Question

Assume that your business is working on a complicated project that is supposed to be completed in 12 months. Every month you are supposed to

Assume that your business is working on a complicated project that is supposed to be completed in 12 months.

Every month you are supposed to complete a work, worth $20000.

After the fourth month the situation with the project is as follows:

---You fully completed the work for the first month and it cost you $20000, exactly as planned.

---You fully completed the work for the second month and it cost you $25000

---You completed only 1/2 of the work for the third month and you have spent $15000 on it.

---You completed only a quarter of the work for the fourth month and you have spent $10000 on it.

Answer the following questions:

a) Calculate the Earned value of the project after the fourth month. (1)

b) Calculate Cost and Schedule Variances (2)

c) Calculate the Cost Performance Index and Schedule Performance Index (2)

d) Analyze how the project is progressing schedule wise and cost wise (1)

e) Calculate how many more months (and days) are needed to complete the project (2)

f) Calculate how much money will the project cost when completed.(2)

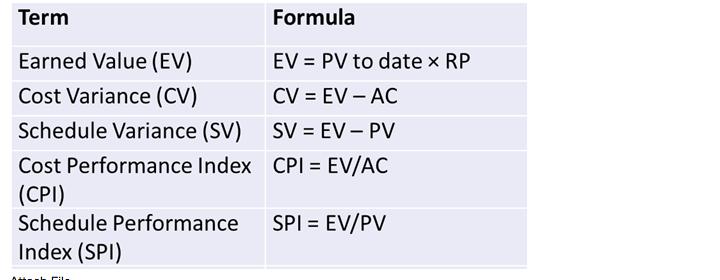

Term Earned Value (EV) Cost Variance (CV) Schedule Variance (SV) Cost Performance Index (CPI) Schedule Performance Index (SPI) Formula EV = PV to date x RP CV = EV- AC SV = EV - PV CPI = EV/AC SPI = EV/PV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate the Earned value of the project after the fourth month To calculate the Earned Value EV after the fourth month we need to sum up the value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started