Question

Assume that the organization will issue a 5-year bond with an annual coupon rate of 7.625%. You are considering making a $100,000 investment in the

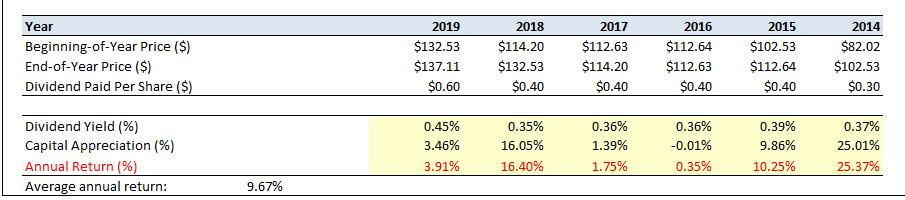

Assume that the organization will issue a 5-year bond with an annual coupon rate of 7.625%. You are considering making a $100,000 investment in the organization either through buying bonds or stocks. Comparing the bond's yield with the annual return on stock investments calculated above, you have to make a decision. Which investment option would you prefer? In addition, when we compute the weighted average cost of capital (WACC) for a project, we normally use a distinct "cost" for each component of capital (debt vs. equity). Normally, equity capital comes at a higher cost than debt capital. Please explain why this is normally the case and whether/how it is related to your decision on making an investment is the organization either through buying bonds to stocks.

Year Beginning-of-Year Price ($) End-of-Year Price ($) Dividend Paid Per Share ($) Dividend Yield (%) Capital Appreciation (%) Annual Return (%) Average annual return: 9.67% 2019 $132.53 $137.11 $0.60 0.45% 3.46% 3.91% 2018 $114.20 $132.53 $0.40 0.35% 16.05% 16.40% 2017 $112.63 $114.20 $0.40 0.36% 1.39% 1.75% 2016 $112.64 $112.63 $0.40 0.36% -0.01% 0.35% 2015 $102.53 $112.64 $0.40 0.39% 9.86% 10.25% 2014 $82.02 $102.53 $0.30 0.37% 25.01% 25.37%

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To make an informed investment decision we need to compare the yield on the 5year bond with the annual return on stock investments Bond Investment The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started