Answered step by step

Verified Expert Solution

Question

1 Approved Answer

assume that the maximum transfer price allowed by the Canadian tax authorities is the market value of the raw products 1. what is the total

assume that the maximum transfer price allowed by the Canadian tax authorities is the market value of the raw products

1. what is the total maximum transfer price allowed in CAD?

2. what is the total net income that perogy king LTD. would earn from its entire operation using 200% of the variable cost?

3. for perogy king? assume the minimum transfer price allowed by the Canadian tax authorities is 200% of the variable cost?

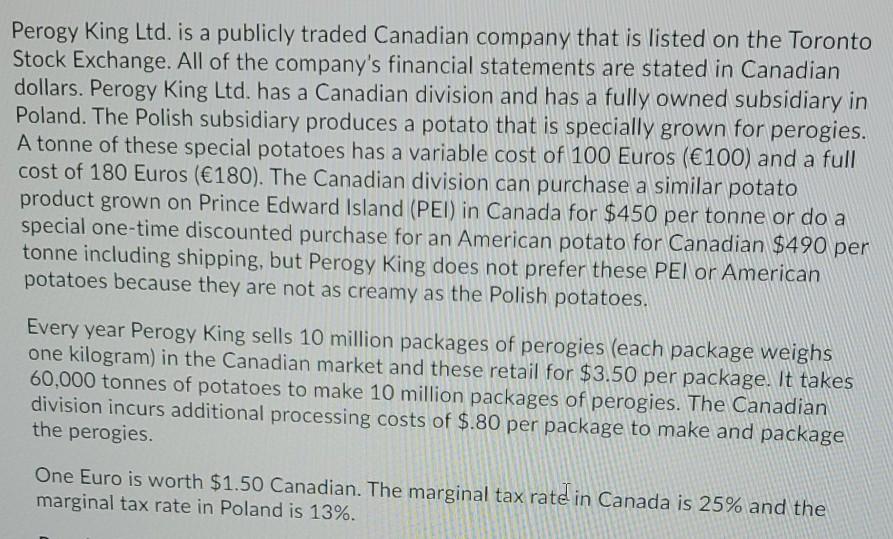

Perogy King Ltd. is a publicly traded Canadian company that is listed on the Toronto Stock Exchange. All of the company's financial statements are stated in Canadian dollars. Perogy King Ltd. has a Canadian division and has a fully owned subsidiary in Poland. The Polish subsidiary produces a potato that is specially grown for perogies. A tonne of these special potatoes has a variable cost of 100 Euros (100) and a full cost of 180 Euros (180). The Canadian division can purchase a similar potato product grown on Prince Edward Island (PEI) in Canada for $450 per tonne or do a special one-time discounted purchase for an American potato for Canadian $490 per tonne including shipping, but Perogy King does not prefer these PEI or American potatoes because they are not as creamy as the Polish potatoes. Every year Perogy King sells 10 million packages of perogies (each package weighs one kilogram) in the Canadian market and these retail for $3.50 per package. It takes 60,000 tonnes of potatoes to make 10 million packages of perogies. The Canadian division incurs additional processing costs of $.80 per package to make and package the perogies. One Euro is worth $1.50 Canadian. The marginal tax rate in Canada is 25% and the marginal tax rate in Poland is 13%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started