Answered step by step

Verified Expert Solution

Question

1 Approved Answer

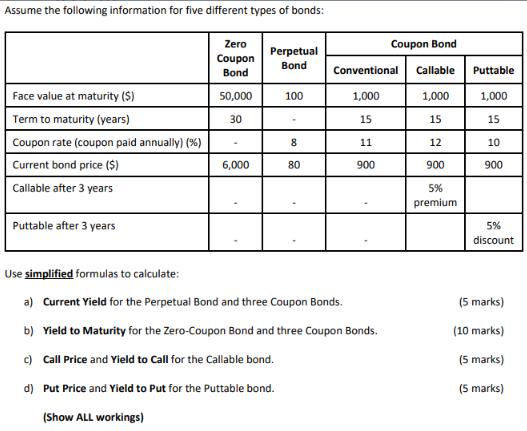

Assume the following information for five different types of bonds: Face value at maturity ($) Term to maturity (years) Coupon rate (coupon paid annually)

Assume the following information for five different types of bonds: Face value at maturity ($) Term to maturity (years) Coupon rate (coupon paid annually) (%) Current bond price ($) Callable after 3 years Puttable after 3 years Zero Coupon Bond 50,000 30 6,000 Perpetual Bond 100 8 80 Conventional 1,000 15 Use simplified formulas to calculate: a) Current Yield for the Perpetual Bond and three Coupon Bonds. 11 900 Coupon Bond Callable 1,000 15 12 900 b) Yield to Maturity for the Zero-Coupon Bond and three Coupon Bonds. c) Call Price and Yield to Call for the Callable bond. d) Put Price and Yield to Put for the Puttable bond. (Show ALL workings) 5% premium Puttable 1,000 15 10 900 5% discount (5 marks) (10 marks) (5 marks) (5 marks)

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Current Yield for the Perpetual Bond and three Coupon Bonds 1 Perpetual Bond textCurrent Yield fracAnnual Coupon PaymentCurrent Bond Price Since its a perpetual bond the coupon payment is constant a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started