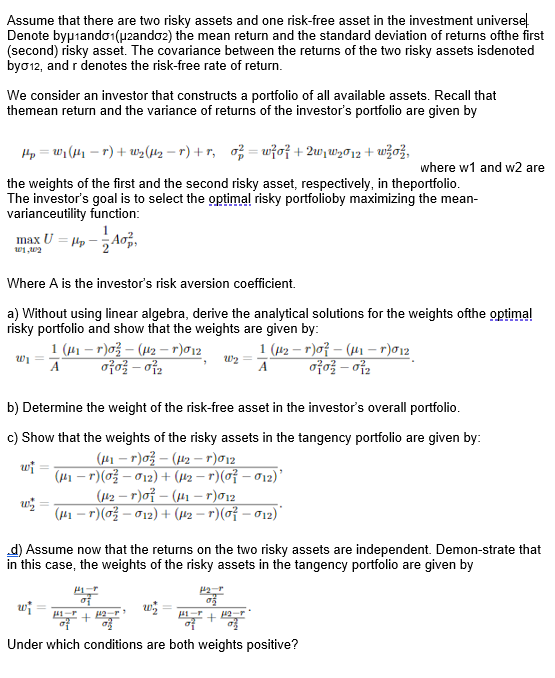

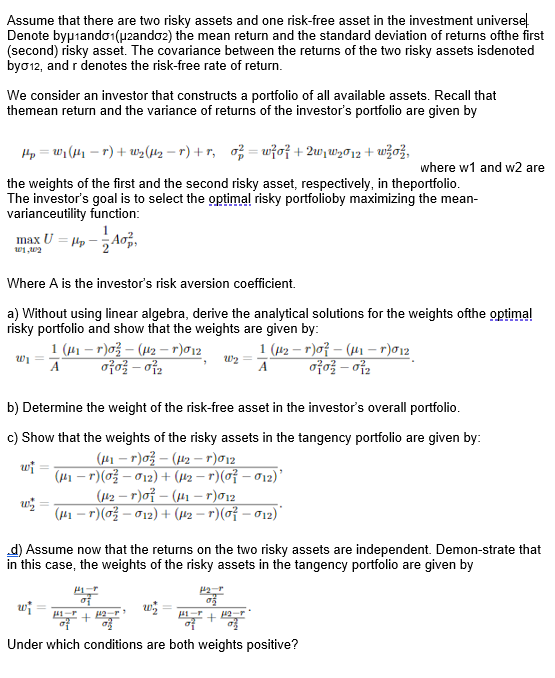

Assume that there are two risky assets and one risk-free asset in the investment universel Denote bypiando 1 (uzando2) the mean return and the standard deviation of returns ofthe first (second) risky asset. The covariance between the returns of the two risky assets isdenoted by012, and r denotes the risk-free rate of return. We consider an investor that constructs a portfolio of all available assets. Recall that themean return and the variance of returns of the investor's portfolio are given by Hp = w1(441 r) + wy(142 - r)+r, o= wo +2w,W2012 + wzoz, where w1 and w2 are the weights of the first and the second risky asset, respectively, in theportfolio. The investor's goal is to select the optimal risky portfolioby maximizing the mean- varianceutility function: max U = 15-503, Where A is the investor's risk aversion coefficient a) Without using linear algebra, derive the analytical solutions for the weights ofthe optimal risky portfolio and show that the weights are given by: 1 (H1-r)o - (H2-r)012 1 (862 - ro - (1-r)012 003-02 go-oiz w W2 b) Determine the weight of the risk-free asset in the investor's overall portfolio. c) Show that weights of the risky assets the tangency portfolio are given by: wi (H1-r)o - (N2-r)012 (H1-r)(03-012) + (H2 - r) - 012) w (142 - ro - (H1-r)012 (H1-r) (3 - 012) + (H2 - ro - 012) d) Assume now that the returns on the two risky assets are independent. Demon-strate that in this case, the weights of the risky assets in the tangency portfolio are given by HT 27 1- + 2- -T w of Under which conditions are both weights positive? 27 + Assume that there are two risky assets and one risk-free asset in the investment universel Denote bypiando 1 (uzando2) the mean return and the standard deviation of returns ofthe first (second) risky asset. The covariance between the returns of the two risky assets isdenoted by012, and r denotes the risk-free rate of return. We consider an investor that constructs a portfolio of all available assets. Recall that themean return and the variance of returns of the investor's portfolio are given by Hp = w1(441 r) + wy(142 - r)+r, o= wo +2w,W2012 + wzoz, where w1 and w2 are the weights of the first and the second risky asset, respectively, in theportfolio. The investor's goal is to select the optimal risky portfolioby maximizing the mean- varianceutility function: max U = 15-503, Where A is the investor's risk aversion coefficient a) Without using linear algebra, derive the analytical solutions for the weights ofthe optimal risky portfolio and show that the weights are given by: 1 (H1-r)o - (H2-r)012 1 (862 - ro - (1-r)012 003-02 go-oiz w W2 b) Determine the weight of the risk-free asset in the investor's overall portfolio. c) Show that weights of the risky assets the tangency portfolio are given by: wi (H1-r)o - (N2-r)012 (H1-r)(03-012) + (H2 - r) - 012) w (142 - ro - (H1-r)012 (H1-r) (3 - 012) + (H2 - ro - 012) d) Assume now that the returns on the two risky assets are independent. Demon-strate that in this case, the weights of the risky assets in the tangency portfolio are given by HT 27 1- + 2- -T w of Under which conditions are both weights positive? 27 +