Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the net cash flow of a potential $5.0 million investment is $750,000 in year 1, then $1 million in year 2, $2

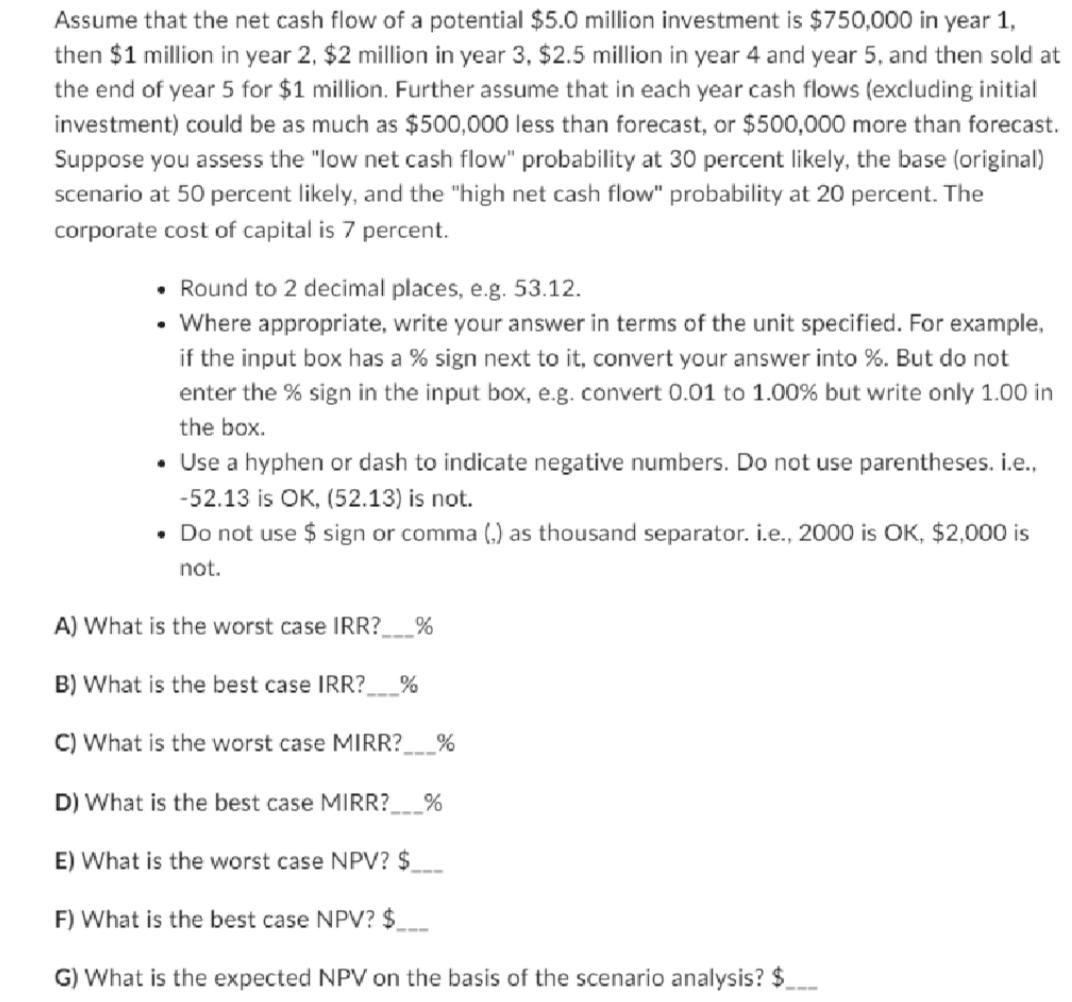

Assume that the net cash flow of a potential $5.0 million investment is $750,000 in year 1, then $1 million in year 2, $2 million in year 3, $2.5 million in year 4 and year 5, and then sold at the end of year 5 for $1 million. Further assume that in each year cash flows (excluding initial investment) could be as much as $500,000 less than forecast, or $500,000 more than forecast. Suppose you assess the "low net cash flow" probability at 30 percent likely, the base (original) scenario at 50 percent likely, and the "high net cash flow" probability at 20 percent. The corporate cost of capital is 7 percent. Round to 2 decimal places, e.g. 53.12. Where appropriate, write your answer in terms of the unit specified. For example, if the input box has a % sign next to it, convert your answer into %. But do not enter the % sign in the input box, e.g. convert 0.01 to 1.00% but write only 1.00 in the box. Use a hyphen or dash to indicate negative numbers. Do not use parentheses. i.e. -52.13 is OK, (52.13) is not. Do not use $ sign or comma (,) as thousand separator. i.e., 2000 is OK, $2,000 is not. A) What is the worst case IRR? B) What is the best case IRR? % C) What is the worst case MIRR? % D) What is the best case MIRR?_ % E) What is the worst case NPV? $_ F) What is the best case NPV? $____ G) What is the expected NPV on the basis of the scenario analysis? $____

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the IRR MIRR and NPV under different scenarios we need to calculate the cash flows for each year based on the probability distri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started