Question

Assume that you are presently 30 years old and that you intend to retire when you turn 65. You would like to make sure

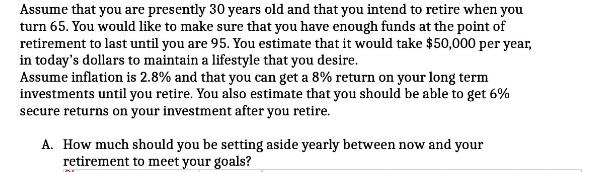

Assume that you are presently 30 years old and that you intend to retire when you turn 65. You would like to make sure that you have enough funds at the point of retirement to last until you are 95. You estimate that it would take $50,000 per year, in today's dollars to maintain a lifestyle that you desire. Assume inflation is 2.8% and that you can get a 8% return on your long term investments until you retire. You also estimate that you should be able to get 6% secure returns on your investment after you retire. A. How much should you be setting aside yearly between now and your retirement to meet your goals?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate how much you should be setting aside yearly between now and your retirement to meet you...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance Turning Money into Wealth

Authors: Arthur J. Keown

8th edition

134730364, 978-0134730363

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App