Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are a consultant to Vanderheiden Inc., The total market value of the common stock of the company is $614million. The company's perpetual

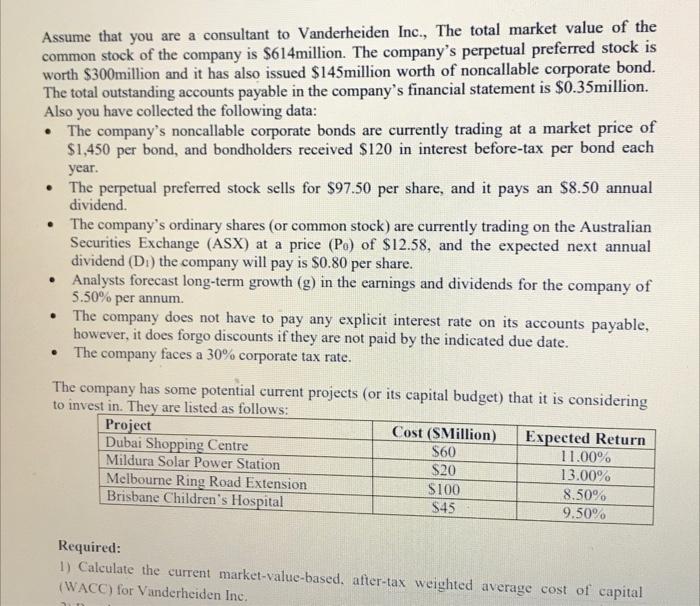

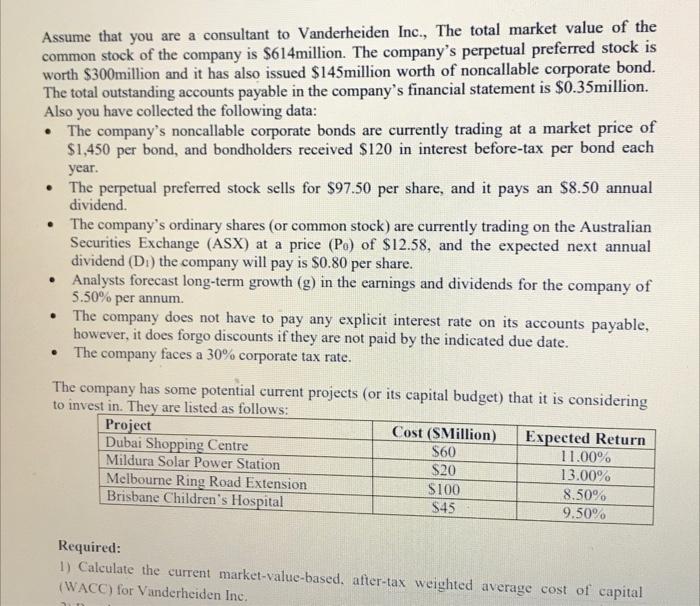

Assume that you are a consultant to Vanderheiden Inc., The total market value of the common stock of the company is $614million. The company's perpetual preferred stock is worth $300million and it has also issued $145million worth of noncallable corporate bond. The total outstanding accounts payable in the company's financial statement is $0.35million. Also you have collected the following data: The company's noncallable corporate bonds are currently trading at a market price of $1,450 per bond, and bondholders received $120 in interest before-tax per bond each year. The perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. The company's ordinary shares (or common stock) are currently trading on the Australian Securities Exchange (ASX) at a price (Po) of $12.58, and the expected next annual dividend (DI) the company will pay is $0.80 per share. Analysts forecast long-term growth (g) in the earnings and dividends for the company of 5.50% per annum. The company does not have to pay any explicit interest rate on its accounts payable, however, it does forgo discounts if they are not paid by the indicated due date. The company faces a 30% corporate tax rate. The company has some potential current projects (or its capital budget) that it is considering to invest in. They are listed as follows: Project Cost (SMillion) Expected Return Dubai Shopping Centre S60 11.00% Mildura Solar Power Station $20 13.00% Melbourne Ring Road Extension $100 8.50% Brisbane Children's Hospital $45 9.50% Required: 1) Calculate the current market value-based, after-tax weighted average cost of capital (WACC) for Vanderheiden Inc. Assume that you are a consultant to Vanderheiden Inc., The total market value of the common stock of the company is $614million. The company's perpetual preferred stock is worth $300million and it has also issued $145million worth of noncallable corporate bond. The total outstanding accounts payable in the company's financial statement is $0.35million. Also you have collected the following data: The company's noncallable corporate bonds are currently trading at a market price of $1,450 per bond, and bondholders received $120 in interest before-tax per bond each year. The perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. The company's ordinary shares (or common stock) are currently trading on the Australian Securities Exchange (ASX) at a price (Po) of $12.58, and the expected next annual dividend (DI) the company will pay is $0.80 per share. Analysts forecast long-term growth (g) in the earnings and dividends for the company of 5.50% per annum. The company does not have to pay any explicit interest rate on its accounts payable, however, it does forgo discounts if they are not paid by the indicated due date. The company faces a 30% corporate tax rate. The company has some potential current projects (or its capital budget) that it is considering to invest in. They are listed as follows: Project Cost (SMillion) Expected Return Dubai Shopping Centre S60 11.00% Mildura Solar Power Station $20 13.00% Melbourne Ring Road Extension $100 8.50% Brisbane Children's Hospital $45 9.50% Required: 1) Calculate the current market value-based, after-tax weighted average cost of capital (WACC) for Vanderheiden Inc

