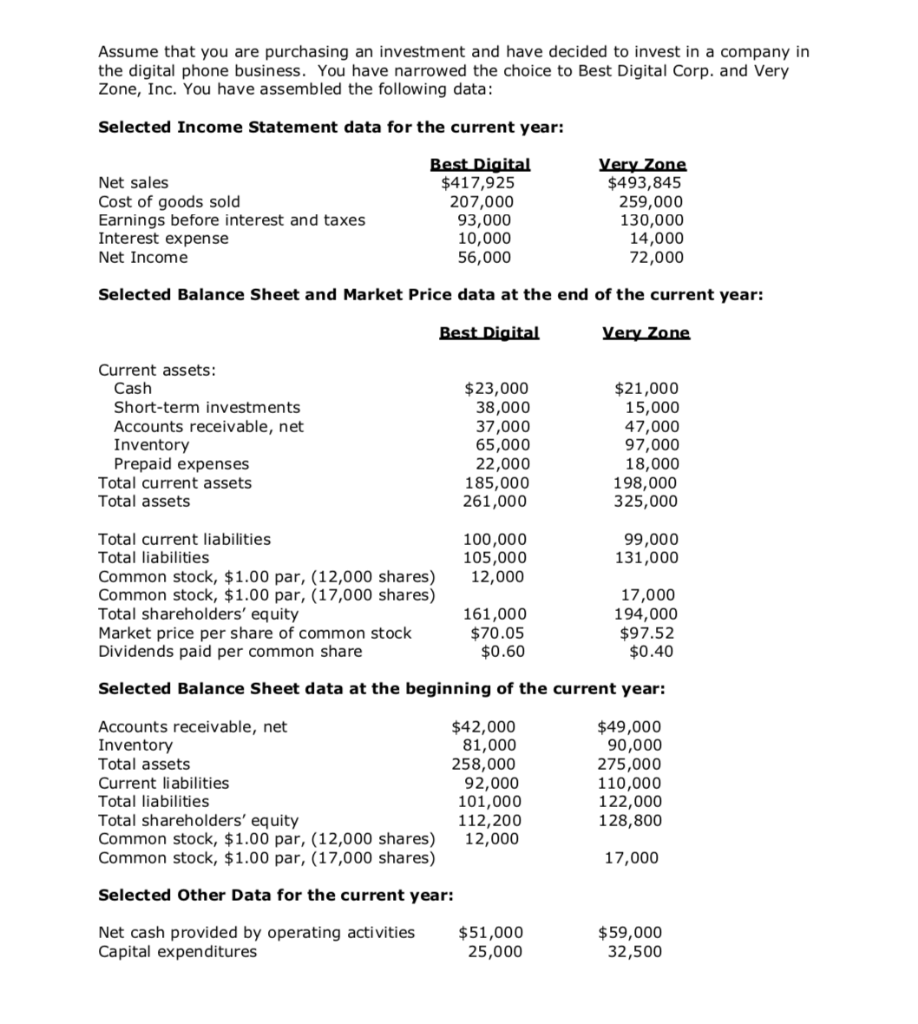

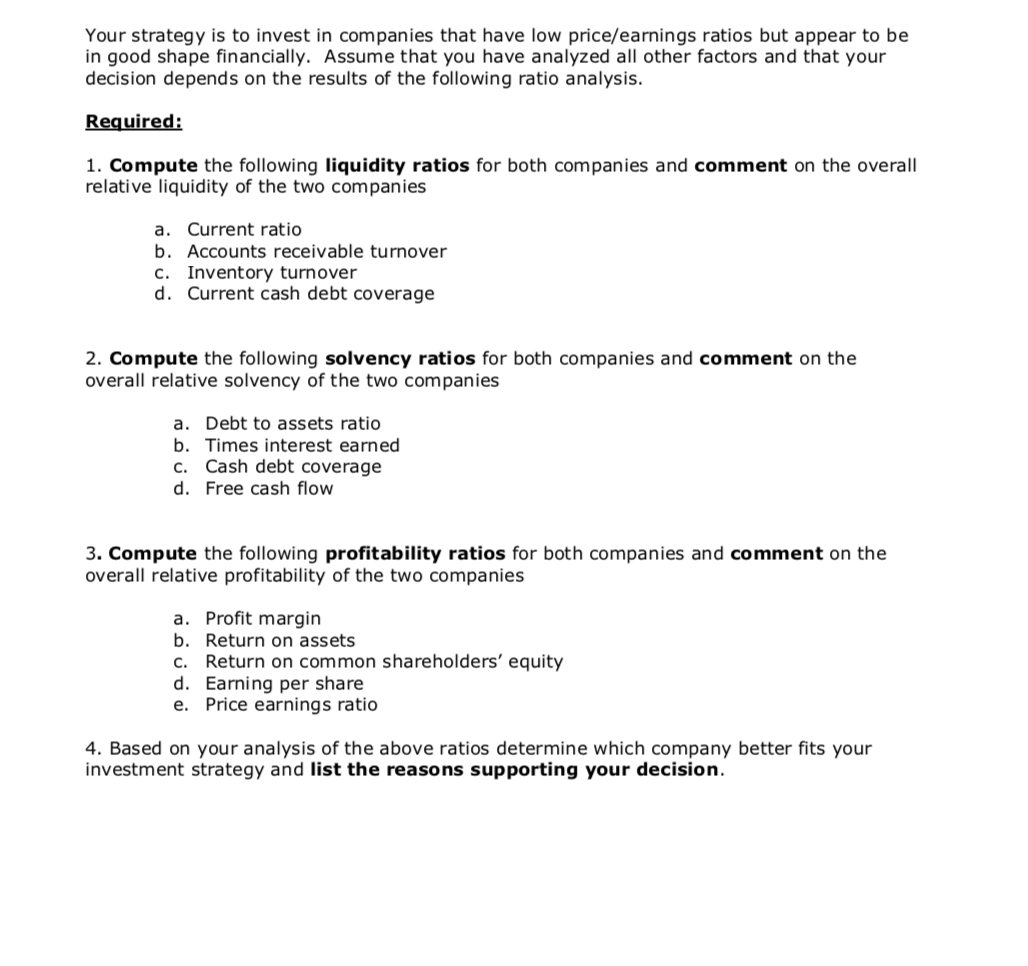

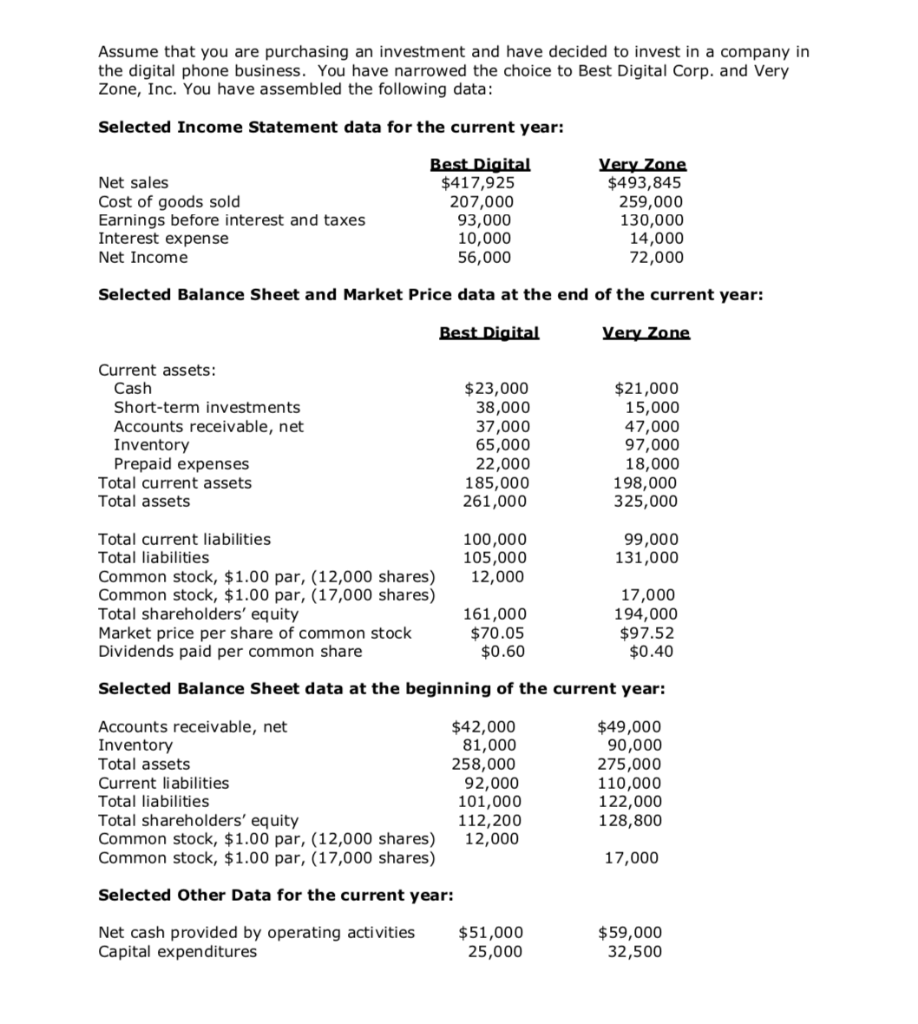

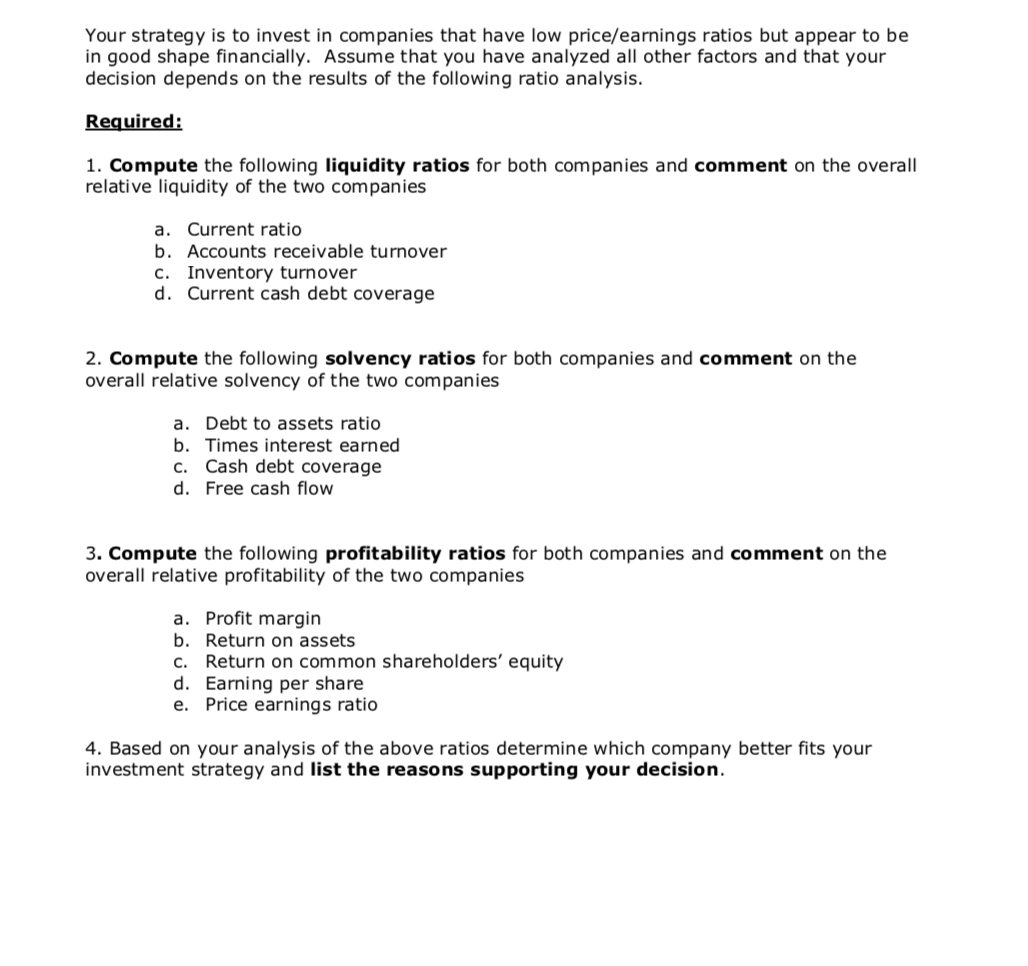

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital Corp. and Very Zone, Inc. You have assembled the following data: Selected Income Statement data for the current year: Net sales Cost of goods sold Earnings before interest and taxes Interest expense Net Income Best Digital $417,925 207,000 93,000 10,000 56,000 Very Zone $493,845 259,000 130,000 14,000 72,000 Selected Balance Sheet and Market Price data at the end of the current year: Best Digital Very Zone Current assets: Cash Short-term investments Accounts receivable, net Inventory Prepaid expenses Total current assets Total assets $23,000 38,000 37,000 65,000 22,000 185,000 261,000 $21,000 15,000 47,000 97,000 18,000 198,000 325,000 100,000 105,000 12,000 99,000 131,000 Total current liabilities Total liabilities Common stock, $1.00 par, (12,000 shares) Common stock, $1.00 par, (17,000 shares) Total shareholders' equity Market price per share of common stock Dividends paid per common share 161,000 $70.05 $0.60 17,000 194,000 $97.52 $0.40 Selected Balance Sheet data at the beginning of the current year: Accounts receivable, net