Question

Assume that you expect the economys rate of inflation to be 4 percent, giving an RFR of 8 percent and a market return ( R

Assume that you expect the economys rate of inflation to be 4 percent, giving an RFR of 8 percent and a market return (RM) of 12 percent.

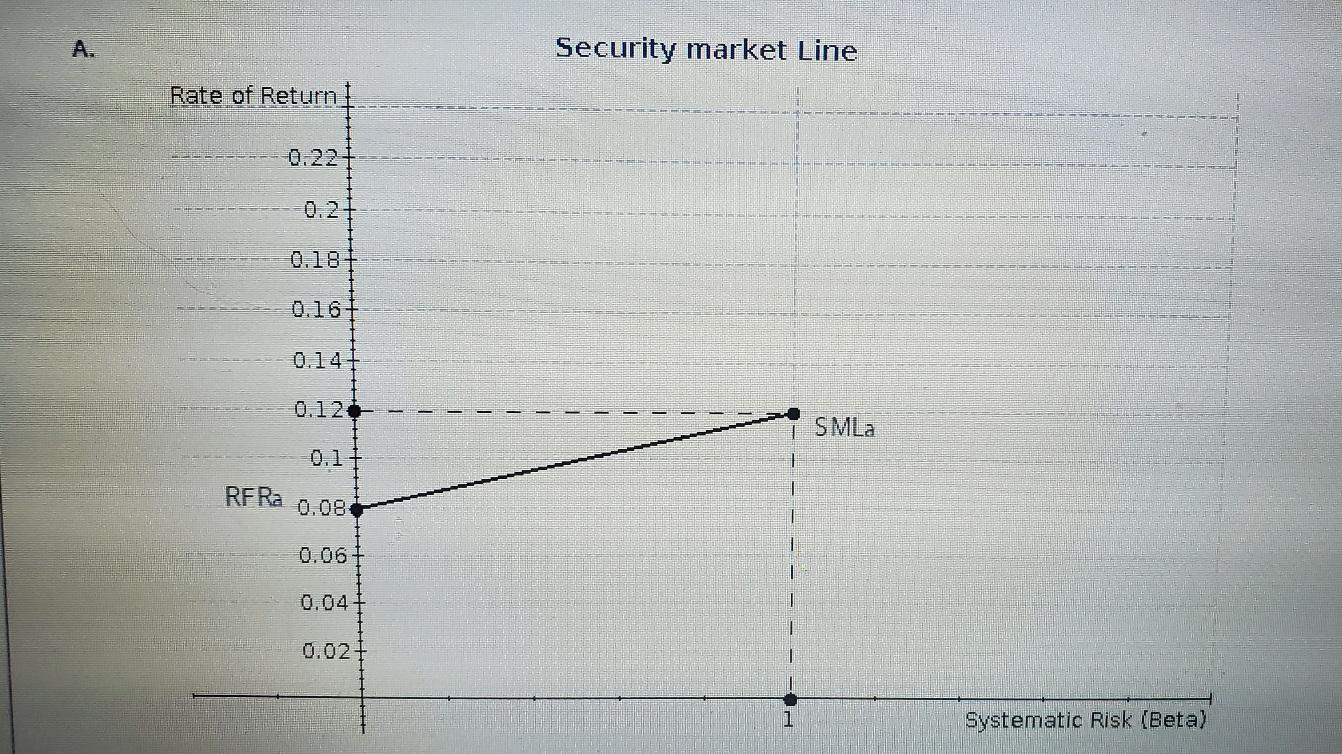

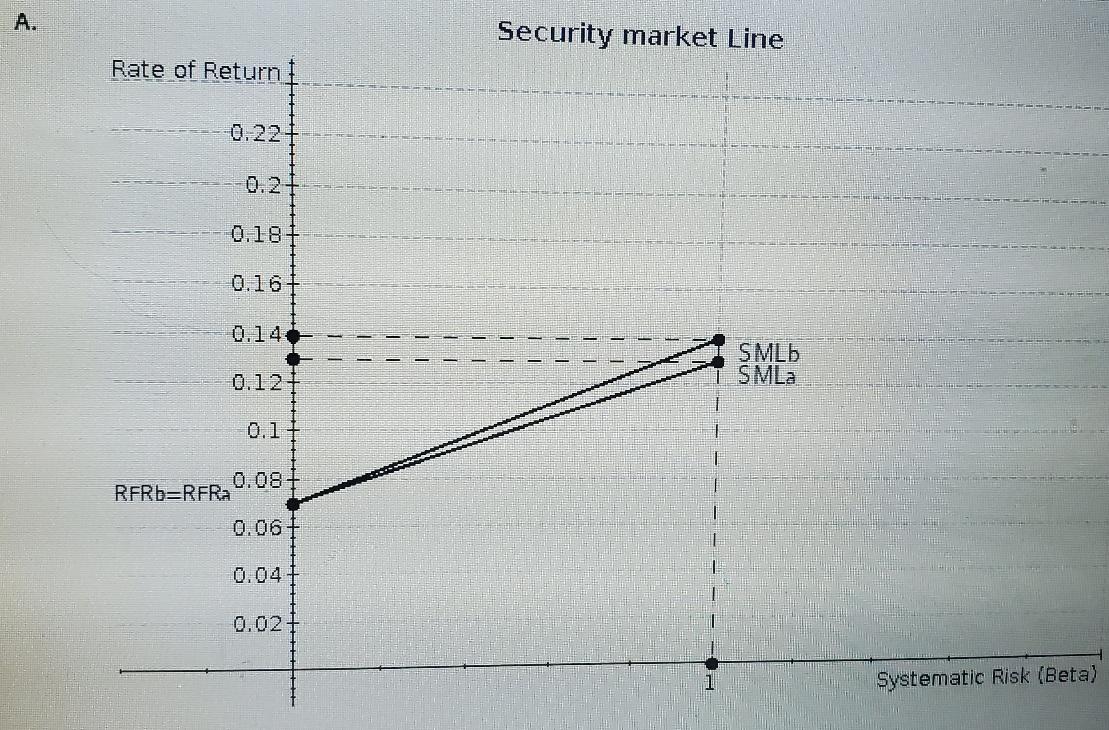

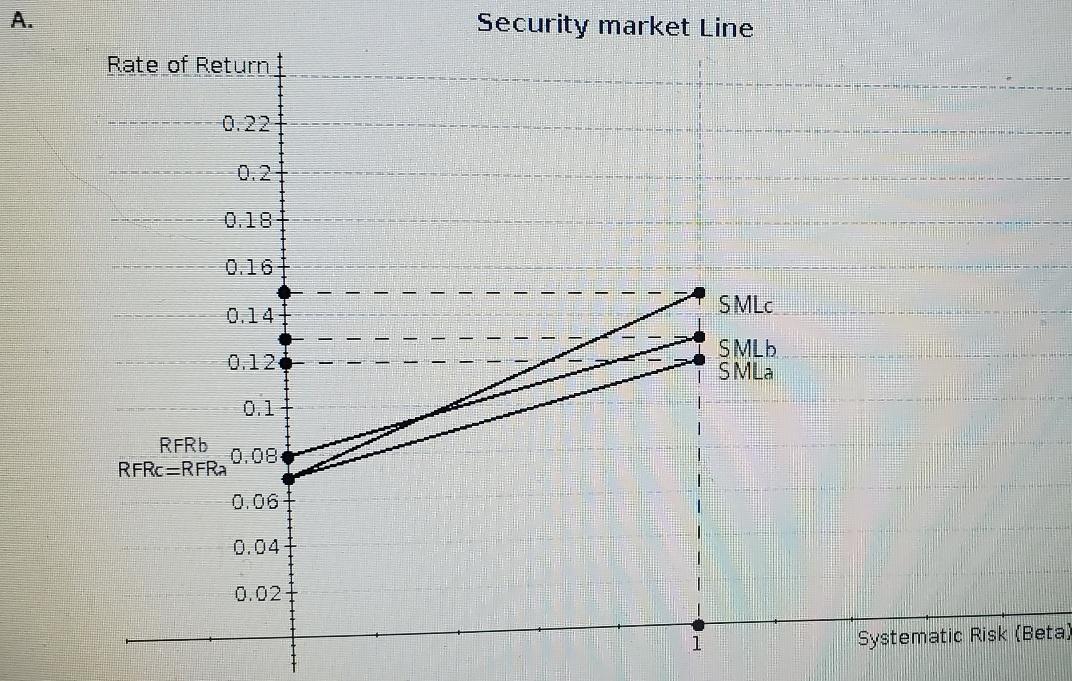

- Choose the correct SML graph under these assumptions.

