Question

Assume that the risk-free rate is rf = 4% and the investor's risk aversion coefficient is A = 4. 1. Consider return targets ranging from

Assume that the risk-free rate isrf= 4% and the investor's risk aversion coefficient is

A= 4.

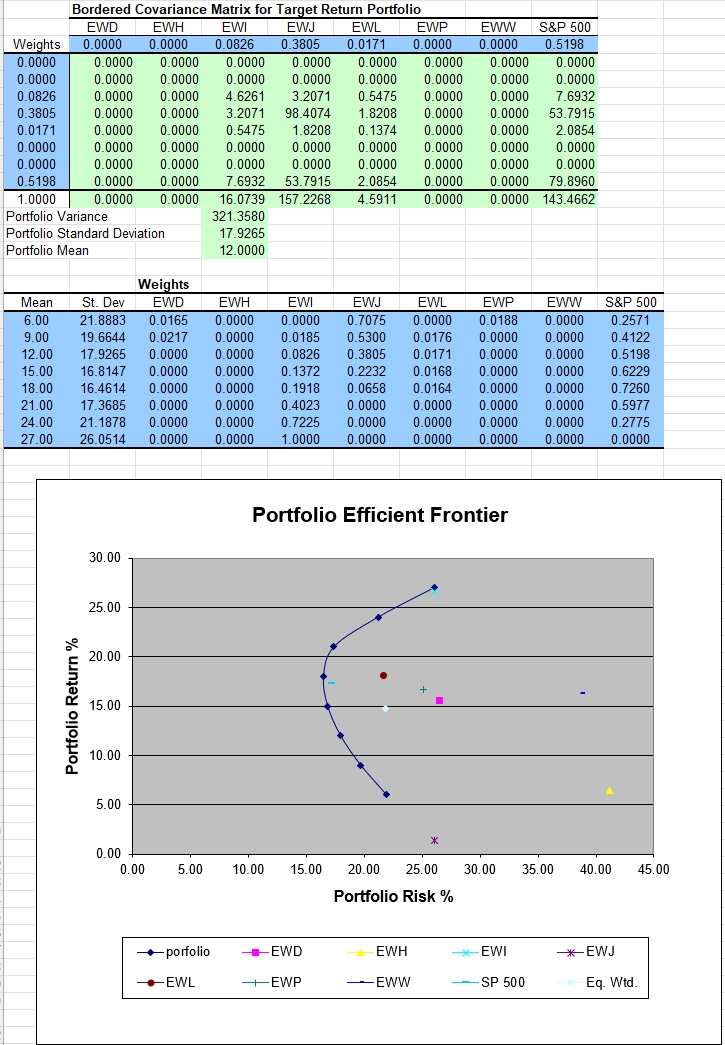

1. Consider return targets ranging from 6% to 26% (in increments of 2%). For each return

target, solve for the portfolio that yields this expected return and that has the smallest

standard deviation of returns possible. Plot the efficient frontier.

2. Solve for the Tangency portfolio's weights. Report the expected return and standard

deviation of this portfolio. Plot the tangency line. What is the maximum Sharpe ratio

possible?

3. Consider a portfolio with a weight ofy(%) on the Tangency portfolio and 1? yon

the risk free bond. Find the valuey ?that maximizes the investor's expected utility.

Use the weights of the Tangency portfolio found in question 2., find the weight of each

individual asset in the optimal portfolio.

4. Solve the utility maximization problem directly (that is, find the set of weights that

maximize the expected utility functionU=E[r]?1

2A?V ar(r)). Verify if these weights

are the same as the ones found in question 3.

5. Suppose that you're not allowed to short any assets. Does this change the optimal

portfolio? How much (in percentage) expected utility is lost because of this restriction?

