Question

Assume that you can build 56K square feet on the site instead of 28K used in the worksheet BackOfEnvelope. What is the maximum residual land

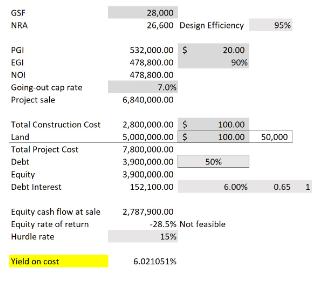

GSF NRA PGI EGI NOI Going-out cap rate Project sale Total Construction Cost Land Total Project Cost Debt Equity Debt interest Equity cash flow at sale Equity rate of return Hurdle rate Yield on cost 28,000 26,600 Design Efficiency 532,000.00 $ 478,800.00 478,800.00 7.0% 6,840,000.00 2,800,000.00 $ 5,000,000.00 $ 7,800,000.00 3,900,000.00 3,900,000.00 152,100.00 2,787,900.00 6.021051% 20.00 50% 90% 100.00 100.00 50,000 -28.5 % Not feasible 15% 6.00% 95% 0.65

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine the maximum residual land value that makes this development feasible we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App