The correct graph is -Select-graph Agraph Bgraph Cgraph DItem 1 .

A.

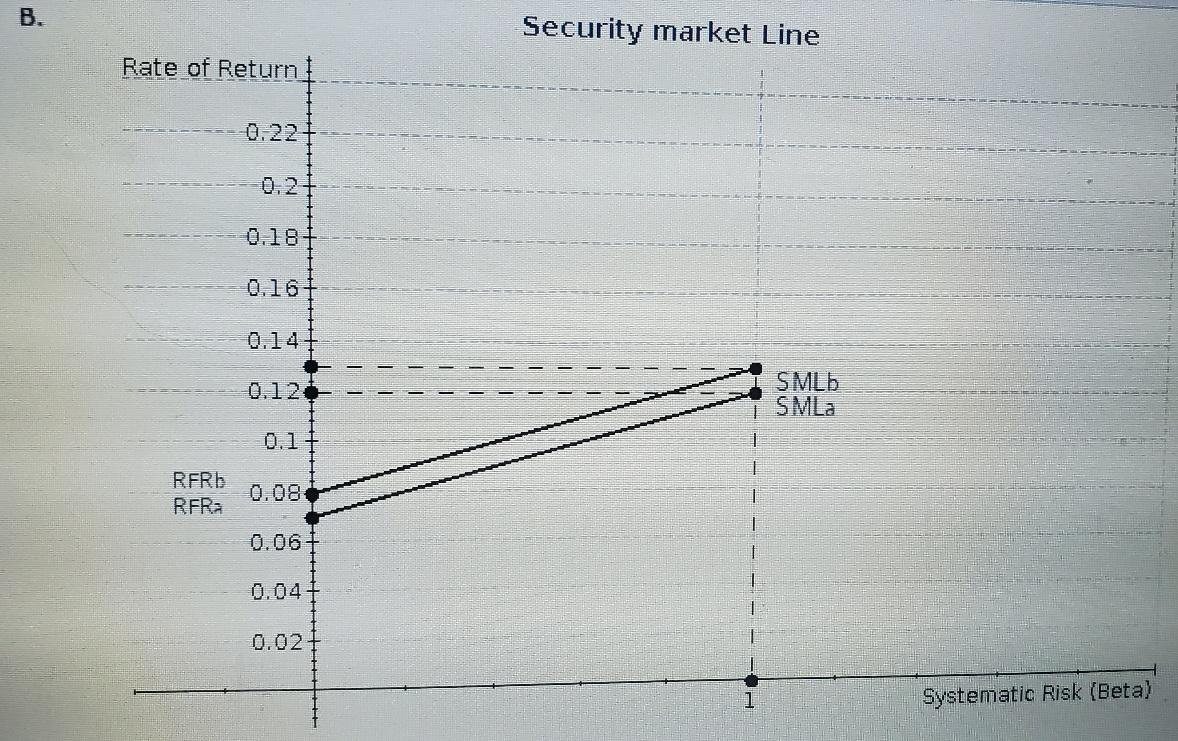

B.

