Question

Assume that you were approached by the CFO of USC Airlines, an established mid-sized hypothetical US airline operating interstate charter flights and providing maintenance services

Assume that you were approached by the CFO of USC Airlines, an established mid-sized hypothetical US airline operating interstate charter flights and providing maintenance services for small aircrafts.

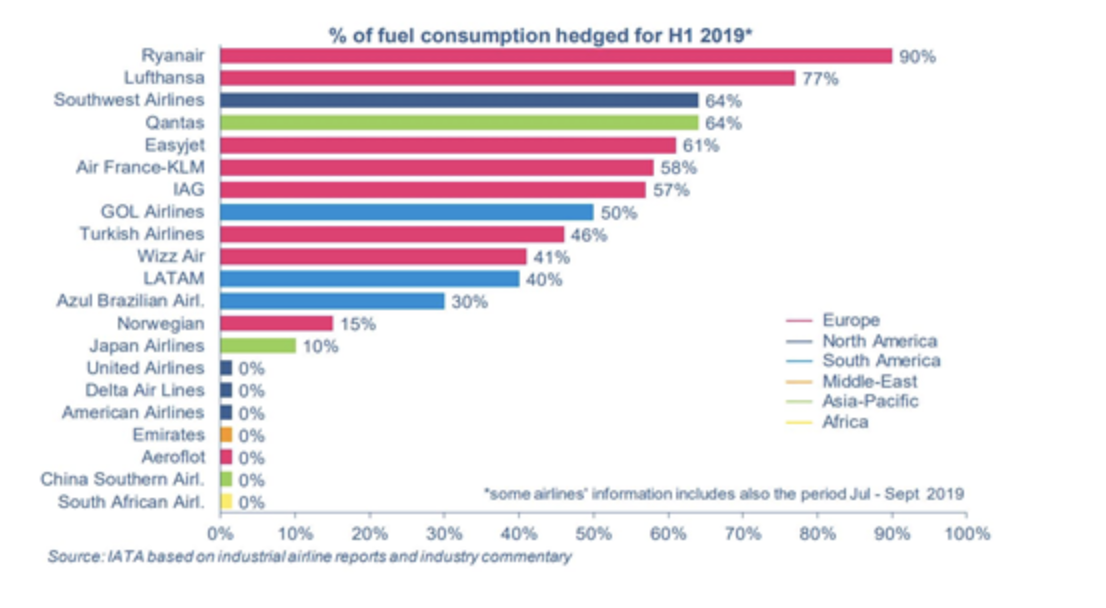

The CFO is debating the effectiveness of hedging transactions, including hedging jet fuel. Her opinion is mainly driven by an international report that shows that not all airlines hedge jet fuel. An extract of the report is provided in the graph below provided by the International Air Transport Association:

USC consumes on average $100 million of jet fuel per year.

In your capacity as a prospective analyst who is familiar with Derivatives products, please answer the following questions which will help you form a view that would aid you to advise the CFO.

1- Discuss the effects of hedging costs on the decision to hedge and its potential outcomes for a mid-sized firm such as USC? (Discuss advantages and disadvantages)

% of fuel consumption hedged for H1 2019* Ryanair Lufthansa 90% 77% Southwest Airlines 64% 64% Qantas Easyjet Air France-KLM IAG 61% | 58% | 57% GOL Airlines 50% Turkish Airlines 46% | 41% | 40% Wizz Air LATAM Azul Brazilian Airl. 30% Norwegian Japan Airlines United Airlines Delta Air Lines 1 0% American Airlines 1 0% Emirates 0% Aeroflot 0% China Southern Airl. 0% South African Airl. Europe North America South America Middle-East Asia-Pacific Africa 15% 10% 0% "some airlines" information includes also the period Jul - Sept 2019 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Source: IATA based on industrial airline reports and industry commentary

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Hedging is a danger management strategy hired to offset losses in investments by taking a contrary r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started