Answered step by step

Verified Expert Solution

Question

1 Approved Answer

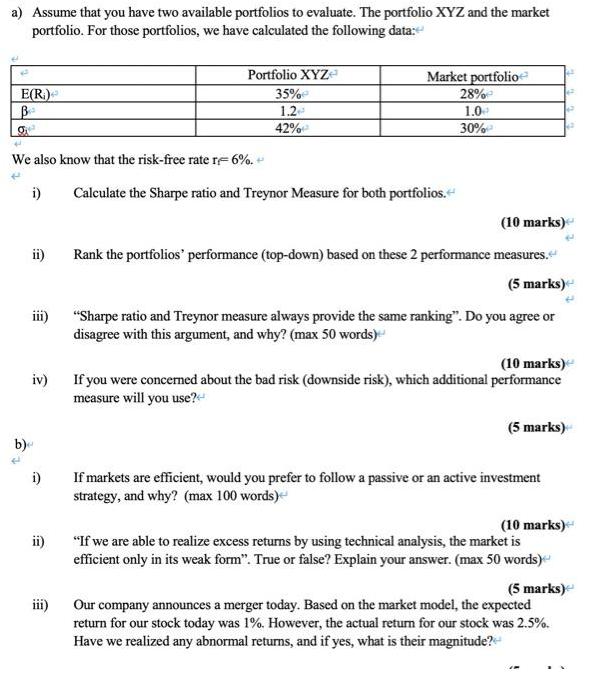

a) Assume that you have two available portfolios to evaluate. The portfolio XYZ and the market portfolio. For those portfolios, we have calculated the

a) Assume that you have two available portfolios to evaluate. The portfolio XYZ and the market portfolio. For those portfolios, we have calculated the following data: P E(R) B 4 We also know that the risk-free rate r 6%. + 4 b) i) ii) iv) Portfolio XYZ 35% 1.2 42% ii) Market portfolio 28% 1.0 30% Calculate the Sharpe ratio and Treynor Measure for both portfolios. < 22 42 (10 marks) Rank the portfolios' performance (top-down) based on these 2 performance measures. < (5 marks) "Sharpe ratio and Treynor measure always provide the same ranking". Do you agree or disagree with this argument, and why? (max 50 words) (10 marks) If you were concerned about the bad risk (downside risk), which additional performance measure will you use? < (5 marks) If markets are efficient, would you prefer to follow a passive or an active investment strategy, and why? (max 100 words) (10 marks) "If we are able to realize excess returns by using technical analysis, the market is efficient only in its weak form". True or false? Explain your answer. (max 50 words) (5 marks) Our company announces a merger today. Based on the market model, the expected return for our stock today was 1%. However, the actual return for our stock was 2.5%. Have we realized any abnormal returns, and if yes, what is their magnitude?

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

i The abnormal return is the difference between the actual return and the expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started