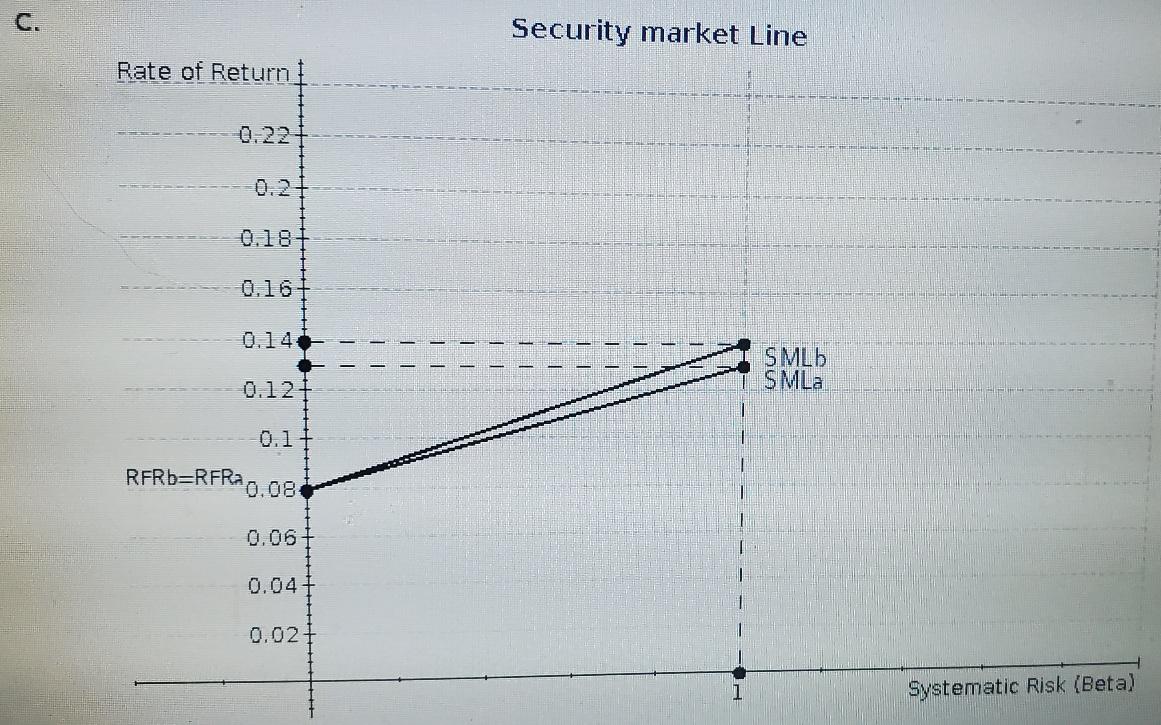

C.

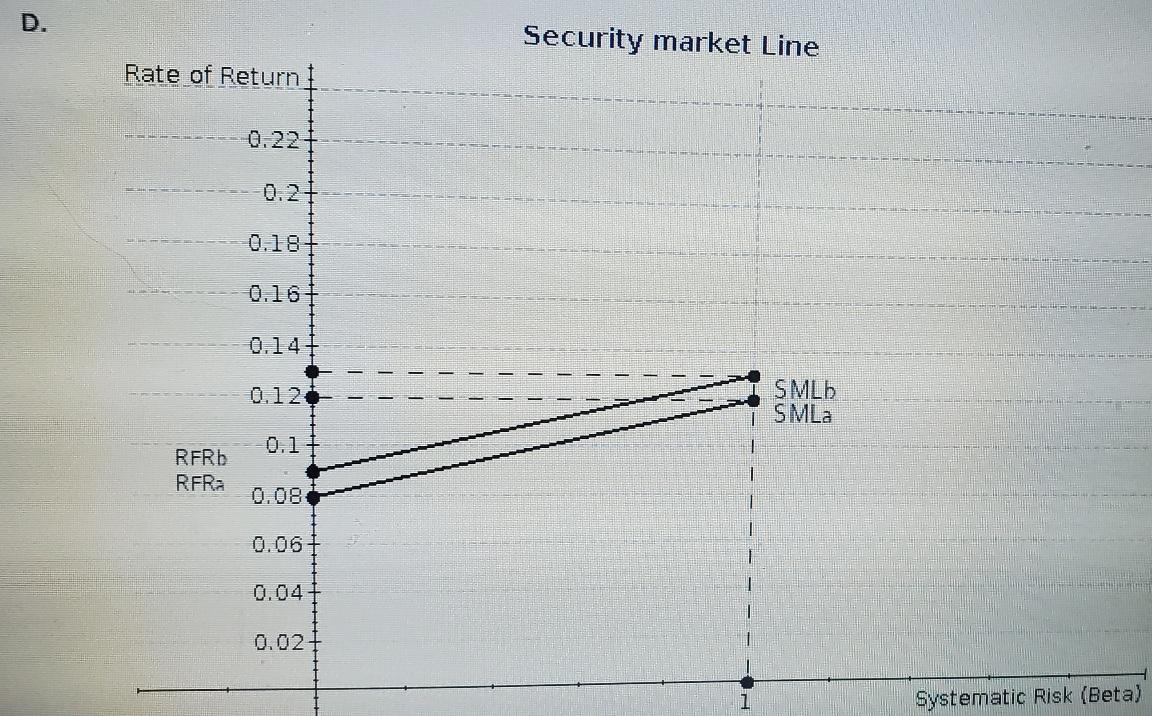

D.

- Subsequently, you expect the rate of inflation to increase from 4 percent to 5 percent. What effect would this have on the RFR and the RM?

