Assume that U.S. and Argentine investors require a real return of 2 percent. If the U.S. nominal interest rate is 5 percent, and Argentina's nominal

Assume that U.S. and Argentine investors require a real return of 2 percent. If the U.S. nominal interest rate is 5 percent, and Argentina's nominal interest rate is 7 percent, then according to the IFE, the Argentine inflation rate is expected to be about ____ the U.S. inflation rate, and the Argentine peso is expected to ____. *

3 percentage points below; appreciate by about 3 percent

3 percentage points above; depreciate by about 3 percent

2 percentage points below; appreciate by about 2 percent

2 percentage points above; depreciate by about 2 percent

A foreign currency ________ option gives the holder the right to ________ a foreign currency, whereas a foreign currency ________ option gives the holder the right to ________ an option. *

call, buy, put, sell

call, sell, put, buy

put, hold, call, release

none of the above

When the exchange rate for the euro changes from $1.00 to $1.20, then, holding everything else constant, the euro has *

1 point

appreciated and German cars sold in the United States become more expensive

appreciated and German cars sold in the United States become less expensive.

depreciated and American wheat sold in Germany becomes more expensive.

depreciated and American wheat sold in Germany becomes less expensive

Appleton Co., based in the United States, has costs from orders of foreign material that are lower than its foreign revenue. All foreign transactions are denominated in the foreign currency of concern. This firm would ____ a stronger dollar and would ____ a weaker dollar. *

1 point

be adversely affected by; benefit from

benefit from; be adversely affected by

benefit from; be unaffected by

be adversely affected by; be adversely affected by

Use the following information to calculate the dollar cost of using a money market hedge to hedge 200,000 British pounds of payables due in 180 days. Assume the firm has no excess cash. Assume the spot rate of the pound is $2.02, and the 180-day forward rate is $2.00. The British interest rate is 5 percent, and the U.S. interest rate is 4 percent over the 180-day period. *

1 point

$388,210.

$400,152

$391,210.

$396,190

Which of the following is NOT TRUE regarding economic exposure? *

1 point

The impact of a change in the local currency on inflow and outflow variables can sometimes be indirect and therefore different from what is expected.

Even purely domestic firms can be affected by economic exposure.

The degree of economic exposure will likely be much greater for a firm involved in international business than for a purely domestic firm.

In general, depreciation of the firm's local currency causes a decrease in both cash inflows and outflows

Assume that the U.S. one-year interest rate is 3 percent and the one-year interest rate on Australian dollars is 6 percent. The U.S. expected annual inflation is 5 percent, while the Australian inflation is expected to be 7 percent. You have $100,000 to invest for one year and you believe that PPP holds. The spot exchange rate of an Australian dollar is $0.689. What will be the yield on your investment if you invest in the Australian market? *

1 point

3 percent

4 percent

2 percent

6 percent

Assume zero transaction costs. If the 180-day forward rate underestimates the spot rate 180 days from now, then the real cost of hedging payables with a forward contract will be *

1 point

a. Positive

b. Negative

c. Positive if the forward rate exhibits a premium, and negative if the forward rate exhibits a discount.

d. Zero

Which of the following international transactions would NOT be counted as a balance of payments (BOP) transaction? *

1 point

An American tourist purchases cheese in Milwaukee, Wisconsin.

The U.S. subsidiary of a British firm pays profits (dividends) back to its parent firm in London.

A Canadian lumber baron purchases a U.S. corporate bond through an investment broker in Seattle.

All of the above are considered BOP transactions.

Consider the following: A foreign automobile company builds a manufacturing plant in Tennessee and European investors buy U.S. Treasury Bonds. *

1 point

Both activities would be considered direct investment.

Both activities would be considered portfolio investment.

The auto manufacturer in engaging in portfolio investment, and the European investors are engaged in direct investing.

The auto manufacturer in engaging in direct investment, and the European investors are engaged in portfolio investing.

In determining why a firm becomes multinational there are many reasons. One reason is that the firm is a market seeker. Which of the following is NOT a reason why market-seeking firms produce in foreign countries? *

1 point

satisfaction of local demand in the foreign country

satisfaction of local demand in the domestic markets

political safety and small likelihood of government expropriation of assets

All of the above are market-seeking activities.

