Answered step by step

Verified Expert Solution

Question

1 Approved Answer

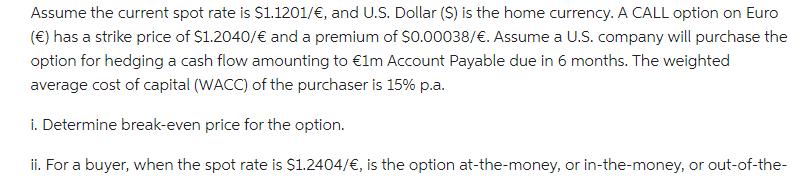

Assume the current spot rate is $1.1201/, and U.S. Dollar ($) is the home currency. A CALL option on Euro () has a strike

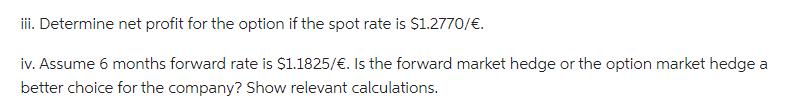

Assume the current spot rate is $1.1201/, and U.S. Dollar ($) is the home currency. A CALL option on Euro () has a strike price of $1.2040/ and a premium of $0.00038/. Assume a U.S. company will purchase the option for hedging a cash flow amounting to 1m Account Payable due in 6 months. The weighted average cost of capital (WACC) of the purchaser is 15% p.a. i. Determine break-even price for the option. ii. For a buyer, when the spot rate is $1.2404/, is the option at-the-money, or in-the-money, or out-of-the- iii. Determine net profit for the option if the spot rate is $1.2770/. iv. Assume 6 months forward rate is $1.1825/. Is the forward market hedge or the option market hedge a better choice for the company? Show relevant calculations. better choice for the company? Show relevant calculations. [Hint: For (iv), do a similar transaction exposure calculation like we have covered during week 7. For option hedging, note that premium is given in dollar per foreign currency amount rather than as a percentage. Thus, a premium of $0.0001/ means, for an option amounting to 10,000, the premium paid is: 10,000 x $0.0001/ = $1. Similar idea is to be used in this math]

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each question and handle them one by one i Determine breakeven price for the option The breakeven price for the option is the strike price plus the option premium This gives the price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started