A change in risk-free rate, with other things being equal, would result in a new SMLb, which would intercept with the -Select-verticalhorizontalItem 2 axis at the new risk-free rate and -Select-wouldwould notItem 3 be parallel to the original SMLa.

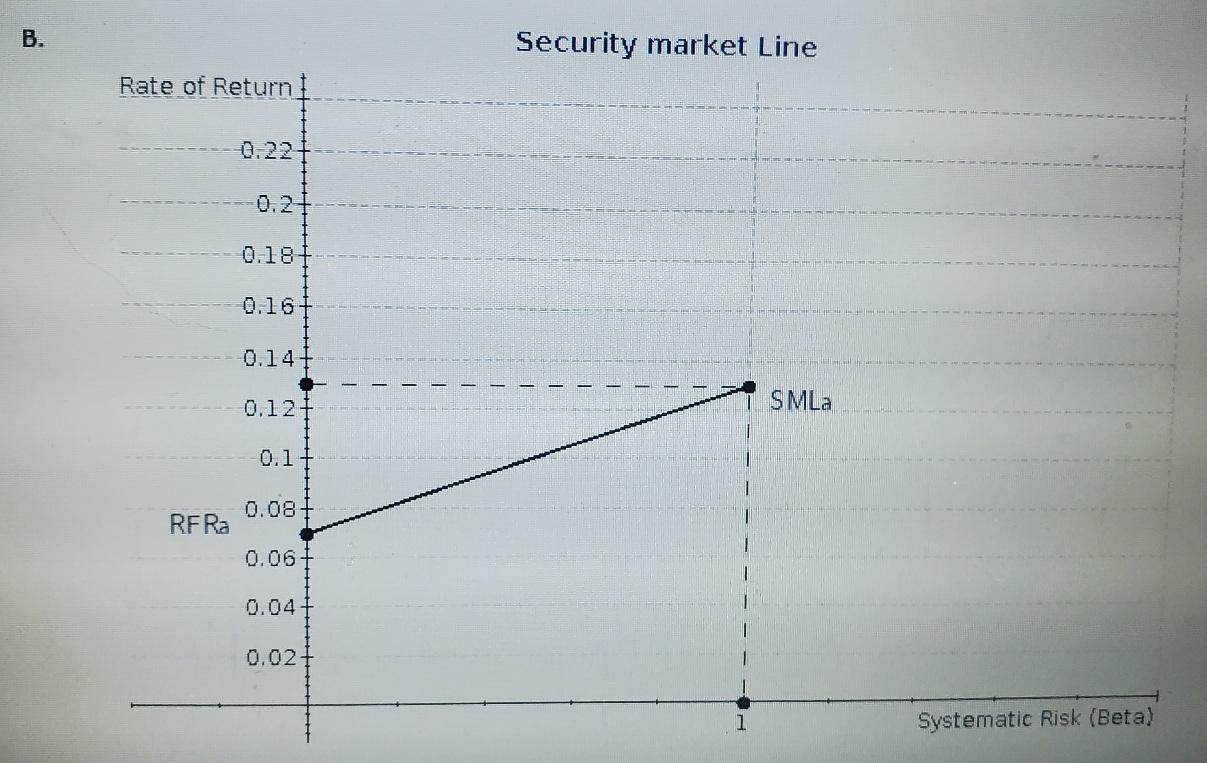

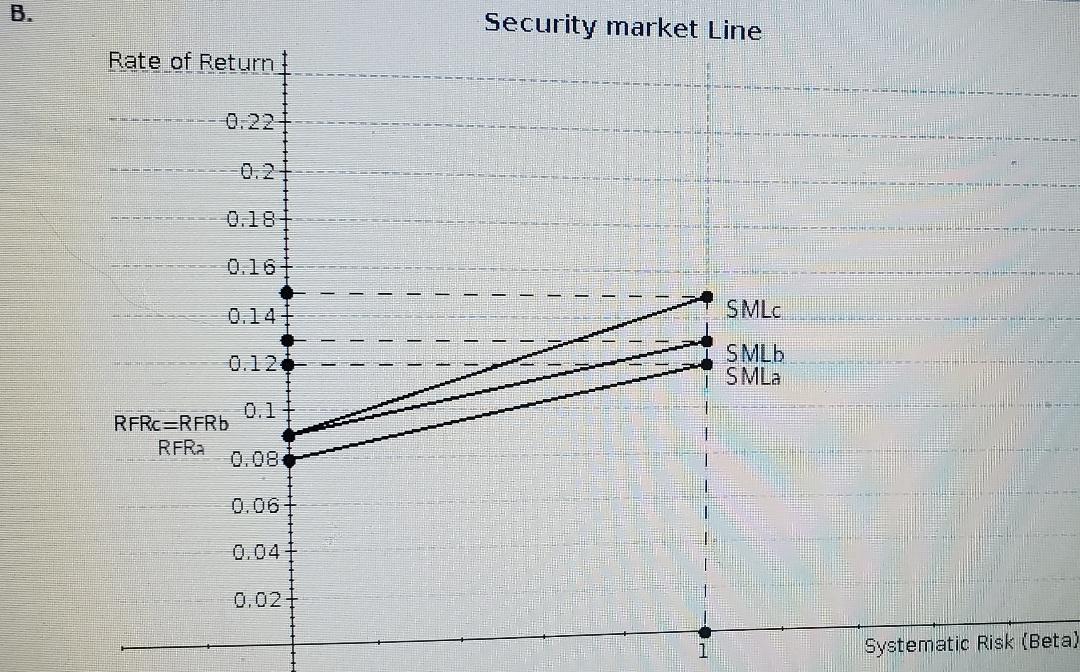

Choose the correct SML graph.

The correct graph is -Select-graph Agraph Bgraph Cgraph DItem 4 .

A.

B.

C.

D.

