Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the date is December 1, 2021 and your client (Gabriel Adams, 1400 E 10th Street, Moorhead MN 56560) has asked you a question

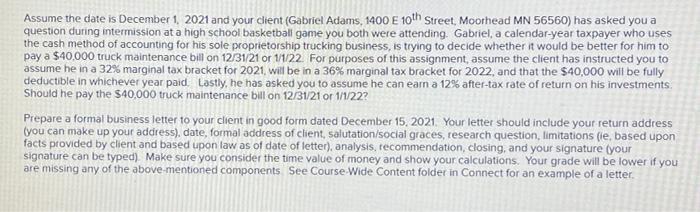

Assume the date is December 1, 2021 and your client (Gabriel Adams, 1400 E 10th Street, Moorhead MN 56560) has asked you a question during intermission at a high school basketball game you both were attending. Gabriel, a calendar-year taxpayer who uses the cash method of accounting for his sole proprietorship trucking business, is trying to decide whether it would be better for him to pay a $40,000 truck maintenance bill on 12/31/21 or 1/1/22. For purposes of this assignment, assume the client has instructed you to assume he in a 32% marginal tax bracket for 2021, will be in a 36% marginal tax bracket for 2022, and that the $40,000 will be fully deductible in whichever year paid. Lastly, he has asked you to assume he can earn a 12% after-tax rate of return on his investments. Should he pay the $40,000 truck maintenance bill on 12/31/21 or 1/1/22? Prepare a formal business letter to your client in good form dated December 15, 2021. Your letter should include your return address (you can make up your address), date, formal address of client, salutation/social graces, research question, limitations (ie, based upon facts provided by client and based upon law as of date of letter), analysis, recommendation, closing, and your signature (your signature can be typed). Make sure you consider the time value of money and show your calculations. Your grade will be lower if you are missing any of the above-mentioned components. See Course-Wide Content folder in Connect for an example of a letter.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Dear Gabriel Thank you for your question during intermission at the basketball game Based upon the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started