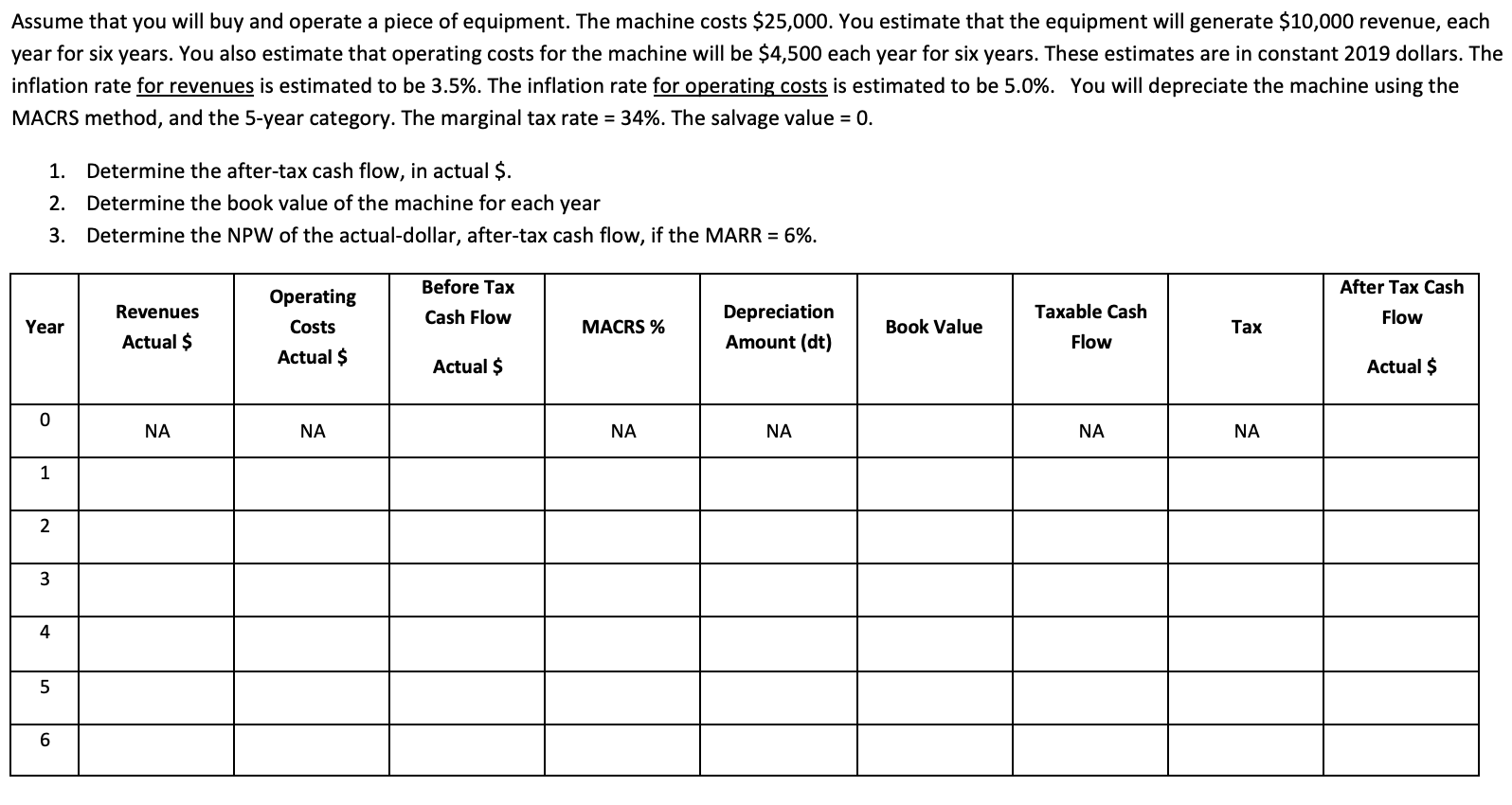

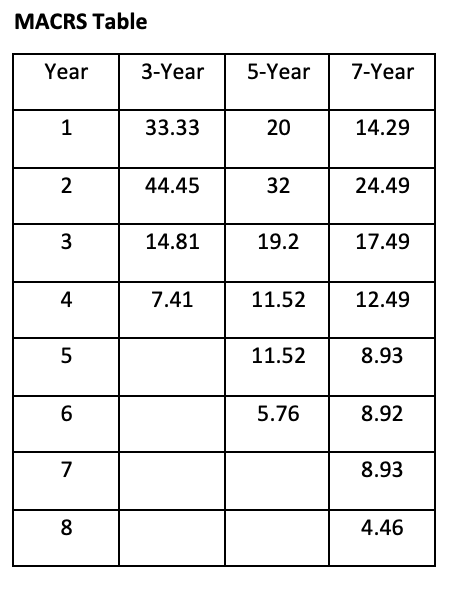

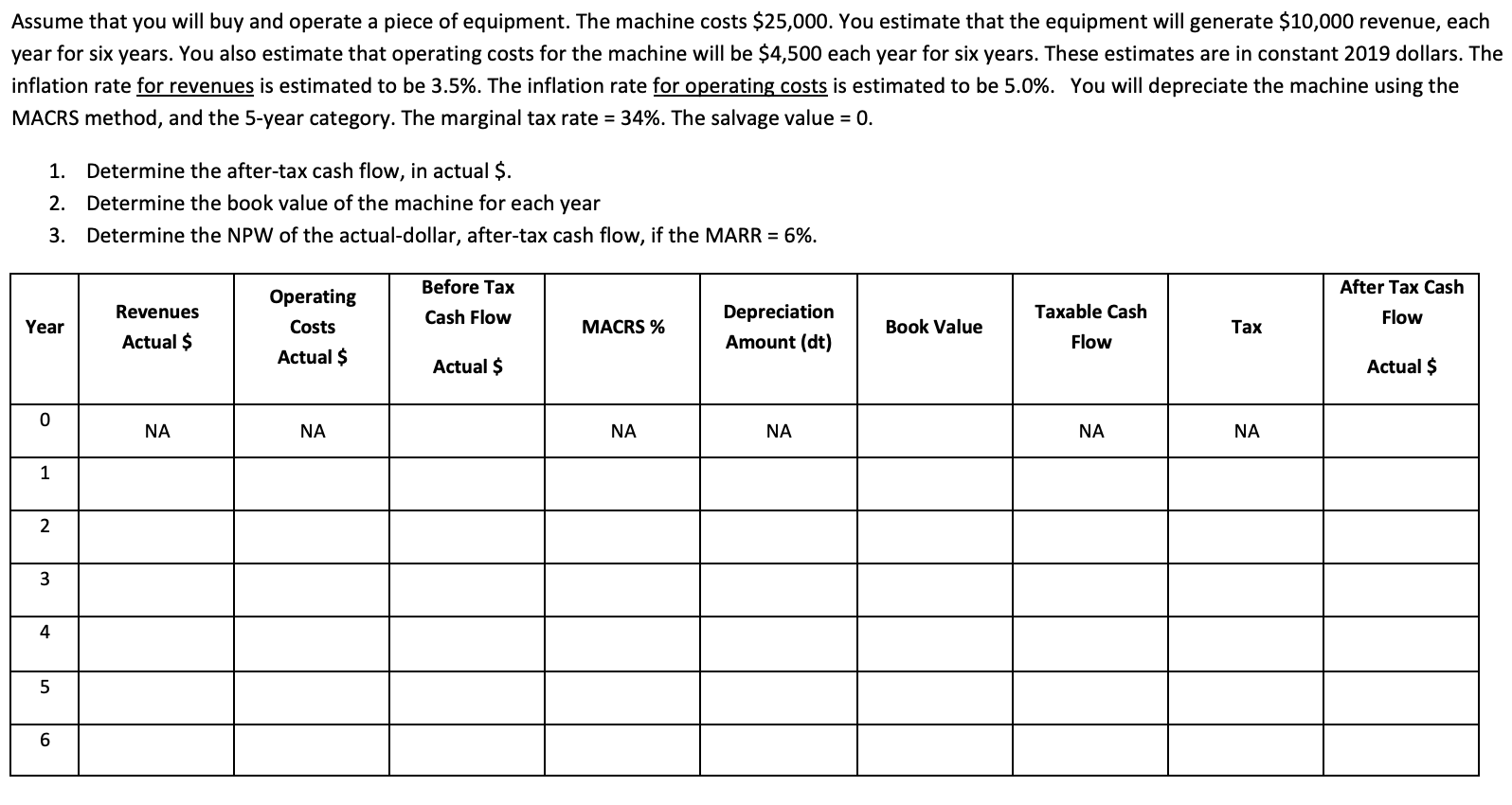

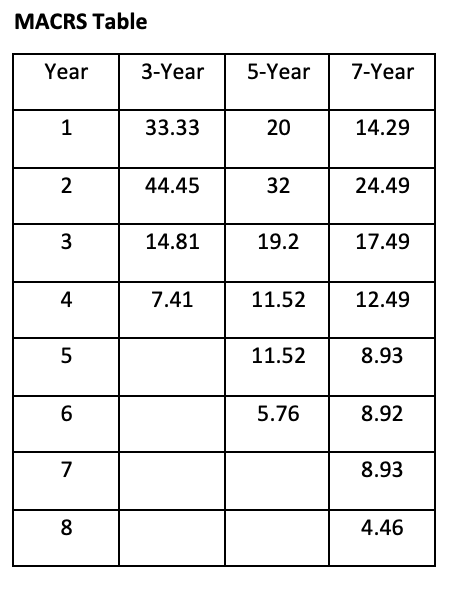

Assume that you will buy and operate a piece of equipment. The machine costs $25,000. You estimate that the equipment will generate $10,000 revenue, each year for six years. You also estimate that operating costs for the machine will be $4,500 each year for six years. These estimates are in constant 2019 dollars. The inflation rate for revenues is estimated to be 3.5%. The inflation rate for operating costs is estimated to be 5.0%. You will depreciate the machine using the MACRS method, and the 5-year category. The marginal tax rate = 34%. The salvage value = 0. 1. Determine the after-tax cash flow, in actual $. 