Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the spot price for crude palm oil is RM2,275. If the storage cost is RM5 per month, the risk-free interest rate is

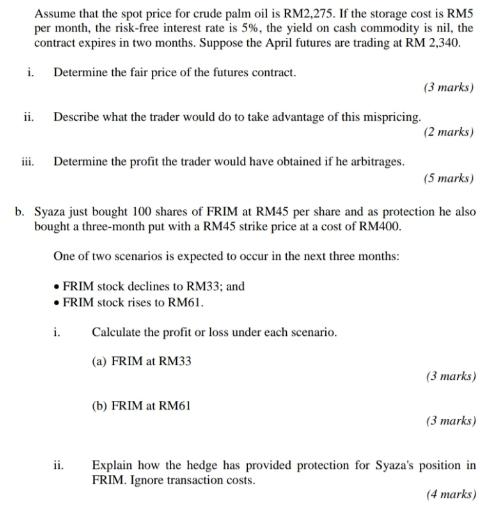

Assume that the spot price for crude palm oil is RM2,275. If the storage cost is RM5 per month, the risk-free interest rate is 5%, the yield on cash commodity is nil, the contract expires in two months. Suppose the April futures are trading at RM 2,340. i. Determine the fair price of the futures contract. ii. iii. Describe what the trader would do to take advantage of this mispricing. Determine the profit the trader would have obtained if he arbitrages. ii. Calculate the profit or loss under each scenario. (a) FRIM at RM33 (3 marks) b. Syaza just bought 100 shares of FRIM at RM45 per share and as protection he also bought a three-month put with a RM45 strike price at a cost of RM400. One of two scenarios is expected to occur in the next three months: FRIM stock declines to RM33; and FRIM stock rises to RM61. i. (b) FRIM at RM61 (2 marks) (5 marks) (3 marks) (3 marks) Explain how the hedge has provided protection for Syaza's position in FRIM. Ignore transaction costs. (4 marks)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

i To determine the fair price of the futures contract we can use the costofcarry model The fair price of the futures contract is given by Fair Price S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started