Question

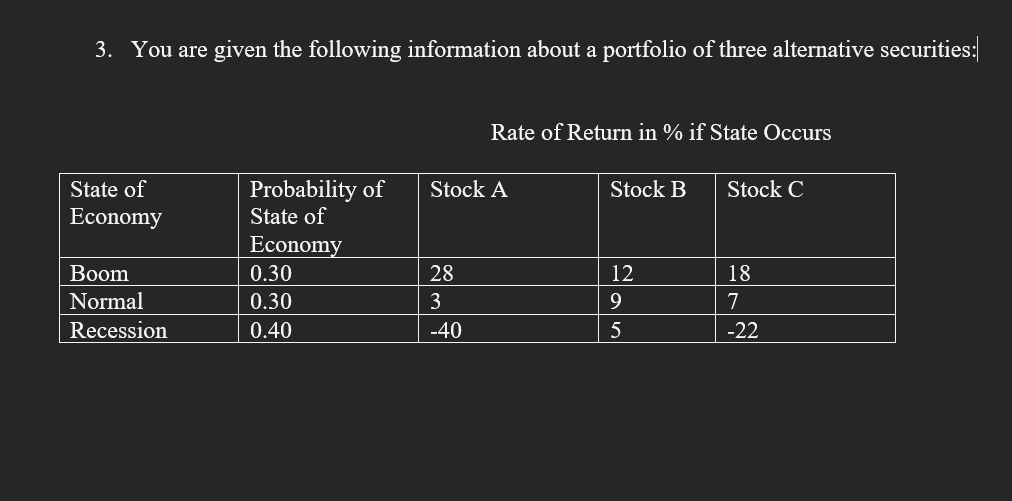

Assume that you have invested 40 percent in both stocks A and B, and 20 percent in stock C. a. Given the stocks weights above,

Assume that you have invested 40 percent in both stocks A and B, and 20 percent in stock C.

a. Given the stocks weights above, calculate the portfolio rate of returns in each state of economy.

b. Calculate the portfolio expected return and standard deviation. Show all your work.

c. Using the CAPM and assuming a risk free of return of 7%, a market risk premium of return of 5%, and portfolio beta of 1.87, calculate the portfolio required rate of return. Using this result and the expected return found in part b, state whether this portfolio is undervalued or overvalued. What should be your trading strategy? Explain.

3. You are given the following information about a portfolio of three alternative securities: Rate of Return in \% if State OccursStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started