Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the rate of inflation expected over the coming financial year in Saudi Arabia is 5.1%. a. Explain how a 1-year Saudi government-bill (Gov.-bill)

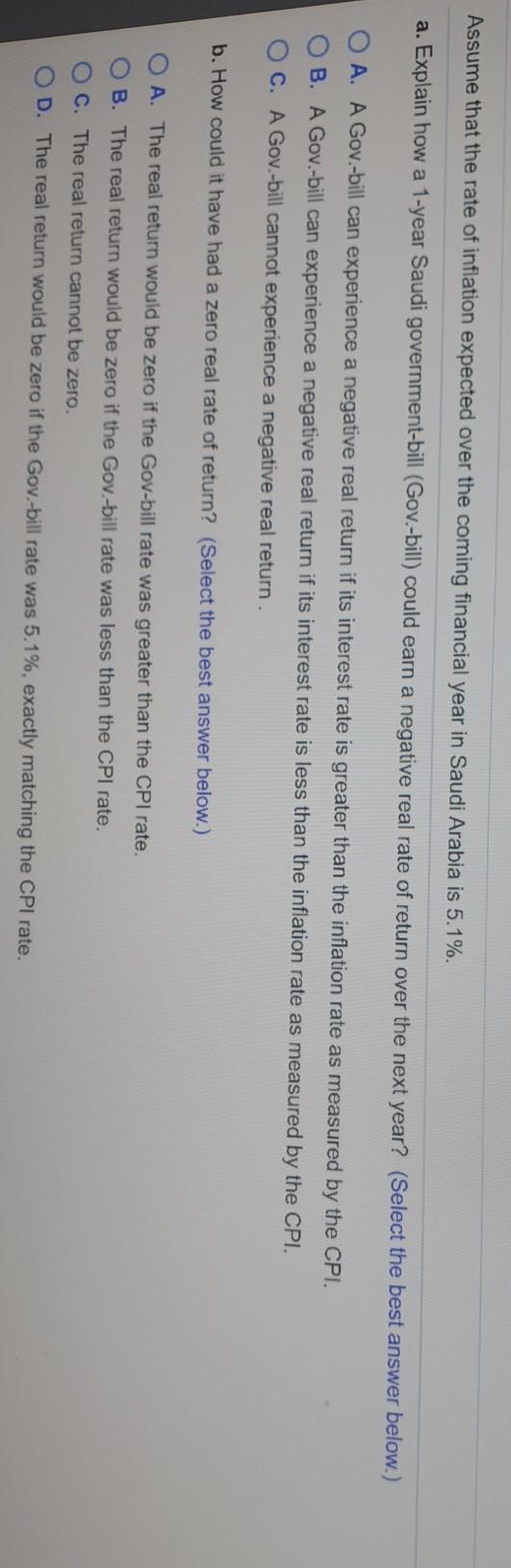

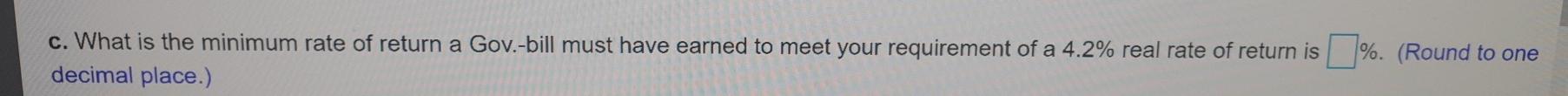

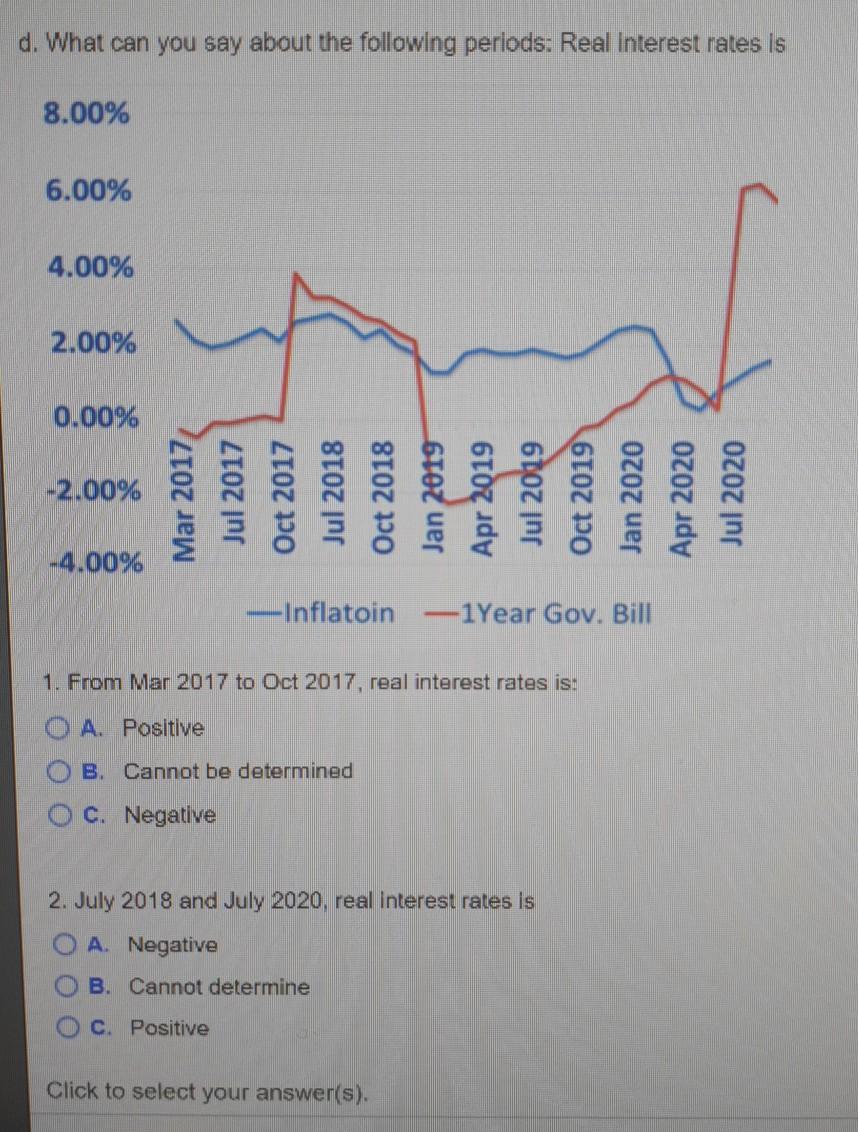

Assume that the rate of inflation expected over the coming financial year in Saudi Arabia is 5.1%. a. Explain how a 1-year Saudi government-bill (Gov.-bill) could earn a negative real rate of return over the next year? (Select the best answer below.) O A. A Gov.-bill can experience a negative real return if its interest rate is greater than the inflation rate as measured by the CPI. OB. A Gov.-bill can experience a negative real return if its interest rate is less than the inflation rate as measured by the CPI. OC. A Gov.-bill cannot experience a negative real return. b. How could it have had a zero real rate of return? (Select the best answer below.) A. The real return would be zero if the Gov-bill rate was greater than the CPI rate. B. The real return would be zero if the Gov.-bill rate was less than the CPI rate. OC. The real return cannot be zero. OD. The real return would be zero if the Gov.-bill rate was 5.1%, exactly matching the CPI rate. c. What is the minimum rate of return a Gov.-bill must have earned to meet your requirement of a 4.2% real rate of return is %. (Round to one decimal place.) d. What can you say about the following periods: Real Interest rates is 8.00% 6.00% 4.00% 2.00% 0.0096 -2.00% -4.0096 Inflatoin 1 Year Gov. Bill 1. From Mar 2017 to Oct 2017, real interest rates is: A. Positive B. Cannot be determined O c. Negative 2. July 2018 and July 2020, real interest rates is A. Negative B. Cannot determine Oc. Positive Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started