Answered step by step

Verified Expert Solution

Question

1 Approved Answer

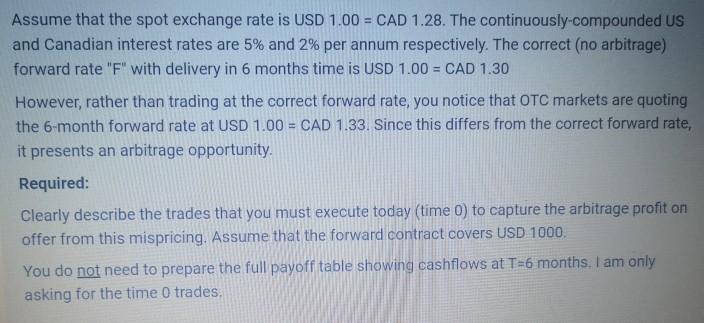

Assume that the spot exchange rate is USD 1.00 = CAD 1.28. The continuously-compounded US and Canadian interest rates are 5% and 2% per

Assume that the spot exchange rate is USD 1.00 = CAD 1.28. The continuously-compounded US and Canadian interest rates are 5% and 2% per annum respectively. The correct (no arbitrage) forward rate "F" with delivery in 6 months time is USD 1.00 = CAD 1.30 However, rather than trading at the correct forward rate, you notice that OTC markets are quoting the 6-month forward rate at USD 1.00 = CAD 1.33. Since this differs from the correct forward rate, it presents an arbitrage opportunity. %3D Required: Clearly describe the trades that you must execute today (time 0) to capture the arbitrage profit on offer from this mispricing. ASsume that the forward contract covers USD 1000. You do not need to prepare the full payoff table showing cashflows at T=6 months. I am only asking for the time 0 trades.

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answers The current spot rate is USD 1 CAD 128 No arbitrage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started