The best means of using direct foreign investment (DFI) to fully benefit from cheap foreign factors of production is probably to *

1 point

establish a subsidiary in a new market that can sell products produced elsewhere; this allows for increased production and possibly greater production efficiency.

establish a subsidiary in a market in which raw materials are cheap and accessible; sell the finished product to countries in which the raw materials are more expensive.

establish a subsidiary in a market that has relatively low costs of labor and land; sell the finished product to countries where the cost of production is higher.

acquire a competitor that has controlled its local market

Which of the following statements regarding currency futures contracts and forward contracts is NOT true? *

1 point

A futures contract is a standardized amount per currency whereas the forward contact is for any size desired.

A futures contract is for a fixed maturity whereas the forward contract is for any maturity you like up to one year.

Futures contracts trade on organized exchanges whereas forwards take place between individuals and banks with other banks via telecom linkages.

All of the above are true.

Campbell Co. is a U.S. firm that has a subsidiary located in Jamaica. The subsidiary has generated losses for the last five years and is expected to generate losses for the next ten years because its costs denominated in Jamaican dollars exceed the revenue that it receives in Jamaican dollars. Campbell is reluctant to divest this subsidiary, however. So, the U.S. parent must periodically use some of its funds to pay for the high expenses in Jamaica. Given this information, Campbell would benefit from a(n) ____ of the Jamaican dollar. *

1 point

Jamaican government pegging (set equal to U.S. dollar

Appreciation

Depreciation

Stabilization

Denver Company (a U.S. firm) wants to establish a subsidiary that would produce products and then sell them locally within the country of Barbazo. When it conducts a country risk analysis, all country risk characteristics of Barbazo except ____ should be examined for this purpose. *

1 point

potential blockage of funds that are remitted by subsidiaries established in Barbazo

exchange rate movements of Barbazo's currency against the dollar

potential tariffs imposed on products imported by Barbazo's government

attitude of consumers in Barbazo about buying products from a subsidiary that is U.S.-owned

Consider the following: A foreign automobile company builds a manufacturing plant in Tennessee and European investors buy U.S. Treasury Bonds. *

1 point

Both activities would be considered direct investments.

Both activities would be considered portfolio investments.

The auto manufacturer is engaging in portfolio investment and the European investors are engaged in direct investing.

The auto manufacturer is engaging in direct investment and the European investors are engaged in portfolio investing.

Option 5

According to the interest parity condition, if the domestic interest rate is ________ the foreign interest rate, then ________. *

1 point

above; there is expected appreciation of the foreign currency

above; there is expected depreciation of the foreign currency

below; there is expected appreciation of the foreign currency

below; the interest parity condition is violated

Pro Corp., a U.S.-based MNC, uses purchasing power parity to forecast the value of the Thai baht (THB), which has a current exchange rate of $0.022. Inflation in the United States is expected to be 3 percent during the next year, while inflation in Thailand is expected to be 10 percent. Under this scenario, Pro Corp. would forecast the value of the baht at the end of the year to be: *

1 point

$0.023.

$0.021.

$0.020.

None of the above

The countries that use the euro as their currency have: *

1 point

agreed to use a single currency (exchange rate stability), allow the free movement of capital in and out of their economies (financial integration), but give up individual control of their own money supply (monetary independence)

gained control over their own money supply (monetary independence), allowed the free movement of capital in and out of their economies (financial integration), but give up exchange rate stability.

agreed to use a single currency (exchange rate stability), allow individual control of their own money supply (monetary independence), but give up the free movement of capital in and out of their economies (financial integration).

none of the above

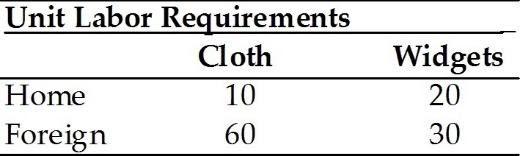

Given the information in the table below *

1 point

neither country has a comparative advantage in cloth.

Home has a comparative advantage in cloth.

Foreign has a comparative advantage in cloth.

Home has a comparative advantage in both cloth and widgets.

Unit Labor Requirements Cloth Widgets Home 10 20 Foreign 60 30

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Assume that US and Argentine investors require a real return of 2 percent If the US nominal interest rate is 5 percent and Argentinas nominal interest rate is 7 percent then according to the IFE the A...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started