Answered step by step

Verified Expert Solution

Question

1 Approved Answer

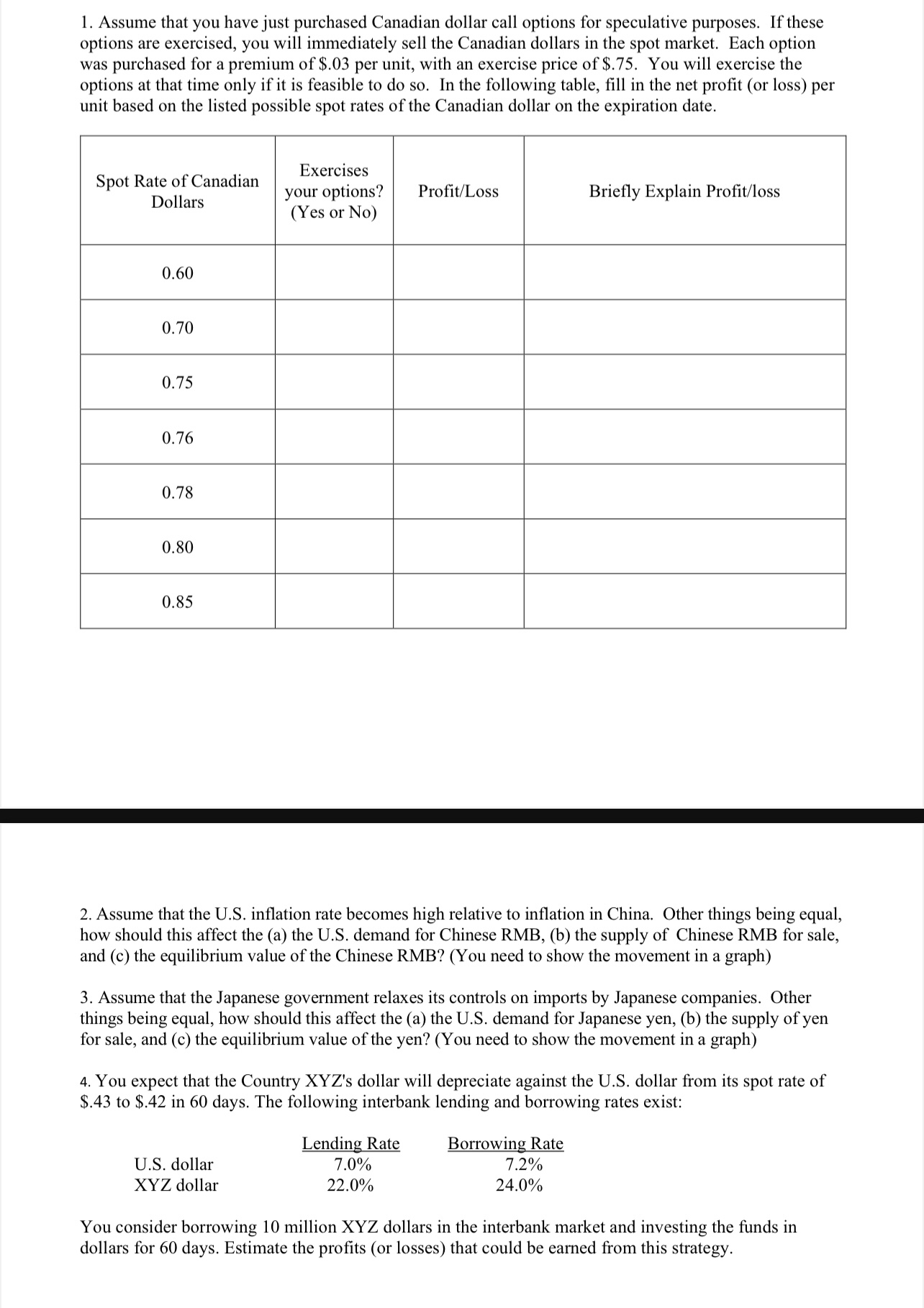

Assume that you have just purchased Canadian dollar call options for speculative purposes. If these options are exercised, you will immediately sell the Canadian dollars

Assume that you have just purchased Canadian dollar call options for speculative purposes. If these options are exercised, you will immediately sell the Canadian dollars in the spot market. Each option was purchased for a premium of $ per unit, with an exercise price of $ You will exercise the options at that time only if it is feasible to do so In the following table, fill in the net profit or loss per unit based on the listed possible spot rates of the Canadian dollar on the expiration date.

tabletableSpot Rate of CanadianDollarstableExercisesyour options?Yes or NoProfitLossBriefly Explain Profitloss

Assume that the US inflation rate becomes high relative to inflation in China. Other things being equal, how should this affect the a the US demand for Chinese RMBb the supply of Chinese RMB for sale, and c the equilibrium value of the Chinese RMBYou need to show the movement in a graph

Assume that the Japanese government relaxes its controls on imports by Japanese companies. Other things being equal, how should this affect the a the US demand for Japanese yen, b the supply of yen for sale, and c the equilibrium value of the yen? You need to show the movement in a graph

You expect that the Country XYZs dollar will depreciate against the US dollar from its spot rate of $ to $ in days. The following interbank lending and borrowing rates exist:

tableLending Rate,,Borrowing RateUS dollar,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started