Assume that you are a consultant to Vanderheiden Inc., The total market value of the common stock of the company is $614million. The company's perpetual preferred stock is worth $300million and it has also issued $145million worth of noncallable corporate bond. The total outstanding accounts payable in the company's financial statement is $0.35million. Also you have collected the following data: The company's noncallable corporate bonds are currently trading at a market price of $1,450 per bond, and bondholders received $120 in interest before-tax per bond each year. The perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. The company's ordinary shares (or common stock) are currently trading on the Australian Securities Exchange (ASX) at a price (Po) of $12.58, and the expected next annual dividend (DI) the company will pay is $0.80 per share. Analysts forecast long-term growth (g) in the earnings and dividends for the company of 5.50% per annum. The company does not have to pay any explicit interest rate on its accounts payable, however, it does forgo discounts if they are not paid by the indicated due date. The company faces a 30% corporate tax rate. The company has some potential current projects (or its capital budget) that it is considering to invest in. They are listed as follows: Project Cost (SMillion) Expected Return Dubai Shopping Centre S60 11.00% Mildura Solar Power Station $20 13.00% Melbourne Ring Road Extension $100 8.50% Brisbane Children's Hospital $45 9.50% Required: 1) Calculate the current market value-based, after-tax weighted average cost of capital (WACC) for Vanderheiden Inc. Assume that you are a consultant to Vanderheiden Inc., The total market value of the common stock of the company is $614million. The company's perpetual preferred stock is worth $300million and it has also issued $145million worth of noncallable corporate bond. The total outstanding accounts payable in the company's financial statement is $0.35million. Also you have collected the following data: The company's noncallable corporate bonds are currently trading at a market price of $1,450 per bond, and bondholders received $120 in interest before-tax per bond each year. The perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. The company's ordinary shares (or common stock) are currently trading on the Australian Securities Exchange (ASX) at a price (Po) of $12.58, and the expected next annual dividend (DI) the company will pay is $0.80 per share. Analysts forecast long-term growth (g) in the earnings and dividends for the company of 5.50% per annum. The company does not have to pay any explicit interest rate on its accounts payable, however, it does forgo discounts if they are not paid by the indicated due date. The company faces a 30% corporate tax rate. The company has some potential current projects (or its capital budget) that it is considering to invest in. They are listed as follows: Project Cost (SMillion) Expected Return Dubai Shopping Centre S60 11.00% Mildura Solar Power Station $20 13.00% Melbourne Ring Road Extension $100 8.50% Brisbane Children's Hospital $45 9.50% Required: 1) Calculate the current market value-based, after-tax weighted average cost of capital (WACC) for Vanderheiden Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started