Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your firm reported net income of $120 million in 2023, while the firm had sales of $1,200 million and a cost of

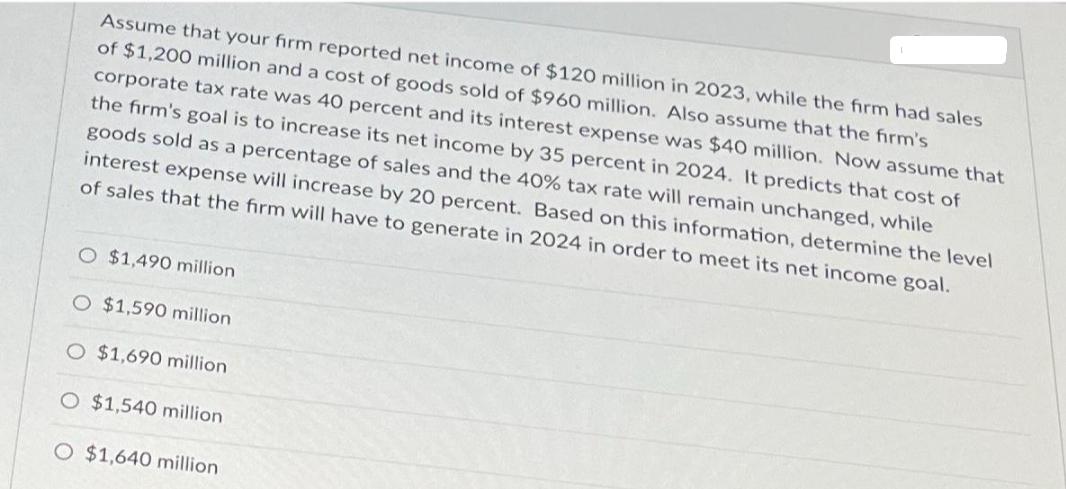

Assume that your firm reported net income of $120 million in 2023, while the firm had sales of $1,200 million and a cost of goods sold of $960 million. Also assume that the firm's corporate tax rate was 40 percent and its interest expense was $40 million. Now assume that the firm's goal is to increase its net income by 35 percent in 2024. It predicts that cost of goods sold as a percentage of sales and the 40% tax rate will remain unchanged, while interest expense will increase by 20 percent. Based on this information, determine the level of sales that the firm will have to generate in 2024 in order to meet its net income goal. O $1,490 million O $1,590 million O $1,690 million O $1,540 million. O $1,640 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the level of sales the firm needs to generate in 2024 to meet its net income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started