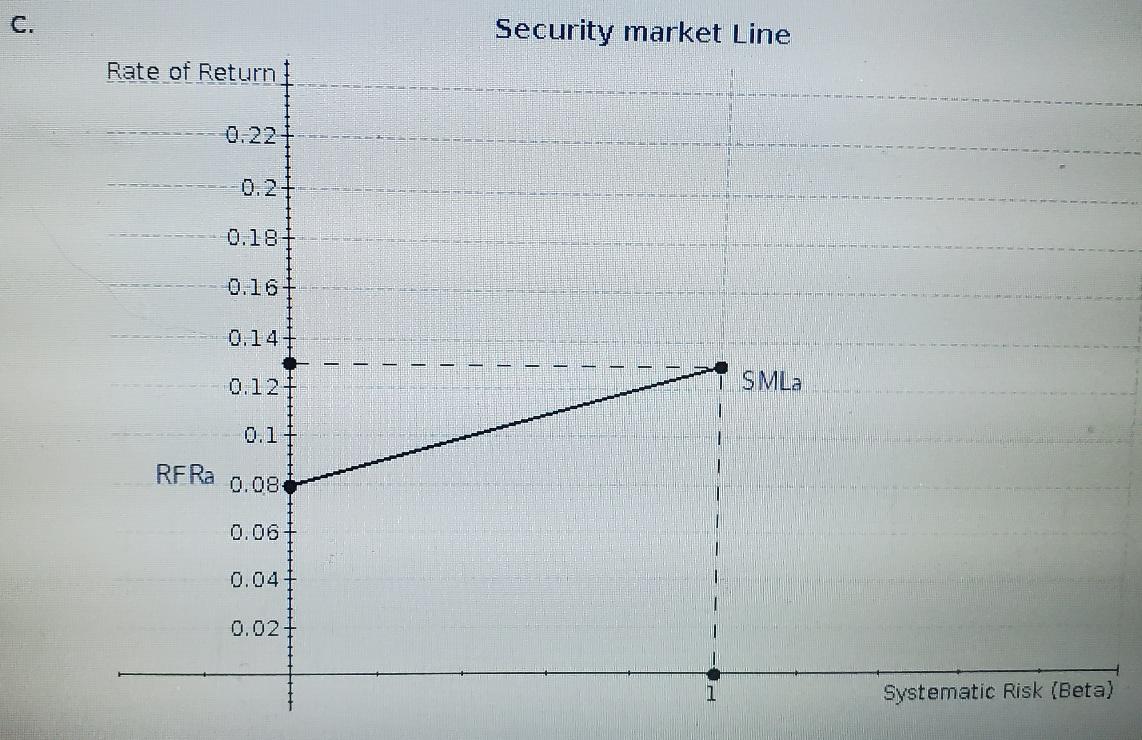

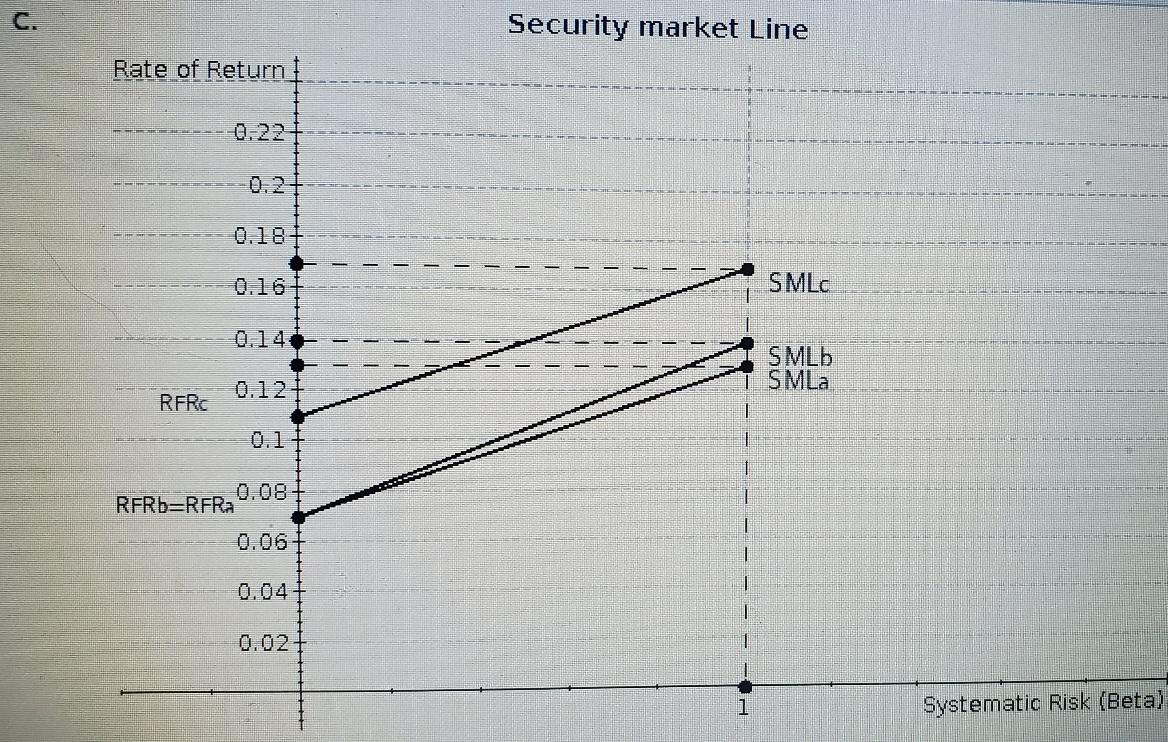

- Choose an SML on the same graph to reflect an RFR of 9 percent and an RM of 15 percent.

The correct graph is -Select-graph Agraph Bgraph Cgraph DItem 5 .

A.

B.

