Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the Mexican peso currently trades at 14 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while

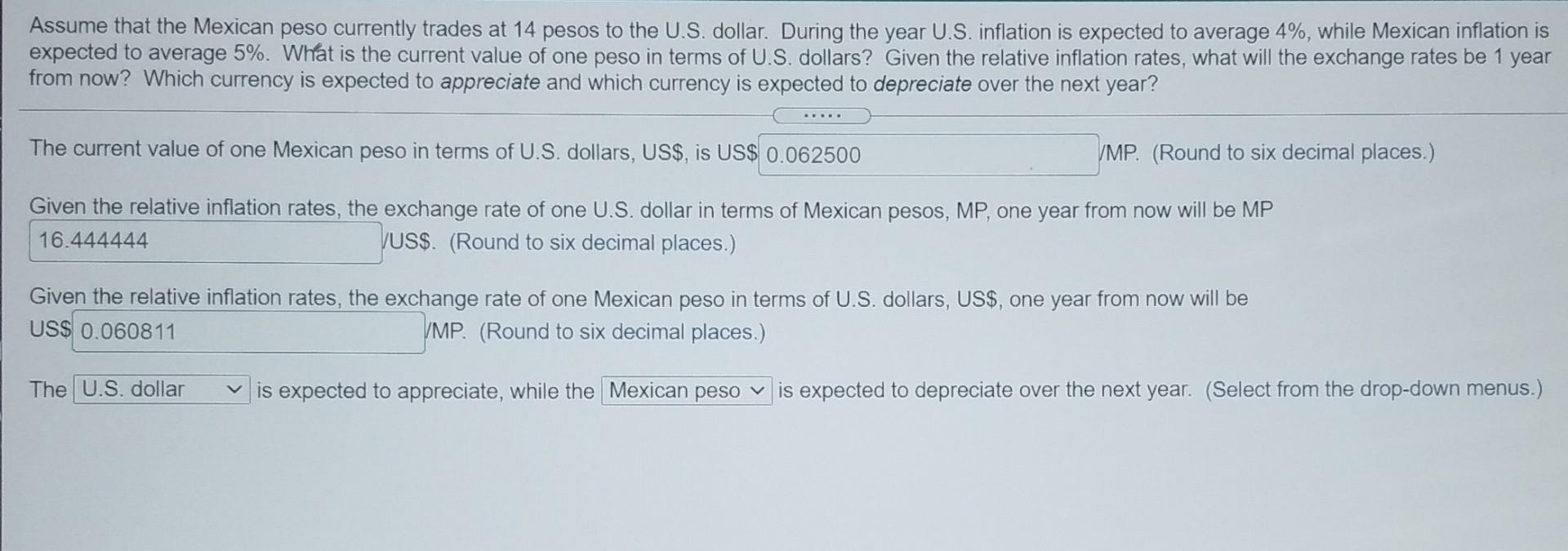

Assume that the Mexican peso currently trades at 14 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 5%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, US$, is US$ 0.062500 VMP. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP 16.444444 VUS$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ 0.060811 VMP. (Round to six decimal places.) The U.S. dollar is expected to appreciate, while the Mexican peso v is expected to depreciate over the next year. (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started