Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the Black-Scholes framework. A non-dividend-paying stock S with price process (S,) is currently priced at So = 50 and its annual volatility is

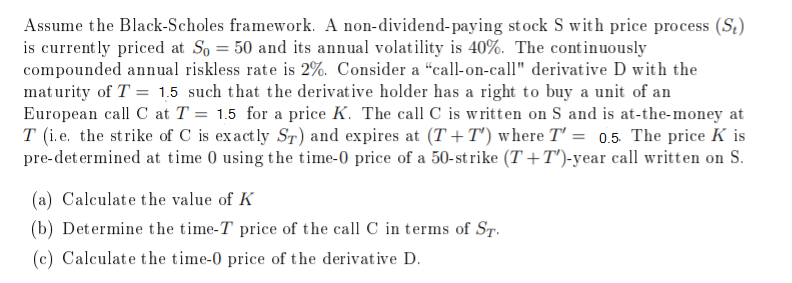

Assume the Black-Scholes framework. A non-dividend-paying stock S with price process (S,) is currently priced at So = 50 and its annual volatility is 40%. The continuously compounded annual riskless rate is 2%. Consider a call-on-call" derivative D with the maturity of T = 1.5 such that the derivative holder has a right to buy a unit of an European call C at T = 1.5 for a price K. The call C is written on S and is at-the-money at T (i.e. the strike of C is exactly St) and expires at (T+T') where T' = 0.5 The price K is pre-det ermined at time 0 using the time-0 price of a 50-st rike (T +T')-year call written on S. (a) Calculate the value of K (b) Determine the time-T price of the call C in terms of ST. (c) Calculate the time-0 price of the derivative D.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a K 50 e002 05 5051 The price of K is calculated by taking the time 0 price of a 50strike T Tyear ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started