Question

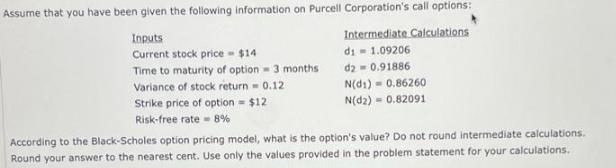

Assume that you have been given the following information on Purcell Corporation's call options: Inputs Intermediate Calculations Current stock price - $14 di 1.09206

Assume that you have been given the following information on Purcell Corporation's call options: Inputs Intermediate Calculations Current stock price - $14 di 1.09206 d2 0.91886 Time to maturity of option 3 months Variance of stock return = 0.12 Strike price of option = $12 Risk-free rate 8% N(01) = 0.86260 N(02) = 0.82091 According to the Black-Scholes option pricing model, what is the option's value? Do not round intermediate calculations. Round your answer to the nearest cent. Use only the values provided in the problem statement for your calculations.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the call option using the BlackScholes option pricing model we can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App