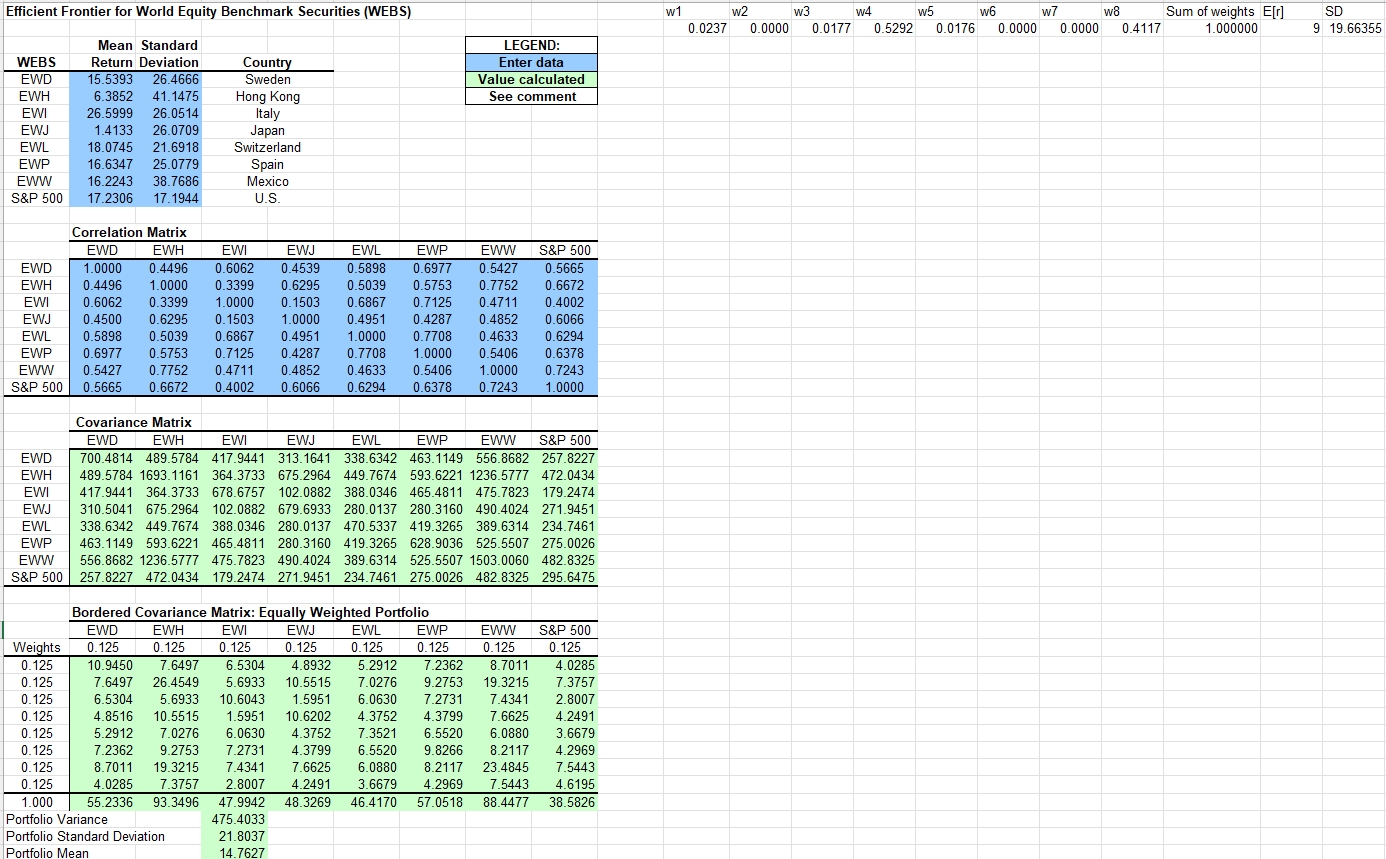

Efficient Frontier for World Equity Benchmark Securities (WEBS) Mean Standard WEBS Return Deviation EWD EWH EWI 15.5393 26.4666 6.3852 41.1475 26.5999 26.0514 Country Sweden Hong Kong LEGEND: Enter data Value calculated See comment Italy EWJ 1.4133 EWL 18.0745 26.0709 21.6918 Japan Switzerland EWP 16.6347 25.0779 Spain EWW S&P 500 16.2243 17.2306 17.1944 38.7686 Mexico U.S. Correlation Matrix EWD EWD EWH 1.0000 0.4496 EWI EWJ EWL EWP EWW S&P 500 EWH EWI EWJ EWL 0.6062 0.4539 0.4496 1.0000 0.3399 0.6295 0.6062 0.3399 1.0000 0.1503 0.6867 0.7125 0.4002 0.4500 0.6295 0.1503 1.0000 0.4951 0.4287 0.4852 0.6066 0.5898 0.5039 0.6867 0.4951 1.0000 0.7708 0.4633 0.6294 EWP 0.6977 0.5753 0.7125 0.4287 0.7708 1.0000 EWW 0.5427 0.7752 0.4711 0.4852 0.4633 0.5406 S&P 500 0.5665 0.6672 0.4002 0.6066 0.6294 0.6378 0.5898 0.6977 0.5427 0.5665 0.5039 0.5753 0.7752 0.6672 0.4711 0.5406 0.6378 1.0000 0.7243 0.7243 1.0000 S&P 500 257.8227 Covariance Matrix EWD EWH EWI EWJ EWL EWP EWW 700.4814 489.5784 417.9441 313.1641 338.6342 463.1149 556.8682 489.5784 1693.1161 364.3733 675.2964 449.7674 593.6221 1236.5777 472.0434 417.9441 364.3733 678.6757 102.0882 388.0346 465.4811 475.7823 179.2474 310.5041 675.2964 102.0882 679.6933 280.0137 280.3160 490.4024 271.9451 338.6342 