Answered step by step

Verified Expert Solution

Question

1 Approved Answer

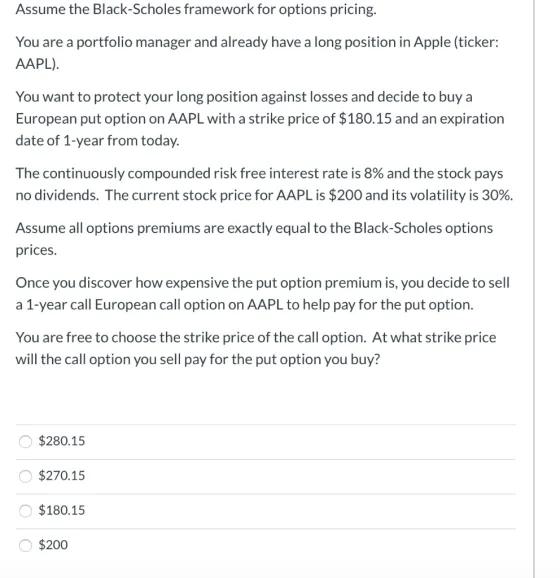

Assume the Black-Scholes framework for options pricing. You are a portfolio manager and already have a long position in Apple (ticker: AAPL). You want

Assume the Black-Scholes framework for options pricing. You are a portfolio manager and already have a long position in Apple (ticker: AAPL). You want to protect your long position against losses and decide to buy a European put option on AAPL with a strike price of $180.15 and an expiration date of 1-year from today. The continuously compounded risk free interest rate is 8% and the stock pays no dividends. The current stock price for AAPL is $200 and its volatility is 30%. Assume all options premiums are exactly equal to the Black-Scholes options prices. Once you discover how expensive the put option premium is, you decide to sell a 1-year call European call option on AAPL to help pay for the put option. You are free to choose the strike price of the call option. At what strike price will the call option you sell pay for the put option you buy? $280.15 $270.15 $180.15 $200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the strike price of the call option that will pay for the put option we need to calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started