Answered step by step

Verified Expert Solution

Question

1 Approved Answer

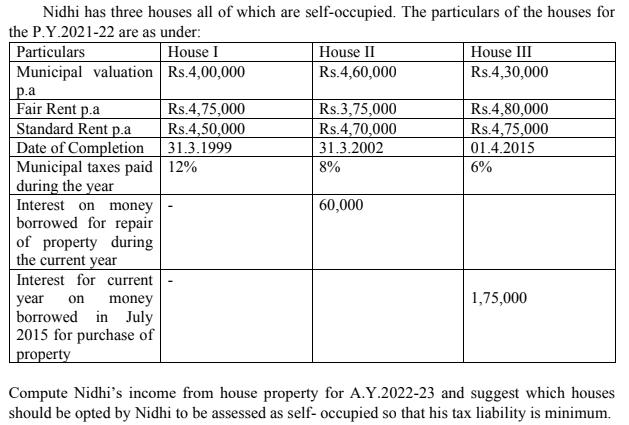

Nidhi has three houses all of which are self-occupied. The particulars of the houses for the P.Y.2021-22 are as under: Particulars House I Municipal

Nidhi has three houses all of which are self-occupied. The particulars of the houses for the P.Y.2021-22 are as under: Particulars House I Municipal valuation Rs.4,00,000 p.a Fair Rent p.a Standard Rent p.a Date of Completion Municipal taxes paid during the year Interest on money borrowed for repair of property during the current year Interest for current year on money borrowed in July 2015 for purchase of property Rs.4,75,000 Rs.4,50,000 31.3.1999 12% House II Rs.4,60,000 Rs.3,75,000 Rs.4,70,000 31.3.2002 8% 60,000 House III Rs.4,30,000 Rs.4,80,000 Rs.4,75,000 01.4.2015 6% 1,75,000 Compute Nidhi's income from house property for A.Y.2022-23 and suggest which houses should be opted by Nidhi to be assessed as self- occupied so that his tax liability is minimum.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Nidhis income from house property for AY202223 would be Income from House I Municipal valua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started