Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that three years ago, you purchased a 10-year corporate bond that pays 12.0 percent. The purchase price was $1,000. Also, assume that today comparable

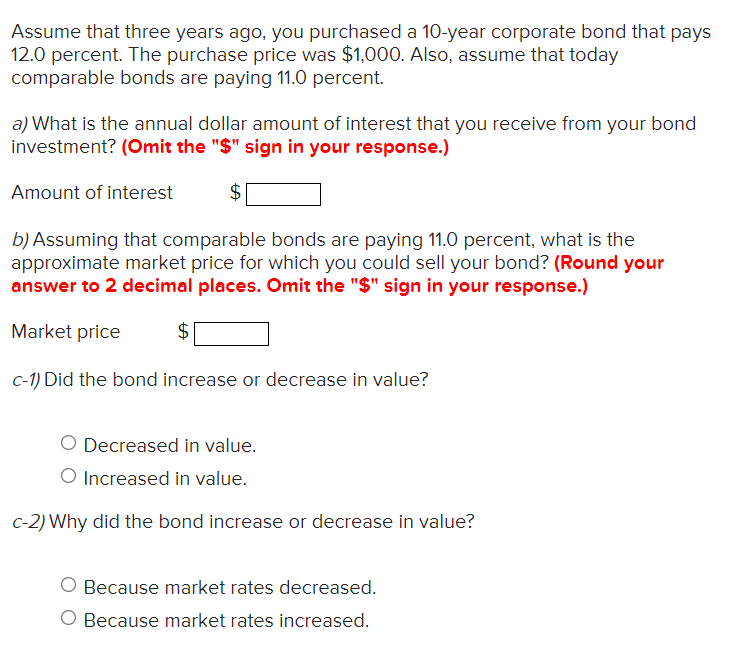

Assume that three years ago, you purchased a 10-year corporate bond that pays 12.0 percent. The purchase price was $1,000. Also, assume that today comparable bonds are paying 11.0 percent. a) What is the annual dollar amount of interest that you receive from your bond investment? (Omit the "\$" sign in your response.) Amount of interest $ b) Assuming that comparable bonds are paying 11.0 percent, what is the approximate market price for which you could sell your bond? (Round your answer to 2 decimal places. Omit the "\$" sign in your response.) Market price $ c1) Did the bond increase or decrease in value? Decreased in value. Increased in value. c2) Why did the bond increase or decrease in value? Because market rates decreased. Because market rates increased

Assume that three years ago, you purchased a 10-year corporate bond that pays 12.0 percent. The purchase price was $1,000. Also, assume that today comparable bonds are paying 11.0 percent. a) What is the annual dollar amount of interest that you receive from your bond investment? (Omit the "\$" sign in your response.) Amount of interest $ b) Assuming that comparable bonds are paying 11.0 percent, what is the approximate market price for which you could sell your bond? (Round your answer to 2 decimal places. Omit the "\$" sign in your response.) Market price $ c1) Did the bond increase or decrease in value? Decreased in value. Increased in value. c2) Why did the bond increase or decrease in value? Because market rates decreased. Because market rates increased Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started