Answered step by step

Verified Expert Solution

Question

1 Approved Answer

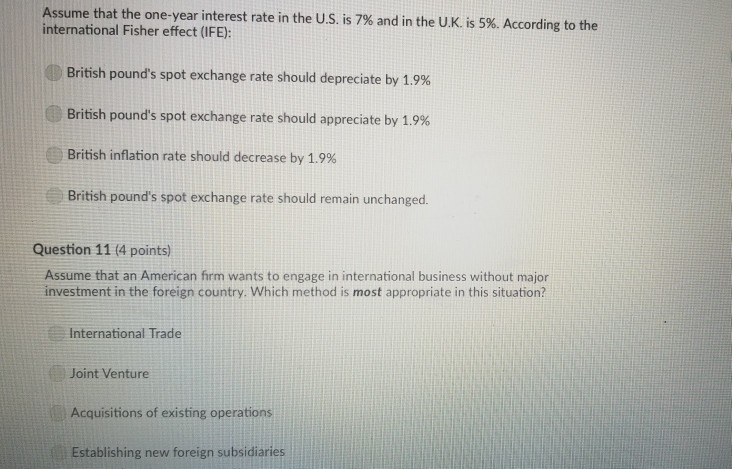

Assume that the one-year interest rate in the U.S. is 7% and in the U.K. is 5 %. According to the international Fisher effect (IFE):

Assume that the one-year interest rate in the U.S. is 7% and in the U.K. is 5 %. According to the international Fisher effect (IFE): British pound's spot exchange rate should depreciate by 1.9% British pound's spot exchange rate should appreciate by 1.9 % British inflation rate should decrease by 1.9% British pound's spot exchange rate should remain unchanged. Question 11 (4 points) Assume that an American firm wants to engage in international business without major investment in the foreign country. Which method is most appropriate in this situation? International Trade Joint Venture Acquisitions of existing operations Establishing new foreign subsidiaries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started