Question

Assume the cash flows arising from a project are the only potential source of cash flow for a company and the company currently owes

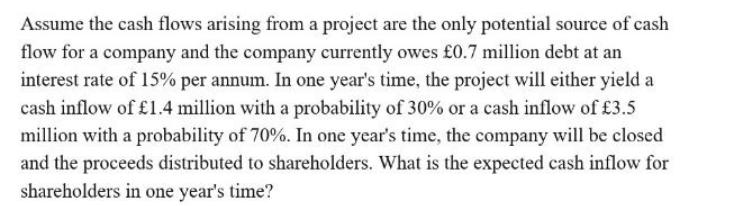

Assume the cash flows arising from a project are the only potential source of cash flow for a company and the company currently owes 0.7 million debt at an interest rate of 15% per annum. In one year's time, the project will either yield a cash inflow of 1.4 million with a probability of 30% or a cash inflow of 3.5 million with a probability of 70%. In one year's time, the company will be closed and the proceeds distributed to shareholders. What is the expected cash inflow for shareholders in one year's time?

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the expected cash inflow for shareholders in one years time Lets denote the cash inflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App