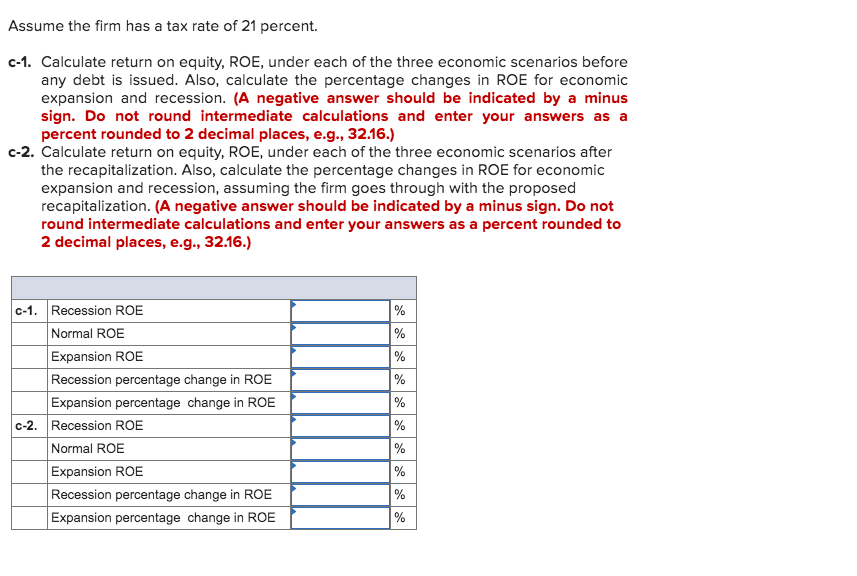

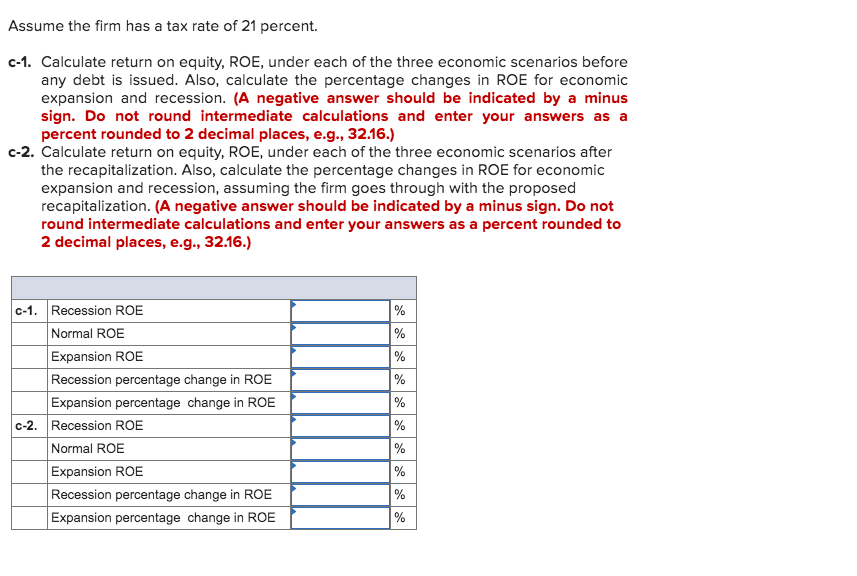

Assume the firm has a tax rate of 21 percent. C-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. Also, calculate the percentage changes in ROE for economic expansion and recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate return on equity, ROE, under each of the three economic scenarios after the recapitalization. Also, calculate the percentage changes in ROE for economic expansion and recession, assuming the firm goes through with the proposed recapitalization. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. Recession ROE Normal ROE Expansion ROE Recession percentage change in ROE Expansion percentage change in ROE Recession ROE Normal ROE Expansion ROE Recession percentage change in ROE Expansion percentage change in ROE Assume the firm has a tax rate of 21 percent. C-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. Also, calculate the percentage changes in ROE for economic expansion and recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate return on equity, ROE, under each of the three economic scenarios after the recapitalization. Also, calculate the percentage changes in ROE for economic expansion and recession, assuming the firm goes through with the proposed recapitalization. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. Recession ROE Normal ROE Expansion ROE Recession percentage change in ROE Expansion percentage change in ROE Recession ROE Normal ROE Expansion ROE Recession percentage change in ROE Expansion percentage change in ROE