Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the spot-rate curve is flat at 6%. Consider a portfolio consisting of two par-coupon bonds. (Recall that if the spot-rate curve is

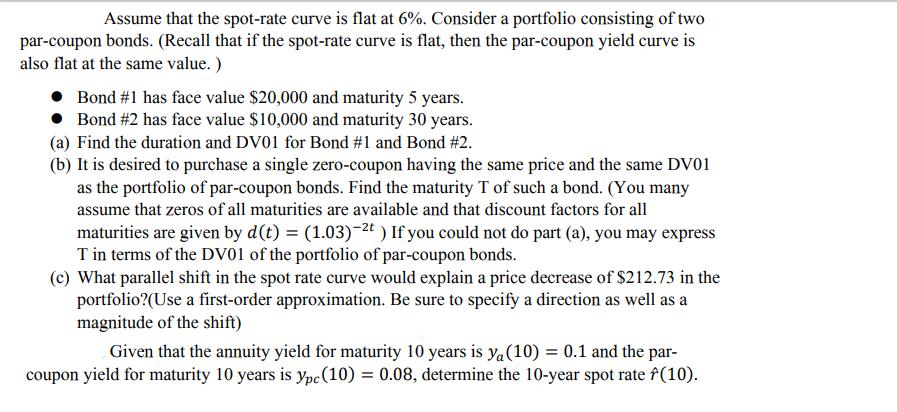

Assume that the spot-rate curve is flat at 6%. Consider a portfolio consisting of two par-coupon bonds. (Recall that if the spot-rate curve is flat, then the par-coupon yield curve is also flat at the same value.) Bond #1 has face value $20,000 and maturity 5 years. Bond #2 has face value $10,000 and maturity 30 years. (a) Find the duration and DV01 for Bond #1 and Bond #2. (b) It is desired to purchase a single zero-coupon having the same price and the same DV01 as the portfolio of par-coupon bonds. Find the maturity T of such a bond. (You many assume that zeros of all maturities are available and that discount factors for all maturities are given by d(t) = (1.03)-2t) If you could not do part (a), you may express T in terms of the DV01 of the portfolio of par-coupon bonds. (c) What parallel shift in the spot rate curve would explain a price decrease of $212.73 in the portfolio?(Use a first-order approximation. Be sure to specify a direction as well as a magnitude of the shift) Given that the annuity yield for maturity 10 years is ya (10) = 0.1 and the par- coupon yield for maturity 10 years is ype(10) = 0.08, determine the 10-year spot rate (10).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the duration and DV01 for Bond 1 and Bond 2 we need to calculate the present value of each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started