2. Determine the book value of the machine for each year 3. Determine the NPW of the actual-dollar, after-tax cash flow, if the MARR = 6%. Before Tax Cash Flow After Tax Cash Flow Year Revenues Actual $ Operating Costs Actual $ MACRS % Depreciation Amount (dt) Book Value Taxable Cash Flow Tax Actual $ Actual $ 0 NA NA NA NA NA NA 1 2 3 4 5 6 MACRS Table Year 3-Year 5-Year 7-Year 1 33.33 20 14.29 2 44.45 32 24.49 3 14.81 19.2 17.49 4 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 Assume that you will buy and operate a piece of equipment. The machine costs $25,000. You estimate that the equipment will generate $10,000 revenue, each year for six years. You also estimate that operating costs for the machine will be $4,500 each year for six years. These estimates are in constant 2019 dollars. The inflation rate for revenues is estimated to be 3.5%. The inflation rate for operating costs is estimated to be 5.0%. You will depreciate the machine using the MACRS method, and the 5-year category. The marginal tax rate = 34%. The salvage value = 0. 1. Determine the after-tax cash flow, in actual $. 2. Determine the book value of the machine for each year 3. Determine the NPW of the actual-dollar, after-tax cash flow, if the MARR = 6%. Before Tax Cash Flow After Tax Cash Flow Year Revenues Actual $ Operating Costs Actual $ MACRS % Depreciation Amount (dt) Book Value Taxable Cash Flow Tax Actual $ Actual $ 0 NA NA NA NA NA NA 1 2 3 4 5 6 MACRS Table Year 3-Year 5-Year 7-Year 1 33.33 20 14.29 2 44.45 32 24.49 3 14.81 19.2 17.49 4 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46