Answered step by step

Verified Expert Solution

Question

1 Approved Answer

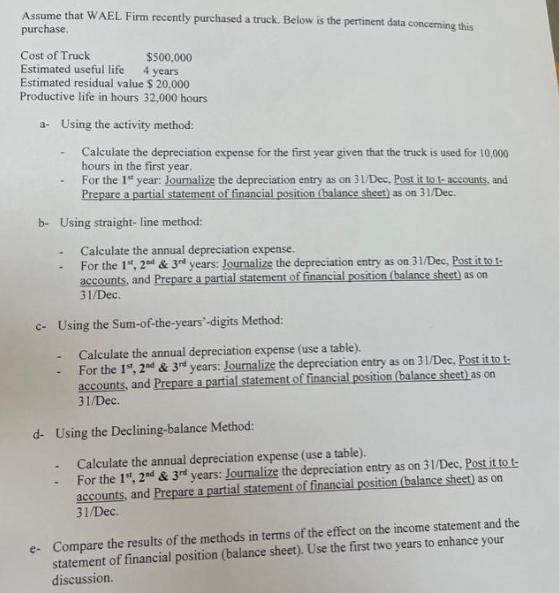

Assume that WAEL Firm recently purchased a truck. Below is the pertinent data concerning this purchase. Cost of Truck $500,000 Estimated useful life 4

Assume that WAEL Firm recently purchased a truck. Below is the pertinent data concerning this purchase. Cost of Truck $500,000 Estimated useful life 4 years Estimated residual value $ 20,000 Productive life in hours 32,000 hours a- Using the activity method: Calculate the depreciation expense for the first year given that the truck is used for 10,000 hours in the first year. For the 1st year: Journalize the depreciation entry as on 31/Dec. Post it to t-accounts, and Prepare a partial statement of financial position (balance sheet) as on 31/Dec. b- Using straight-line method: Calculate the annual depreciation expense. For the 1", 2nd & 3rd years: Journalize the depreciation entry as on 31/Dec, Post it to t- accounts, and Prepare a partial statement of financial position (balance sheet) as on 31/Dec. c-Using the Sum-of-the-years-digits Method: Calculate the annual depreciation expense (use a table). For the 1", 2nd & 3rd years: Journalize the depreciation entry as on 31/Dec, Post it to t- accounts, and Prepare a partial statement of financial position (balance sheet) as on 31/Dec. d- Using the Declining-balance Method: Calculate the annual depreciation expense (use a table). For the 1", 2nd & 3rd years: Journalize the depreciation entry as on 31/Dec, Post it to t- accounts, and Prepare a partial statement of financial position (balance sheet) as on 31/Dec. e- Compare the results of the methods in terms of the effect on the income statement and the statement of financial position (balance sheet). Use the first two years to enhance your discussion.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Using the activity method Depreciation expense for the first year Cost of Truck x Actual usage hoursEstimated productive life hours 500000 x 1000032...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started