Answered step by step

Verified Expert Solution

Question

1 Approved Answer

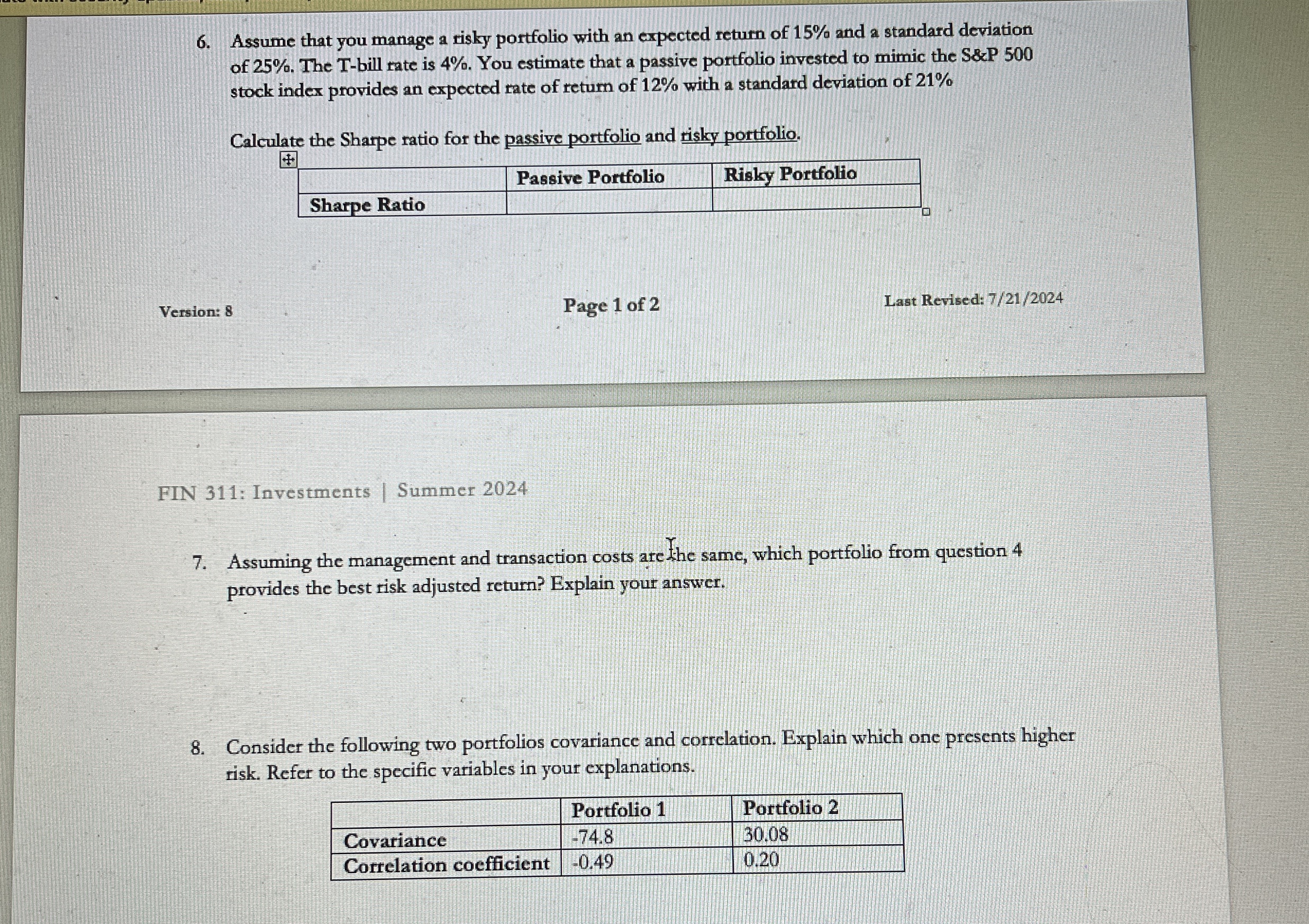

Assume that you manage a risky portfolio with an expected return of 1 5 % and a standard deviation of 2 5 % . The

Assume that you manage a risky portfolio with an expected return of and a standard deviation of The Tbill rate is You estimate that a passive portfolio invested to mimic the S P stock index provides an expected rate of retum of with a standard deviation of

Calculate the Sharpe ratio for the passive portfolio and risky portfolio.

tablePassive Portfolio,Risky PortfolioSharpe Ratio,,

Version:

Page of

Last Revised:

FIN : Investments Summer

Assuming the management and transaction costs are the same, which portfolio from question provides the best risk adjusted return? Explain your answer.

Consider the following two portfolios covariance and correlation. Explain which one presents higher risk. Refer to the specific variables in your explanations.

tablePortfolio Portfolio CovarianceCorrelation coefficient,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started