449.7674 388.0346 280.0137 470.5337 419.3265 389.6314 234.7461 463.1149 593.6221 465.4811 280.3160 419.3265 628.9036 525.5507 275.0026 556.8682 1236.5777 475.7823 490.4024 389.6314 525.5507 1503.0060 482.8325 S&P 500 257.8227 472.0434 179.2474 271.9451 234.7461 275.0026 482.8325 295.6475 EWD EWH EWI EWJ EWL EWP EWW Bordered Covariance Matrix: Equally Weighted Portfolio EWD Weights 0.125 EWH 0.125 EWJ 0.125 0.125 10.9450 7.6497 0.125 7.6497 26.4549 0.125 0.125 0.125 0.125 0.125 0.125 1.000 EWI EWW S&P 500 0.125 0.125 0.125 6.5304 4.8932 5.2912 7.2362 8.7011 4.0285 5.6933 10.5515 7.0276 9.2753 19.3215 7.3757 6.5304 5.6933 10.6043 1.5951 6.0630 7.2731 7.4341 2.8007 4.8516 10.5515 1.5951 10.6202 4.3752 4.3799 7.6625 4.2491 5.2912 7.0276 6.0630 4.3752 7.3521 6.5520 6.0880 3.6679 7.2362 9.2753 7.2731 4.3799 6.5520 9.8266 8.2117 4.2969 8.7011 19.3215 7.4341 7.6625 6.0880 8.2117 23.4845 7.5443 4.0285 7.3757 2.8007 4.2491 3.6679 4.2969 7.5443 55.2336 93.3496 47.9942 48.3269 46.4170 57.0518 88.4477 EWL 0.125 EWP 0.125 4.6195 38.5826 Portfolio Variance Portfolio Standard Deviation Portfolio Mean 475.4033 21.8037 14.7627 w1 w2 w3 w4 w5 w6 w7 w8 0.0237 0.0000 0.0177 0.5292 0.0176 0.0000 0.0000 0.4117 Sum of weights E[r] 1.000000 SD 9 19.66355

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started