Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the rate on a 1-year bond is now 6% but all investors expect 1-year rates to be 7% one year from now and

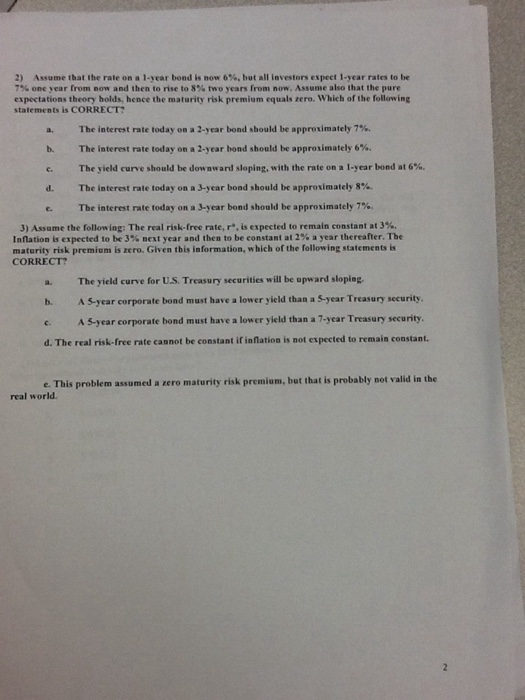

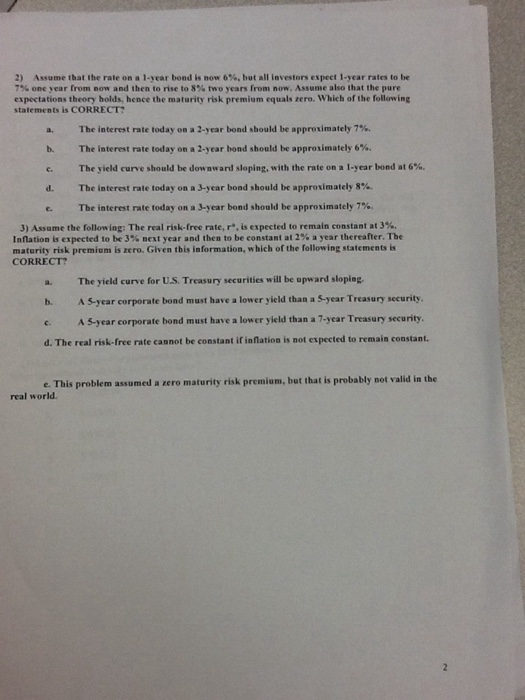

Assume that the rate on a 1-year bond is now 6% but all investors expect 1-year rates to be 7% one year from now and then to rise to 8% two years from now. Assume also that the pure expectations theory holds, hence the maturity risk premium equals zero. Which of the following statements is CORRECT? a. The interest rate today on a 2-year bond should be approximately 7%. b. The interest rate today on a 2-year bond should be approximately 6%. c. The yield curve should be downward sloping, with the rate on a 1-year bond at 6%. d. The interest rate today on a 3-year bond should be approximately 8%. e. The interest rate today on a 3-year bond should be approximately 7%. Assume the following: The real risk-free rate, r, is expected to remain constant at 3%. Inflation is expected to be 3% next year and then to be constant at 2% a year thereafter. The maturity risk premium is zero. Given this information, which of the following statements is CORRECT? a. The yield curve for U.S. Treasury securities will be upward sloping. b. A 5-year corporate bond must have a lower yield than a 5-year Treasury security, c. A 5-year corporate bond must have a lower yield than a 7-year Treasury security. d. The real risk-free rate cannot be constant if inflation is not expected to remain constant. e. This problem assumed a zero maturity risk premium, but that is probably not valid in the real world

Assume that the rate on a 1-year bond is now 6% but all investors expect 1-year rates to be 7% one year from now and then to rise to 8% two years from now. Assume also that the pure expectations theory holds, hence the maturity risk premium equals zero. Which of the following statements is CORRECT? a. The interest rate today on a 2-year bond should be approximately 7%. b. The interest rate today on a 2-year bond should be approximately 6%. c. The yield curve should be downward sloping, with the rate on a 1-year bond at 6%. d. The interest rate today on a 3-year bond should be approximately 8%. e. The interest rate today on a 3-year bond should be approximately 7%. Assume the following: The real risk-free rate, r, is expected to remain constant at 3%. Inflation is expected to be 3% next year and then to be constant at 2% a year thereafter. The maturity risk premium is zero. Given this information, which of the following statements is CORRECT? a. The yield curve for U.S. Treasury securities will be upward sloping. b. A 5-year corporate bond must have a lower yield than a 5-year Treasury security, c. A 5-year corporate bond must have a lower yield than a 7-year Treasury security. d. The real risk-free rate cannot be constant if inflation is not expected to remain constant. e. This problem assumed a zero maturity risk premium, but that is probably not valid in the real world

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started