Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that there are only 5 Treasury Bonds traded in the bond market. These bonds are zero- coupon bonds and have face value of

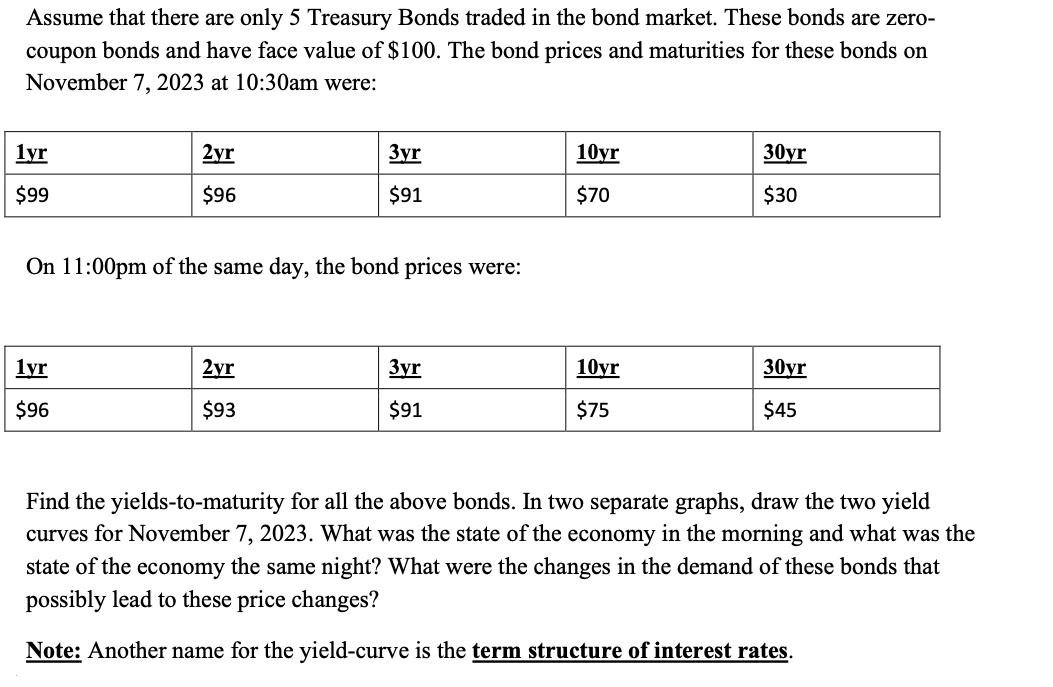

Assume that there are only 5 Treasury Bonds traded in the bond market. These bonds are zero- coupon bonds and have face value of $100. The bond prices and maturities for these bonds on November 7, 2023 at 10:30am were: lyr $99 2yr $96 1yr $96 On 11:00pm of the same day, the bond prices were: 3yr $91 2yr $93 3yr $91 10yr $70 10yr $75 30yr $30 30yr $45 Find the yields-to-maturity for all the above bonds. In two separate graphs, draw the two yield curves for November 7, 2023. What was the state of the economy in the morning and what was the state of the economy the same night? What were the changes in the demand of these bonds that possibly lead to these price changes? Note: Another name for the yield-curve is the term structure of interest rates.

Step by Step Solution

★★★★★

3.46 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION First lets calculate the yieldstomaturity for each of the bonds 1 2yr bond Face value 100 Price 96 Maturity 2 years Yieldtomaturity Price Fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started