Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are the manager of a very successful portfolio with an historical expected rate of return of 15% and a standard deviation

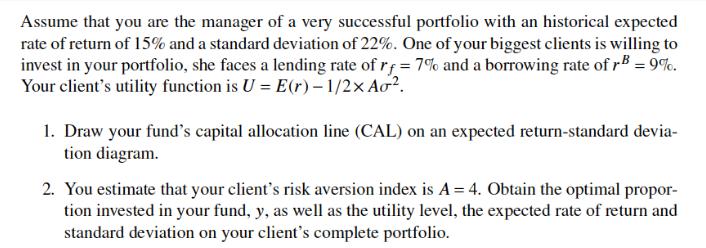

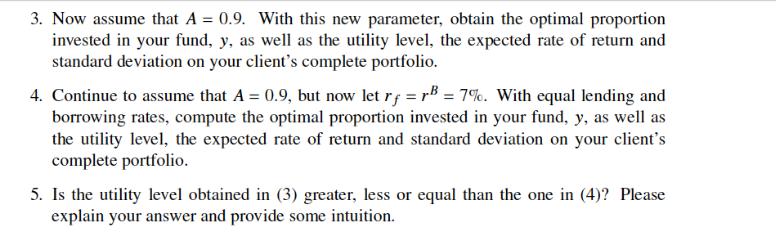

Assume that you are the manager of a very successful portfolio with an historical expected rate of return of 15% and a standard deviation of 22%. One of your biggest clients is willing to invest in your portfolio, she faces a lending rate of rf = 7% and a borrowing rate of r = 9%. Your client's utility function is U = E(r)-1/2x Ao. 1. Draw your fund's capital allocation line (CAL) on an expected return-standard devia- tion diagram. 2. You estimate that your client's risk aversion index is A = 4. Obtain the optimal propor- tion invested in your fund, y, as well as the utility level, the expected rate of return and standard deviation on your client's complete portfolio. 3. Now assume that A = 0.9. With this new parameter, obtain the optimal proportion invested in your fund, y, as well as the utility level, the expected rate of return and standard deviation on your client's complete portfolio. 4. Continue to assume that A=0.9, but now let r = rB = 7%. With equal lending and borrowing rates, compute the optimal proportion invested in your fund, y, as well as the utility level, the expected rate of return and standard deviation on your client's complete portfolio. 5. Is the utility level obtained in (3) greater, less or equal than the one in (4)? Please explain your answer and provide some intuition.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve these calculations lets go through each question step by step a Payback period The payback period is the time it takes for a project to recover its initial investment We sum the net cash flow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started