Question

Assume that the spot-rate curve is flat at 6%. A portfolio contains three zero-coupon bonds each having face value $1,000,000. The maturities of the

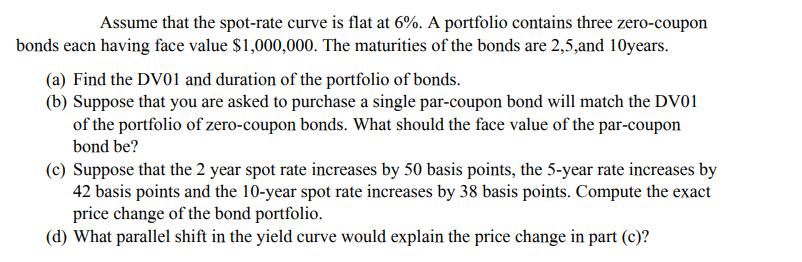

Assume that the spot-rate curve is flat at 6%. A portfolio contains three zero-coupon bonds each having face value $1,000,000. The maturities of the bonds are 2,5,and 10years. (a) Find the DV01 and duration of the portfolio of bonds. (b) Suppose that you are asked to purchase a single par-coupon bond will match the DV01 of the portfolio of zero-coupon bonds. What should the face value of the par-coupon bond be? (c) Suppose that the 2 year spot rate increases by 50 basis points, the 5-year rate increases by 42 basis points and the 10-year spot rate increases by 38 basis points. Compute the exact price change of the bond portfolio. (d) What parallel shift in the yield curve would explain the price change in part (c)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Risk Management and Financial Institutions

Authors: Hull John

4th edition

1118955943, 978-1118955949

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App