Answered step by step

Verified Expert Solution

Question

1 Approved Answer

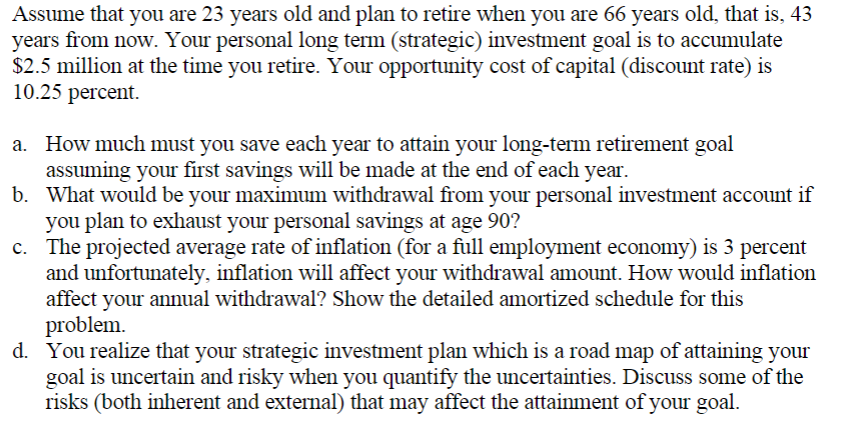

Assume that you are 2 3 years old and plan to retire when you are 6 6 years old, that is 4 3 years from

Assume that you are years old and plan to retire when you are years old, that is years from now. Your personal long term strategicinvestment goal is to accumulate $ million at the time you retire. Your opportunity cost of capital discount rate is percent.

a How much must you save each year to attain your longterm retirement goal assuming your first savings will be made at the end of each year.

b What would be your maximum withdrawal from your personal investment account if you plan to exhaust your personal savings at age

c The projected average rate of inflation for a full employment economy is percent and unfortunately, inflation will affect your withdrawal amount. How would inflation affect your annual withdrawal? Show the detailed amortized schedule for this problem.

d You realize that your strategic investment plan which is a road map of attaining your goal is uncertain and risky when you quantify the uncertainties. Discuss some of the risks both inherent and external that may affect the attainment of your goal.

please show how to complete it in excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started