Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your child has just had her 10th birthday and that you are planning for her education. You have already opened up an

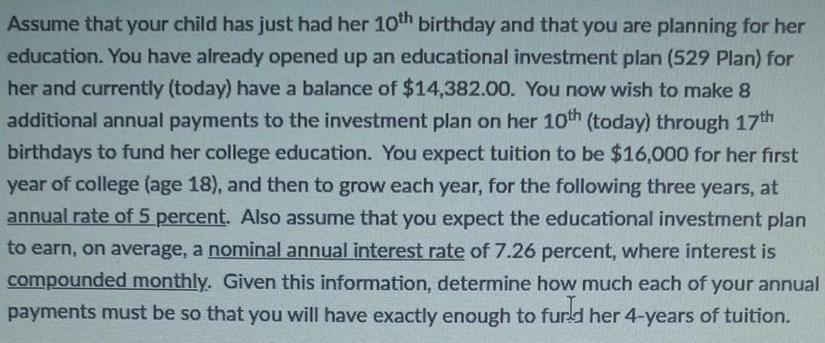

Assume that your child has just had her 10th birthday and that you are planning for her education. You have already opened up an educational investment plan (529 Plan) for her and currently (today) have a balance of $14,382.00. You now wish to make 8 additional annual payments to the investment plan on her 10th (today) through 17th birthdays to fund her college education. You expect tuition to be $16,000 for her first year of college (age 18), and then to grow each year, for the following three years, at annual rate of 5 percent. Also assume that you expect the educational investment plan to earn, on average, a nominal annual interest rate of 7.26 percent, where interest is compounded monthly. Given this information, determine how much each of your annual payments must be so that you will have exactly enough to furld her 4-years of tuition.

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the required annual payments we need to first calculate the future value of the current balance in the 529 plan and the future v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started