Question

Assume that there are three assets A, B and C. The expected returns of stocks A, B and C are 4.25%, 3.00% and 1.80% respectively.

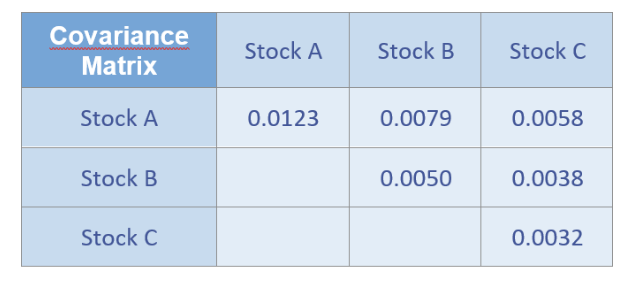

Assume that there are three assets A, B and C. The expected returns of stocks A, B and C are 4.25%, 3.00% and 1.80% respectively. Further calculations reveal the following covariance matrix. Andy holds a Portfolio P that consists of 40% stock A, 15% stock B and 45% of stock C. What is the expected return of portfolio P?

a) What is the expected return of portfolio P?

a. 2.05%

b. 2.96%

c. 1.82%

b) What is the standard deviation of portfolio P?

a. 0.084

b. 0.089

c. 0.079

c)What is the correlation coefficient between stocks B and C?

a. 0.89

b. 1

c. 0.95

d) What does this imply regarding the co-movement of stocks B and C?

a. Strong co-movement

b. Weak co-movement

c. Neither

e)What is the capital market line?

a. The efficient frontier of Portfolios that consist of risky assets

b. None of the answers

c. The efficient frontier of Portfolios that consist of risky and risk-free assets

f) After investing in a stock, the stock achieves a return of -1%, contrary to the CAPM estimation. What could be a reason for the actual return of the stock to be different from the CAPM estimate?

a. The CAPM does not take into account the idiosyncratic risk of the firm

b. The CAPM does not take into account the systematic risk of the firm

c. The CAPM does not take any of the two risks into account

Covariance Matrix Stock A Stock B Stock C Stock A 0.0123 0.0079 0.0058 Stock B 0.0050 0.0038 Stock C 0.0032Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started