Inventory Total assets Current liabilities Total liabilities Total shareholders' equity Common stock, $1.00 par, (12,000 shares) Common stock, $1.00 par, (17,000 shares) $42,000 81,000 258,000 92,000 101,000 112,200 12,000 $49,000 90,000 275,000 110,000 122,000 128,800 17,000 Selected Other Data for the current year: Net cash provided by operating activities Capital expenditures $51,000 25,000 $59,000 32,500 Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of the following ratio analysis. Required: 1. Compute the following liquidity ratios for both companies and comment on the overall relative liquidity of the two companies a. Current ratio b. Accounts receivable turnover c. Inventory turnover d. Current cash debt coverage 2. Compute the following solvency ratios for both companies and comment on the overall relative solvency of the two companies a. Debt to assets ratio b. Times interest earned C. Cash debt coverage d. Free cash flow 3. Compute the following profitability ratios for both companies and comment on the overall relative profitability of the two companies a. Profit margin b. Return on assets c. Return on common shareholders' equity d. Earning per share e. Price earnings ratio 4. Based on your analysis of the above ratios determine which company better fits your investment strategy and list the reasons supporting your decision. Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital Corp. and Very Zone, Inc. You have assembled the following data: Selected Income Statement data for the current year: Net sales Cost of goods sold Earnings before interest and taxes Interest expense Net Income Best Digital $417,925 207,000 93,000 10,000 56,000 Very Zone $493,845 259,000 130,000 14,000 72,000 Selected Balance Sheet and Market Price data at the end of the current year: Best Digital Very Zone Current assets: Cash Short-term investments Accounts receivable, net Inventory Prepaid expenses Total current assets Total assets $23,000 38,000 37,000 65,000 22,000 185,000 261,000 $21,000 15,000 47,000 97,000 18,000 198,000 325,000 100,000 105,000 12,000 99,000 131,000 Total current liabilities Total liabilities Common stock, $1.00 par, (12,000 shares) Common stock, $1.00 par, (17,000 shares) Total shareholders' equity Market price per share of common stock Dividends paid per common share 161,000 $70.05 $0.60 17,000 194,000 $97.52 $0.40 Selected Balance Sheet data at the beginning of the current year: Accounts receivable, net Inventory Total assets Current liabilities Total liabilities Total shareholders' equity Common stock, $1.00 par, (12,000 shares) Common stock, $1.00 par, (17,000 shares) $42,000 81,000 258,000 92,000 101,000 112,200 12,000 $49,000 90,000 275,000 110,000 122,000 128,800 17,000 Selected Other Data for the current year: Net cash provided by operating activities Capital expenditures $51,000 25,000 $59,000 32,500 Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of the following ratio analysis. Required: 1. Compute the following liquidity ratios for both companies and comment on the overall relative liquidity of the two companies a. Current ratio b. Accounts receivable turnover c. Inventory turnover d. Current cash debt coverage 2. Compute the following solvency ratios for both companies and comment on the overall relative solvency of the two companies a. Debt to assets ratio b. Times interest earned C. Cash debt coverage d. Free cash flow 3. Compute the following profitability ratios for both companies and comment on the overall relative profitability of the two companies a. Profit margin b. Return on assets c. Return on common shareholders' equity d. Earning per share e. Price earnings ratio 4. Based on your analysis of the above ratios determine which company better fits your investment strategy and list the reasons supporting your decision