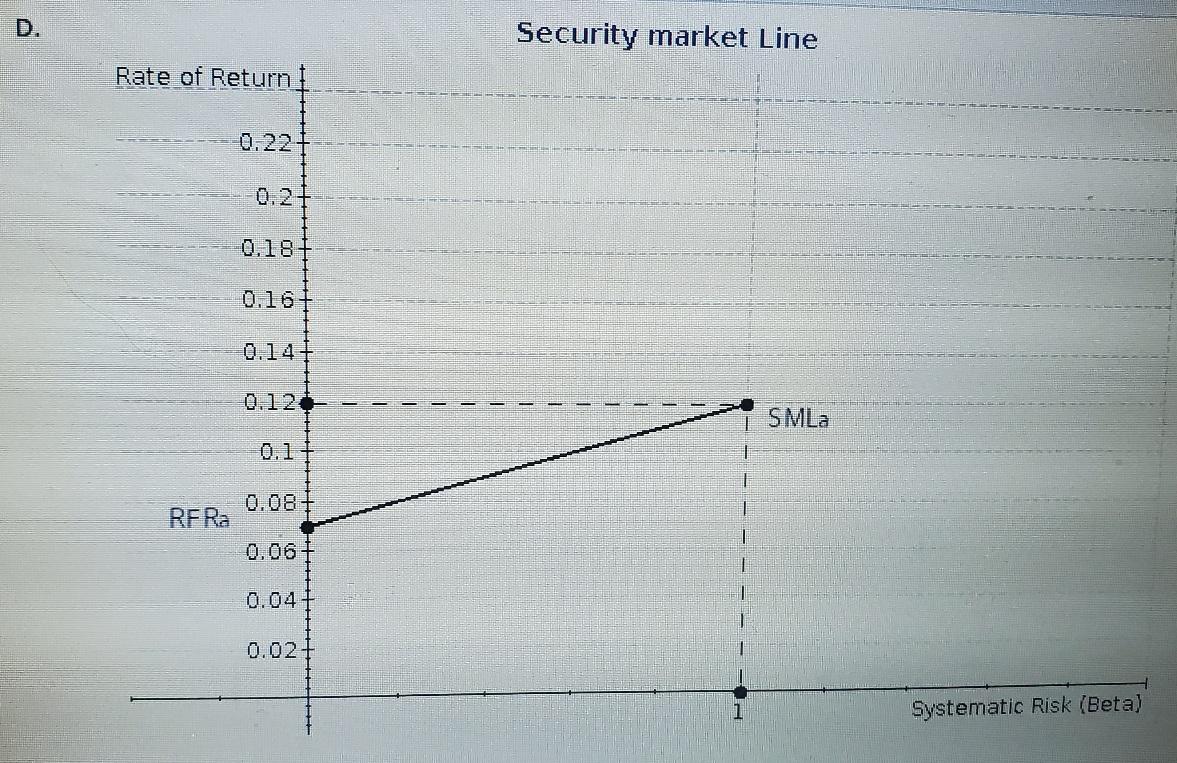

C.

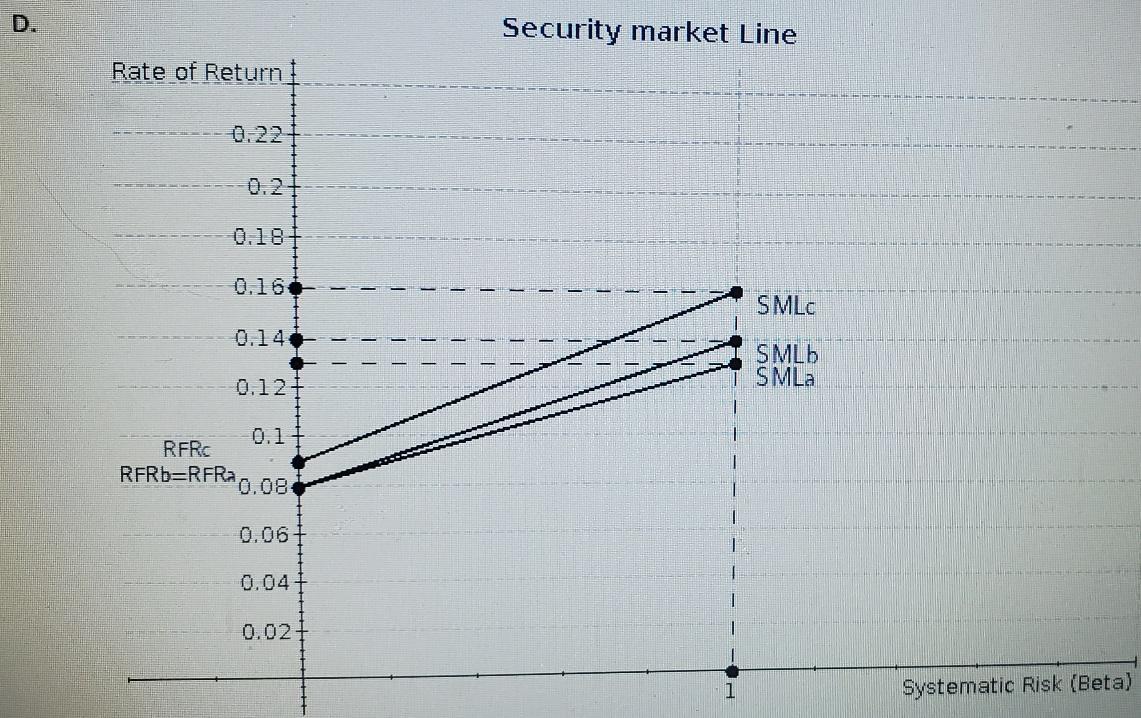

D.

How does this SML differ from that derived in Part b? Round your answer to two decimal places.

New SMLc will have an intercept at and a -Select-samedifferentItem 7 slope so it -Select-willwill notItem 8 be parallel to SMLa.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started