 Q20 (1 point) Assume that the figure below depicts the market for cigarettes. The original supply curve is S.A tax per unit imposed on the sellers causes the supply curve to shift from S to S. Which of the following is true in this instance? Market for Cigarettes Price T 3 re H 10 20 30 40 Quantity (1000's) 30 G0 1) Sellers bear the entire tax burden. 2) Sellers and buyers share the tax burden equally. 3) Sellers and buyers share the tax burden but not equally; sellers bear more of the tax burden than the buyers. 4) Sellers and buyers share the tax burden but not equally; buyers bear more of the tax burden than the sellers. 5) Buyers bear the entire tax burden. Q21 (1 point) Assume that the figure below depicts the market for cigarettes. The original supply curve is Sa. A tax per unit imposed on the sellers causes the supply curve to shift from S to S. What is the equilibrium price increase as a result of the tax? Market for Cigarettes JOLLA ** 0 10 Numerical anwer 30 40 Quity (1000) 50 Q22 (1 point) Assume that the figure below depicts the market for cigarettes. The original supply curve is So. A tax per unit imposed on the sellers causes the supply curve to shift from So to S. What is the amount of tax revenue? Market for Cigarettes Price 7 6 S 4 3 2.5 2 1 10 Numerical answer 21 40 Quantity (1000) 30 GO

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Ans19 250 Option 4 Explanation 23 52 250 The average value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started