Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the market price of coal is $6.4 per ton. At that price the consumption as well as production are 23 billion tons. Also,

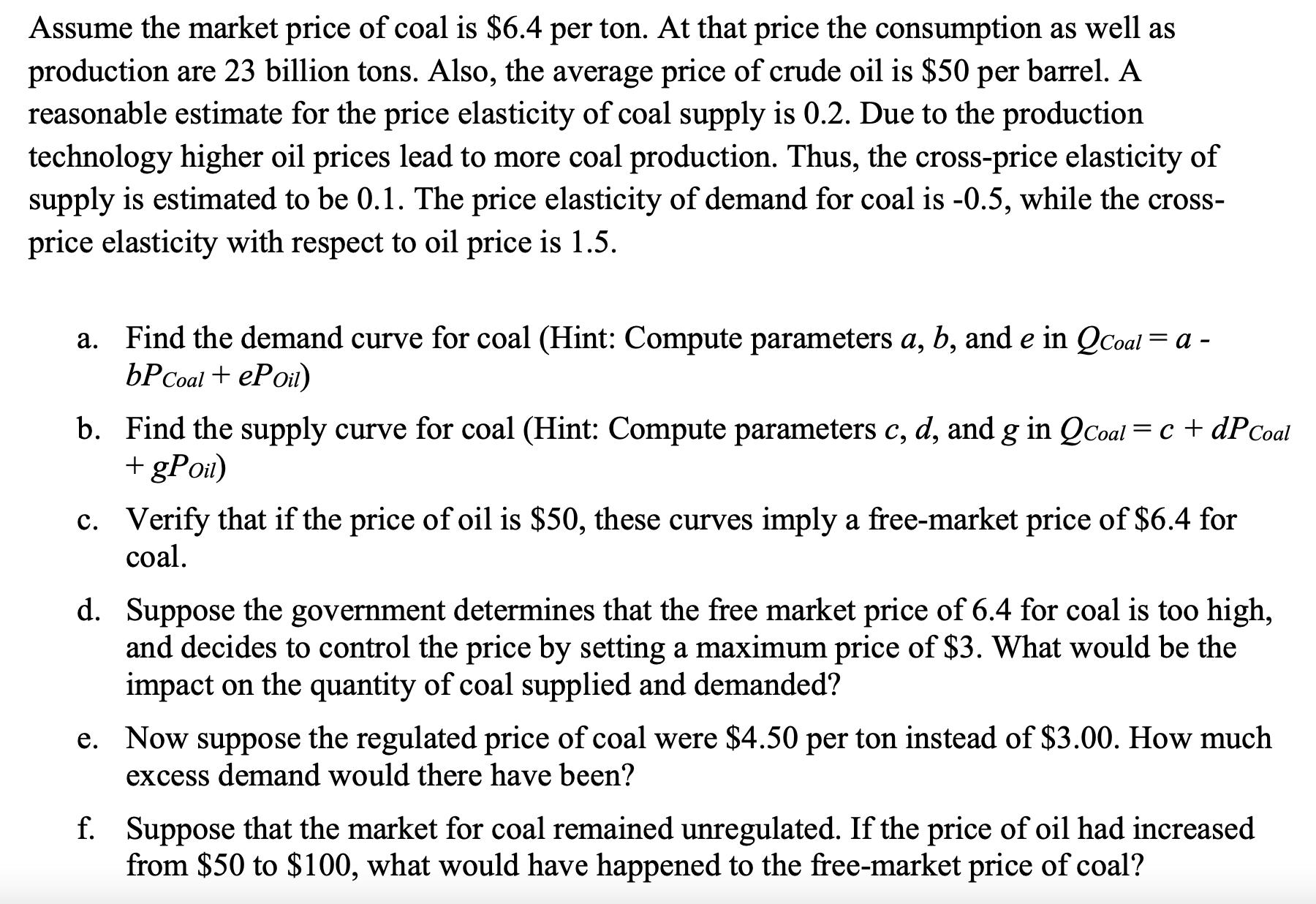

Assume the market price of coal is $6.4 per ton. At that price the consumption as well as production are 23 billion tons. Also, the average price of crude oil is $50 per barrel. A reasonable estimate for the price elasticity of coal supply is 0.2. Due to the production technology higher oil prices lead to more coal production. Thus, the cross-price elasticity of supply is estimated to be 0.1. The price elasticity of demand for coal is -0.5, while the cross- price elasticity with respect to oil price is 1.5. a. Find the demand curve for coal (Hint: Compute parameters a, b, and e in QCoal = a - bPCoal + ePoil) b. Find the supply curve for coal (Hint: Compute parameters c, d, and g in QCoal = c + dP Coal +gPoil) c. Verify that if the price of oil is $50, these curves imply a free-market price of $6.4 for coal. d. Suppose the government determines that the free market price of 6.4 for coal is too high, and decides to control the price by setting a maximum price of $3. What would be the impact on the quantity of coal supplied and demanded? e. Now suppose the regulated price of coal were $4.50 per ton instead of $3.00. How much excess demand would there have been? f. Suppose that the market for coal remained unregulated. If the price of oil had increased from $50 to $100, what would have happened to the free-market price of coal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the demand curve for coal we can use the formula QCoal a bPCoal ePoil Given Price of coal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started