Answered step by step

Verified Expert Solution

Question

1 Approved Answer

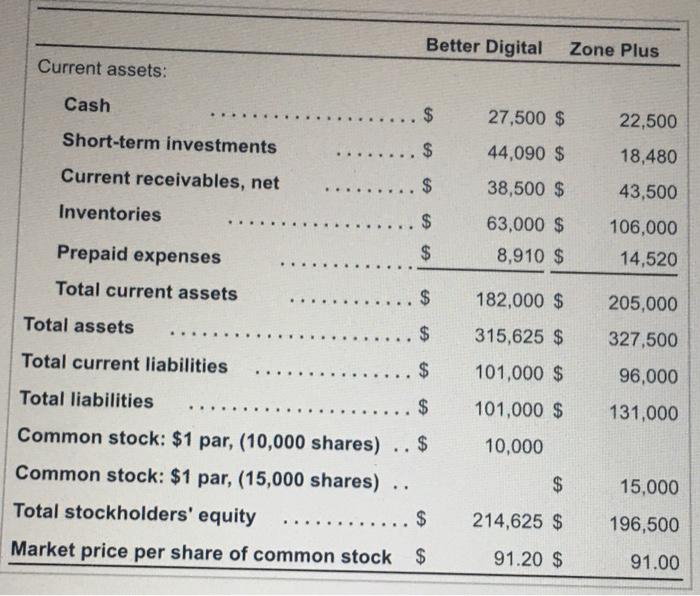

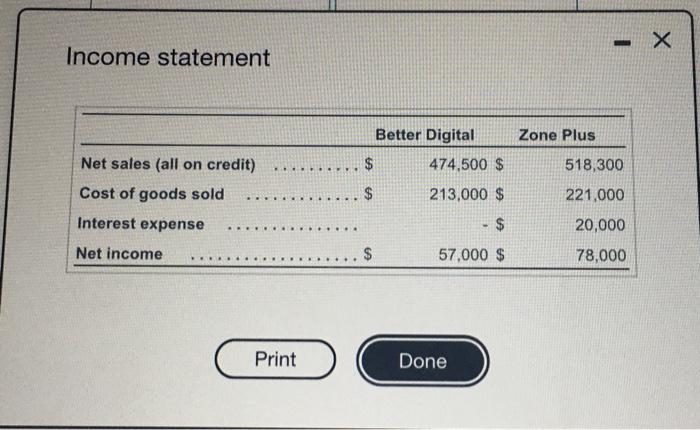

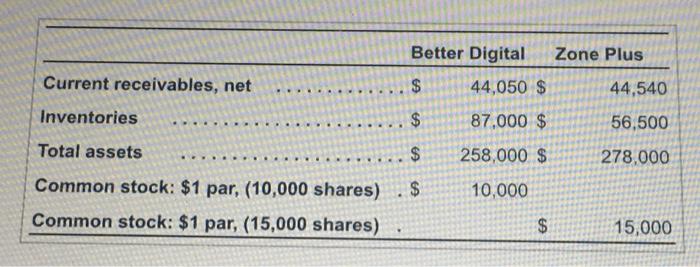

Assume that you are purchasing an investment and have decided to invest in a company in the smartphone business. You have narrowed the choice to

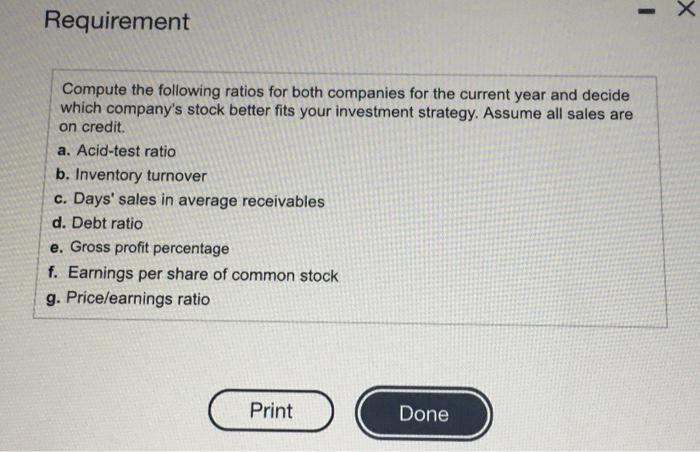

Assume that you are purchasing an investment and have decided to invest in a company in the smartphone business. You have narrowed the choice to Better Digital Electronics or Zone Plus Electronics and have assembled the following data.

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started